Controlling Overview

Controlling modules provide information to management for planning, reporting and monitoring of business operations. Controlling and Finance are independent modules in SAP. Data flows between Finance and Controlling module on real time basis. Cost Element provides the integration point between Controlling and Finance. A cost element can be an expense or revenue item. Below are the components of Controlling :

- Cost Element Accounting

- Cost Center Accounting

- Internal Orders

- Product Costing

- Profit Center Accounting

- CO-PA (Controlling and Profitability analysis)

- Activity Based Costing

Cost Center

A cost center can be a department like Administration department, Finance Department, Marketing department etc.

A cost center collects and redistribute cost to other departments. Each cost center has a planned cost, Actual cost and their Variance

Key benefits of Cost Center Accounting:

- Managers can set budget for the cost centers

- Cost Planning for the Cost Centers

- Cost Centers collect cost and then this cost can be redistributed to other cost centers on specified rules. For e.g. Maintenance Cost center cost can be distributed to Production, administration and other cost centers who used services of maintenance cost center

Standard Cost

- A standard cost is the estimated cost to produce a product

- Standard cost is fixed for a period

- Standard cost for a product is calculated in transaction CK40N

Planned Cost

- A planned cost is the estimated cost for completion of a job order. A standard cost is for one unit of product, whereas planned cost is for a job order.

