Table of Contents

Product Costing Concepts

- Find Cost which are part of Product Cost (COGM)

- Find optimum Lot size for manufacturing the product

- Find Product cost for each manufacturing location / Plant

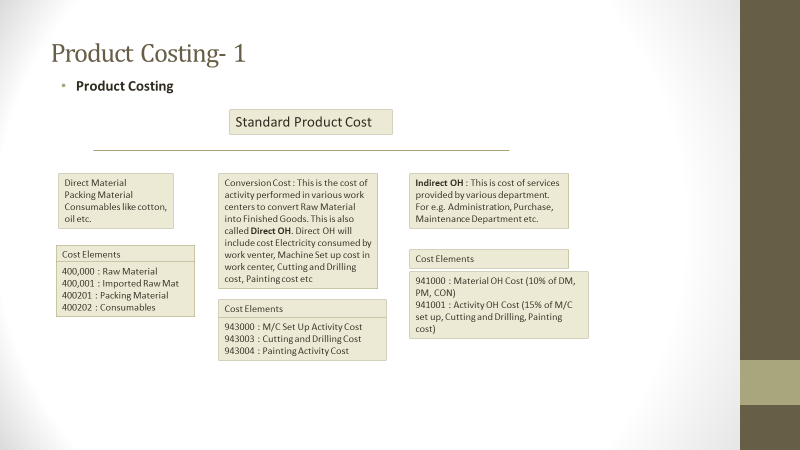

- In Product costing we estimate the product cost. Product cost estimate is also known as standard product cost

- Various techniques used to calculate product cost estimate are as below:

- BPO: Base Planning Object

- Cost Estimate without quantity structure

- Cost estimate with Quantity Structure: BOM and Routing

- BOM: It is list of Raw material along with their quantity used to manufacture the product

- Routing: List of activities like operation 1, operation 2 etc. performed on raw material to convert it into finished goods

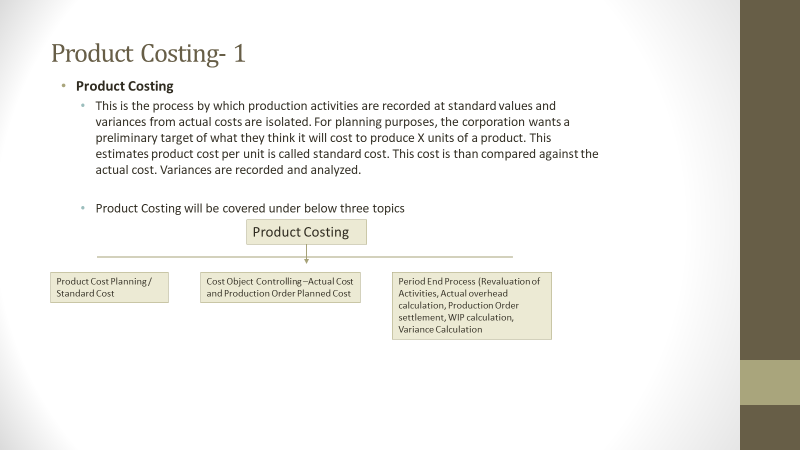

- Product Costing is divided into 3 different topics as below:

- Planning: Calculate standard cost

- Cost Object Planning: This will cover period end process, i.e. Planned cost, Actual cost, variance, settle production order

- Actual Costing / Multiple valuations: Material Ledger

Standard cost estimates settings- Concept

Tcode: CK11N

| Cost Component Split | Material Cost Labor Cost Machine Cost Setup Cost Mat OH Admin OH | All these together make COGM (Cost of goods manufactured) |

| Costing Variant | Made of be below components | |

| Costing Type | Determine cost type like Standard cost | |

| Valuation Variant | ||

| Material | ||

| Activity | ||

| Subcontract | ||

| External | ||

| OH -Costing Sheet | ||

| Date Control | Validity period of standard cost estimate | |

| Qty. Structure control | BOM + Routing = Qty Structure Qty structure control determine which BOM and Routing is used for standard cost estimate | |

| Transfer Control | Standard cost is calculated per plant. Transfer control used to see if same standard cost can be used for other plants | |

| Ref. Variant | ||

| Integration with PP (Production Planning) | ||

Product Costing Types – Concept

There are two Product Costing Types

- MTS (Make to Stock): In this type goods are produced and stocked. They are sold from the stock. Under MTS there are two scenarios

- Product Costing by order

- Product costing by period

- MTO (Make to Order): This is used for large equipment’s, aircraft manufacturing etc. In this type manufacturing of product starts after receiving the sales order.

Cost Object Controlling – Settings

This involves settings for below activities

- Costing variant for Plan cost

- Costing variant for Actual Cost

- Period end process:

- WIP

- Variance (Plan – Actual Cost)

- Settlement: This involve settlement of production order

- Create PA transfer structure for COPA

- FI entries for WIP and variance are posted only at the time of production order settlement

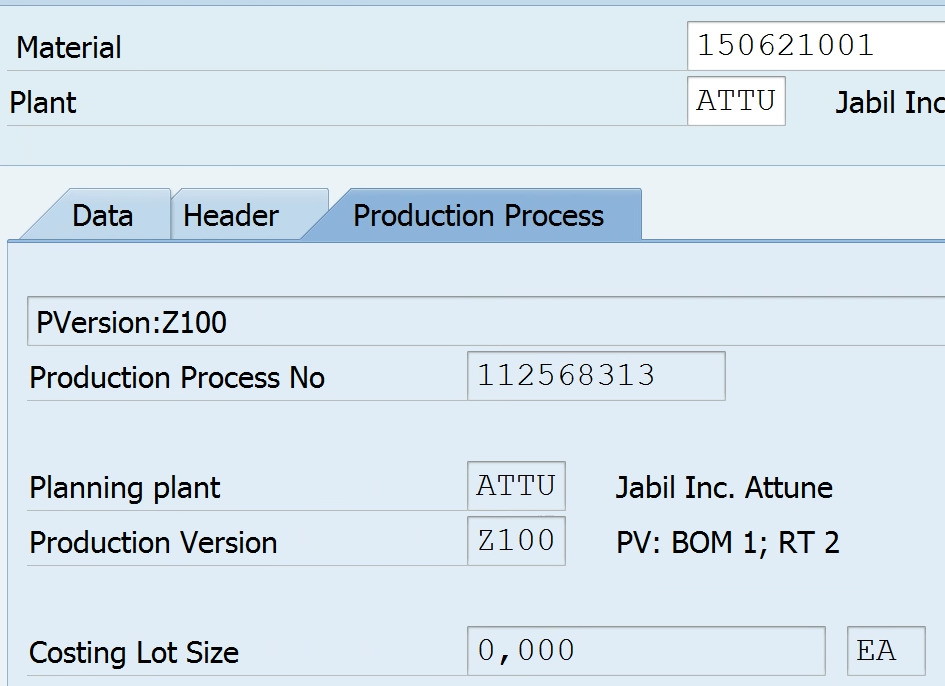

Integration with PP (Production Planning)

Costing Sheet Configuration