- Planned cost for a production order is calculated in CO01

- Actual cost for completion of Production order is calculated in CO01 / CO02

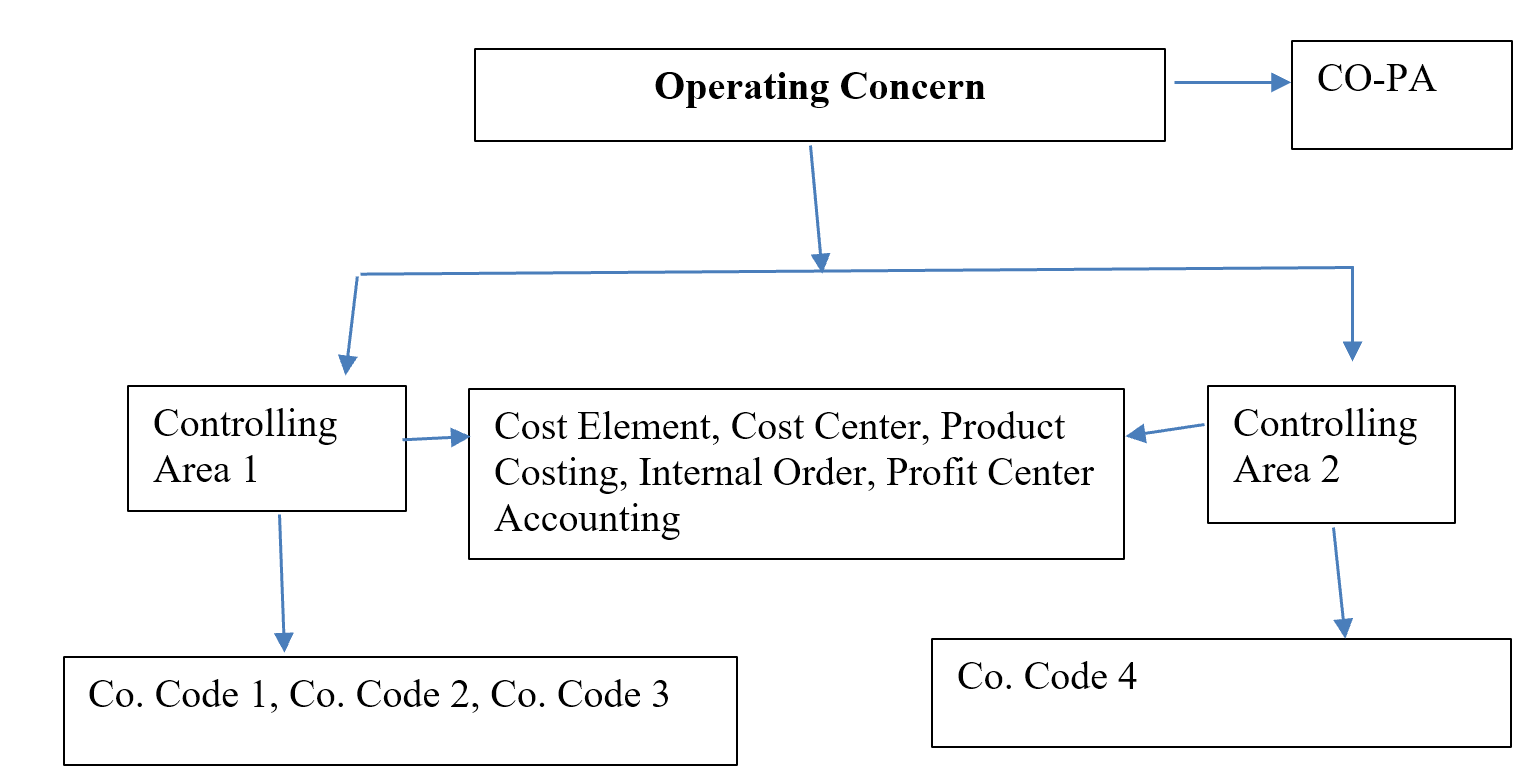

Organization Structure

Controlling Area

The controlling area is an organizational unit in Accounting used to subdivide the business organization from a cost accounting standpoint.

It records and analyze cost element, cost center accounting, internal order, manufacturing related activities (Product costing), and internal unit activities in Profit center accounting

Can assign n number of company codes to a controlling area if below conditions are satisfied

- Chart of accounts is same between company codes and controlling area

- Fiscal year between companies codes have same number of posting periods (other than special posting periods)

- Start and end period is same (Jan-Dec, Apr-Mar) for all fiscal years

- Start and end date is same for all fiscal years

Operating Concern

- Can assign one or more controlling area to one operating concern

Leading and Non-Leading Ledger

- Only leading ledger integrates with controlling area.

- Non-Leading ledger does not integrate with controlling area

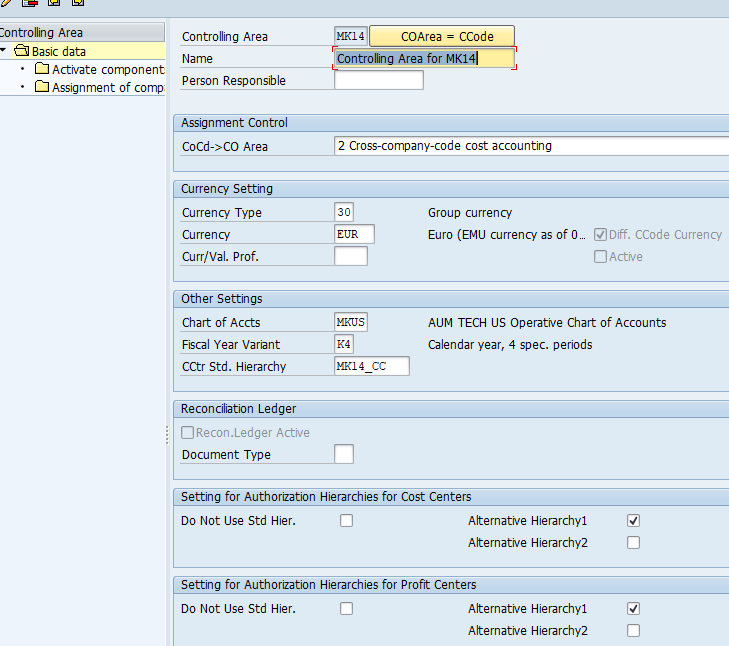

Transaction code to set controlling area: OKKS

Transaction code to create Controlling area: OKKP

- CoCd->CO Area : Cross company code is used when multiple company codes use same controlling area

- Currency type: 20- controlling area currency, 30 - Group currency. Only these two currency types should be used for cross company codes

- Chart of accounts: Use operating chart of accounts of the companies

- Fiscal year variant: Use company code Fiscal year variant

- Cost Center Standard hierarchy: This field is mandatory. Value defined here is the highest node in cost center hierarchy

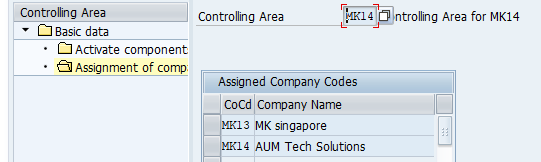

Assign Controlling area to Company codes

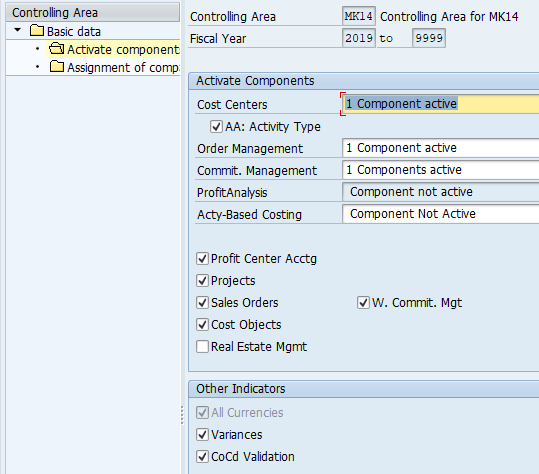

Activate below components

- Cost center

- Select Activity type: This allows analyze of labor activity

- Order management; Production order, Process order, Service order

- Commitment Management

- Profitability analysis is implemented when CO-PA is activated

- Profit Center accounting: Required to activate for classic GL. Not required for new GL as part of finance

- Projects

- Cost Objects

- Variance

- All currencies

- Company code validation: Applies only to cross-company-code cost controlling and to postings from external accounting. E.g.: A procurement order made for a cost center in another company code is possible only if the indicator is inactive.

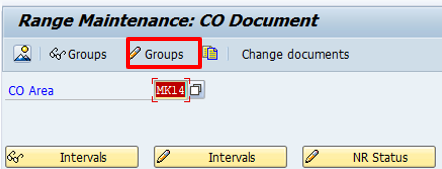

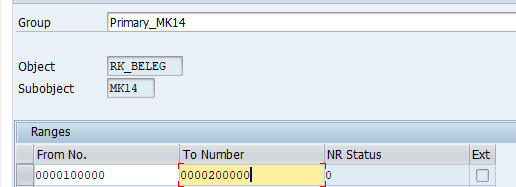

Number Range

Transaction Code: KANK

In Finance Document types are assigned to number ranges

In controlling CO document are saved are Business transaction types

E.g., of Business Transaction types are

- KAUS: Calculate Scrap

- KAMV: Manual cost allocation

CO number range is assigned to business transaction type

Procedure: Click the create button. Now create the Group say Primary posting and create number range for this group say 1 to 199999. Now come back to the previous screen. Select the unassigned business transaction. Click button Element, select the group created earlier. This business transaction get assigned to the group and get’s the number range of the group

| Group | Number Range |

| Primary | 100000-200000 |

| Secondary | 200001-400000 |

| Planning | 400001-600000 |

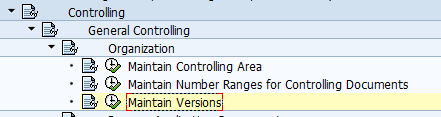

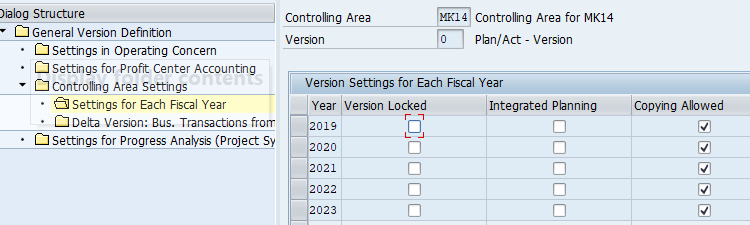

Controlling Versions

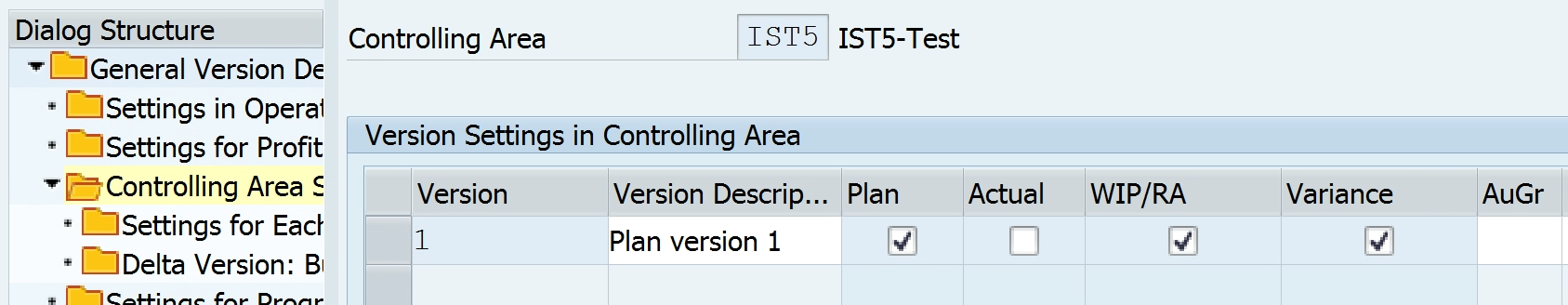

Controlling data is stored in versions

Default version is zero. Version zero is used for both actual and planning. Other versions are used only for planning

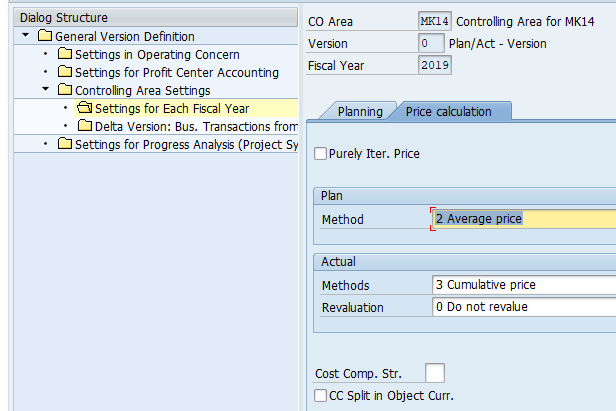

IMG Path : SPRO-Controlling – General controlling – Organization – Maintain versions

Select General version – Select version 0 – Controlling area settings – Select year to be activated – Settings for each fiscal year

Click Price calculation

- Plan Method : Average Price

- Actual Method : Period Price

Cost Element Accounting

Cost elements are cost carrier between cost objects. A cost element can be represent either as cost or revenue. There are two types of cost elements, Primary and Secondary

- Primary Cost Element

- Main integration between FI and CO. Values flow from FI to CO through primary CE

- All income and expense accounts can be created as a primary CE

- GL accounts for WIP and production variance are not created as primary CE. These are calculated in CO. They flow from CO to FI

- Secondary Cost Element

- These are not represented by GL accounts

- They exist only in controlling

- They are used for below purpose

- Transfer cost between cost objects

- Apply direct / Indirect OH to product cost

- Transfer values from cost center to CO-PA

Cost Element Categories

Cost element categories classify primary and secondary cost elements. They determine the transactions with which you can use the cost element, such as internal settlement or allocation. The cost element category determines whether you can post to a cost element directly or indirectly:

- Direct posting: You post a fixed amount to an account by specifying the account number. You can post directly to all primary cost elements.

- Indirect posting: The account is determined automatically at the time of posting. Indirect posting is only possible for secondary cost elements.

Various Cost Element Categories:

- 01 Primary Cost Element : These are used for expense GL accounts other than sales deductions

- 12 Sales deductions : This cost comes from Sales and Distribution (VKOA). This cost flows to CO-PA. Category 01 cannot transfer cost from SD to COPA

- 22 External Settlement

- Move cost from CO to FI

- Transfer Internal order cost from CO to FI

- 11 Revenue : These are used for Sales / Revenue GL accounts

- 21 Internal settlement : Used to settle Service order to cost objects ( Cost center, Internal order, Production Orders, Sales Order)

- 31 WIP / RA

- Used in Product costing. Required for calculation of WIP (Work In Progress) / RA (Result Analysis)

- For WIP there are two accounts. WIP B/S account and WIP P/L account

- Period 6 WIP BS account is DR and WIP P/L account is Credited. Period 7 (Next period) beginning WIP P/L account is DR and WIP BS account is CR.

- 41 Indirect OH

- FI cost is of two types direct cost and indirect cost. Direct cost like material is traceable to the product. Indirect cost like administrative expenses are not directly traceable to the product. Client can provide a % of material cost, say 10%, which can be assigned as Indirect OH to the product

- 42 Assessment CE Category

- Used to transfer values from Cost center to CO-PA. E.g. transfer marketing department cost to COPA

- Transfer cost from one cost center to another cost center

- 43 Activity Cost Element (Direct OH)

Primary Cost Element

- Create Primary Cost Element : KA01/KA02 /KA03 in CO

- Create Primary CE automatically in Controlling : OKB2-OKB3-SM35

- Create Primary CE in FI : FS00

Secondary Cost Element

- Create Secondary Cost Element in Controlling : KA06

List / Display Cost Element: KA23

Primary Cost Element

| Secondary CE | Name | CE Category |

| 942000 | canteen assessment cost element (distribution is based on number of employees) | 42 : Assessment |

| 941000 | material indirect overheads cost element (depreciation based on % of material cost) | 41 : OH |

| 943000 | production dept depreciation direct overheads cost element (for depreciation based on machine hour rate) | 43 :

activity allocation/machine hr. |

| 943001 | employee cost or labor direct OH cost element (for salaries & canteen dept's distributed cost of production department costs based on labor hour rate) | 43 : activity allocation/labor hr. |

| 942001 | material assessment OH cost element (based on revenues ratio) | 42 : Assessment |

| 942002 | marketing assessment OH cost element (based on revenues ratio) (All these are secondary cost elements) | 42 : Assessment |

Cost Element Numbering rules can be similar to one shown below:

- 9: Starting Number

- 41 / 42/43: CE Category

- 000/002: Sequence number

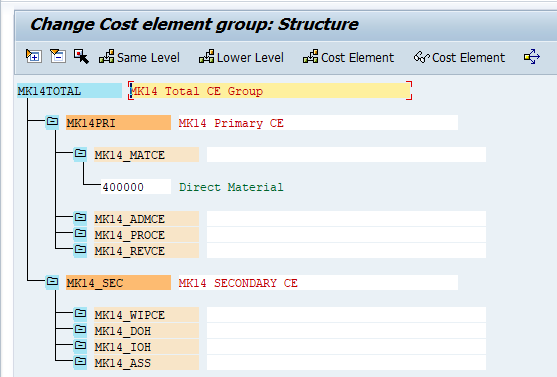

Cost Element Group

Cost Element Group is an organizational unit storing a group of cost elements. Any number of cost element groups can be defined as part of master data maintenance for valuation, planning and allocation purposes in Cost Element Accounting or Cost Center Accounting. It is used for reporting purpose

Transaction Code : KAH1 / KAH2 / KAH3

Menu Path : Accounting – Controlling – Cost Center Accounting – Master Data – Cost Element Group – KAH1-Create

| Total CEG | Primary CE | Material |

| Employee | ||

| Administration | ||

| Selling | ||

| Secondary CE | Assessment CE | |

| Indirect OH | ||

| WIP | ||

| Direct OH |

Cost Center Accounting

Cost center

- Cost centers are responsibility areas for costs within organization and used to capture actual costs of an organization. Costs can be captured as per department wise, area wise, responsibility person wise, etc. Assigning the costs to cost centers determines where the costs are incurred within the organization

- Cost center helps to compare actual expenditure against plan expenditure

- A cost center represents where cost occurs like location, department, responsibility center

- Each cost can be linked to a work center from where cost comes to cost center

- Activities like machine activity, cleaning activity etc. are performed in cost center

Overhead

- Overhead cost refers to cost that cannot be directly assigned to production of goods and services of a company. Overhead cost can be Direct or Indirect overhead cost

- Direct OH: This is allocated to the product based on activity

- Indirect OH

- Non activity related overhead cost: It is allocated to product in costing sheet. For e.g. 20% of material cost

Cost Center accounting include below topic

- Cost Center standard hierarchy

- Cost Center category

- Master data

- Cost Center

- SKF

- Activity Type

- Planning

- Price Calculation

- Allocation Methods

- Cost Center budget

- Actual Posting

- Reports

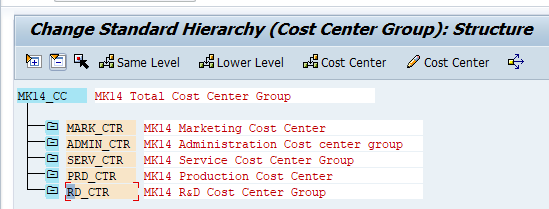

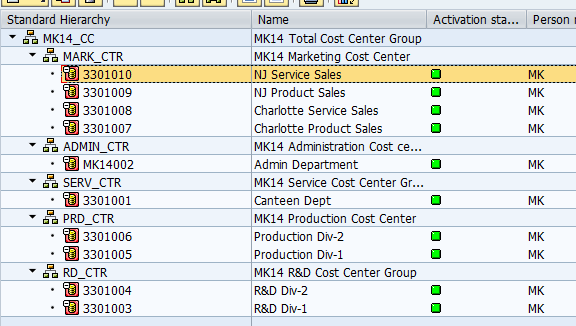

Cost Center Standard hierarchy

Cost center hierarchy consists of groups of cost centers in a tree structure within a controlling area. Cost centers can be grouped together to provide summary cost information. A cost center hierarchy consists of nodes and sub-nodes that cost centers are attached to. A cost center hierarchy comprises all cost centers for a given period and therefore, represents the entire enterprise. This hierarchy is known as the standard hierarchy.

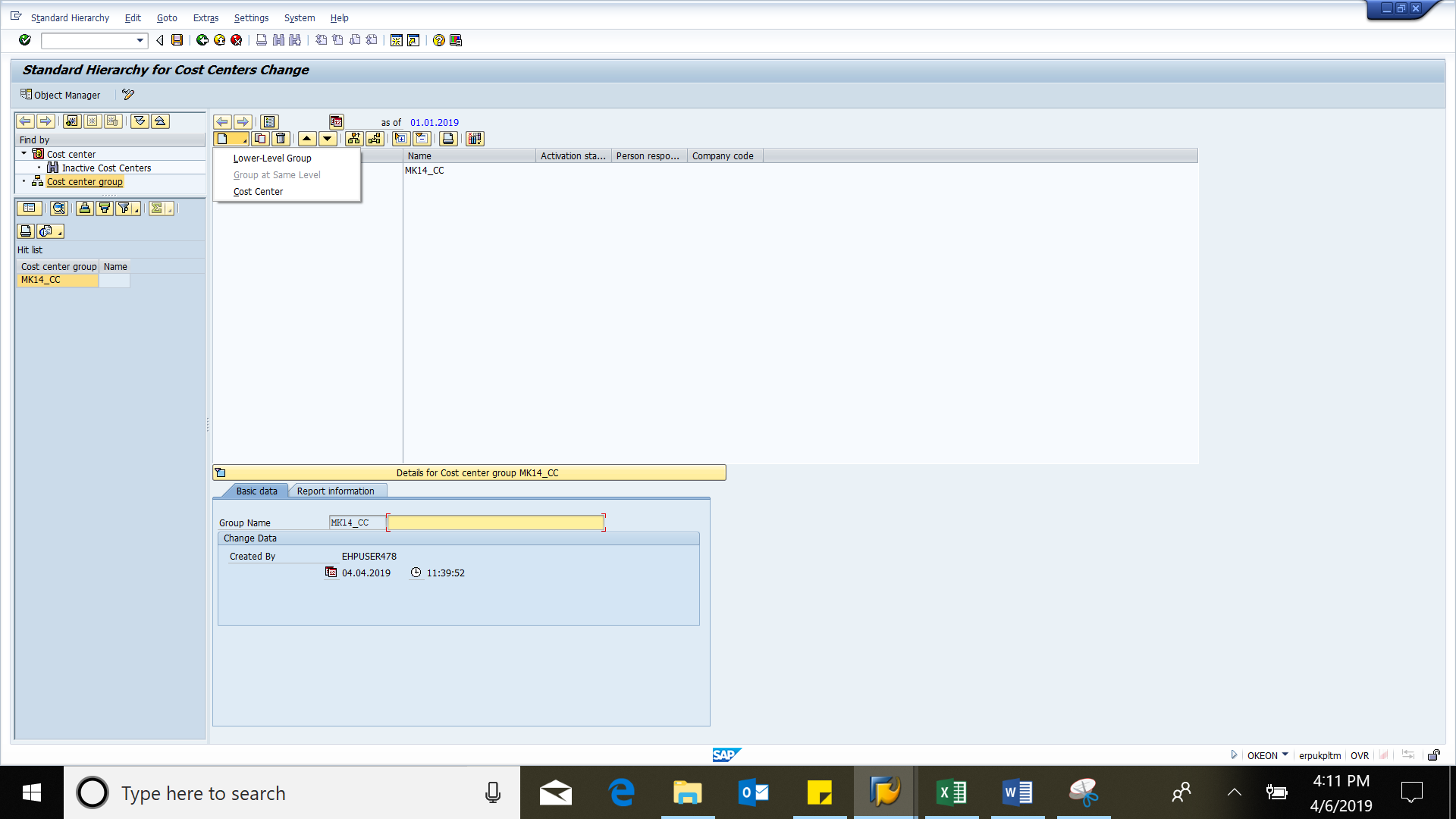

Cost at the top of the Hierarchy is defined in transaction code OKKP

Other cost centers and Cost center group can be defined in transaction code #OKEON

Define standard hierarchy: OKEON

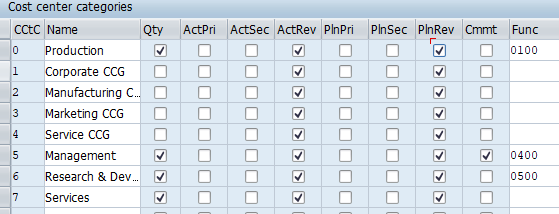

Cost Center Category

The Cost Center category is an indicator in the cost center master data, which specifies the category for the cost center. Examples include administration, production, or sales & distribution cost center category. Cost Center categories provide the ability to safe guard your postings to cost centers as they will prevent non-category costs being posted to the wrong cost center. Cost Center category is also used for reporting purpose

IMG Path : SPRO- CONTROLIING – Cost Center Accounting- Master data -Define Cost center category

- Quantity : If selected, quantity can be entered in the cost center

- Actual Revenue : If selected, actual revenue cannot be posted to cost center. If not selected the revenues are written to the cost center as statistics only.

- Plan Revenue : If selected, plan revenue cannot be posted to cost center. If not selected the revenues are written to the cost center as statistics only.

Create Cost Center Group

- Cost center group is a group of cost center. Used for reporting purpose

- Cost center standard hierarchy highest node is created in transaction code #OKKP

- Create Cost Center Groups in Transaction code OKEON

- Cost center group can also be created in transaction codes# KSH1/KSH2/KSH3

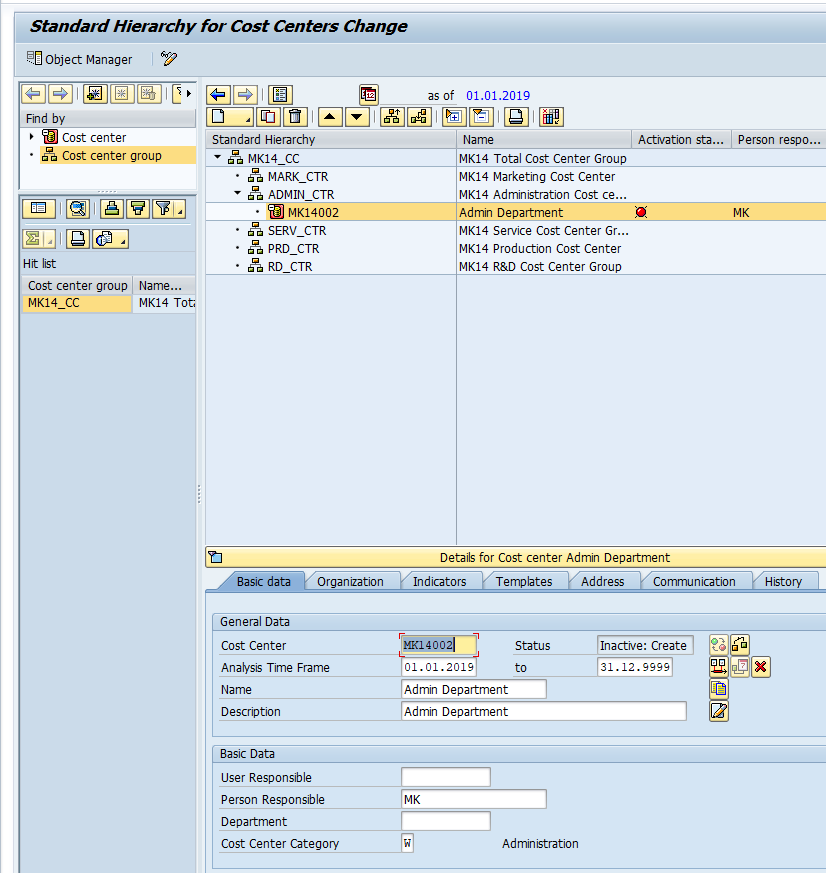

Create Cost Centers

Transaction: OKEON or KS01

Transaction to change / display Cost Center: KS02 / KS03

SKF (Statistical Key Figure)

The ‘Statistical Key Figure (SKF)’ is used as the basis (tracing factor) for making allocations (assessments/distributions). They are the statistical data such as number of employees, area in square meters, etc.

Suppose that you are incurring a monthly expense of USD 5,000 in the cost center cafeteria, the cost of which needs to be allocated to other cost centers. You can achieve this by the SKF. Imagine that you want this to be allocated based on the ‘number of employees’ working in each of the other cost centers such as administrative office (100 employees) and the factory (300 employees). You will now use the number of employees as the SKF for allocating the costs.

In SKF allocation, you have the flexibility of using two different SKF Categories; namely, Total value or Fixed value. You will use fixed values in situations where the SKF does not change very often, as in the case of the number of employees etc. You will use Total values in situations where the value is expected to change every now and then, as in the case of power use or water consumption in the cost center

Transaction code to create SKF: KK01 / KK02

| SKF | Description | Category | Unit |

| EMP | No of employees | FIX | EA |

| SYSTEM | No of Computer units | FIX | EA |

| POWER | Power charge per month | TOTAL | KW |

| AREA | Area per cost center | FIX | FT2 |

SKF Categories

- Fixed : This does not change every month. E.g. no. of employees, SQFT area

- Total : This is variable and changes every month. E.g. power bill

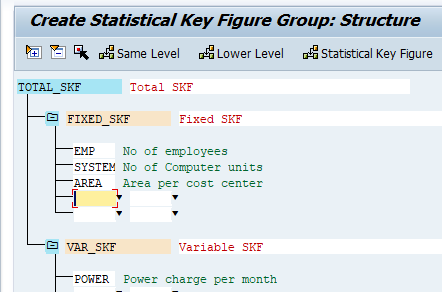

SKF Group

Group of SKF. Used for reporting purpose

Create SKF group : KBH1 / KBH2

- MK21_FIX

- MK21_VAR

Activity Type

- Various activities are performed by cost center. E.g. of these activities are labor activity, machine activity, cleaning activity etc.

- Activity type measure these activities

- Activity type is the basis for allocating cost center overhead cost to Products in Product costing

- Activity type are assigned to work centers. Maximum of 6 activity types can be assigned to a work center

Activity Type categories

- Direct

- Manual entry, manual allocation: activity recorded manually. Activity allocated manually

- Manual entry, No allocation: Idle time

- Indirect

- Indirect determination, Indirect allocation

- Indirect determination, manual entry

Price Indicator

- Manual

- System calculated

- It could be based on capacity

- Price can also be calculated based on activity units. Total cost / Total Hours. Price / Hour

Create Activity Type

- Transaction code: KL01 / KL02 /KL03

- For each activity type secondary cost element of category 43 is required

- Create secondary CE: KA06

| Sec CE |

Comments are closed.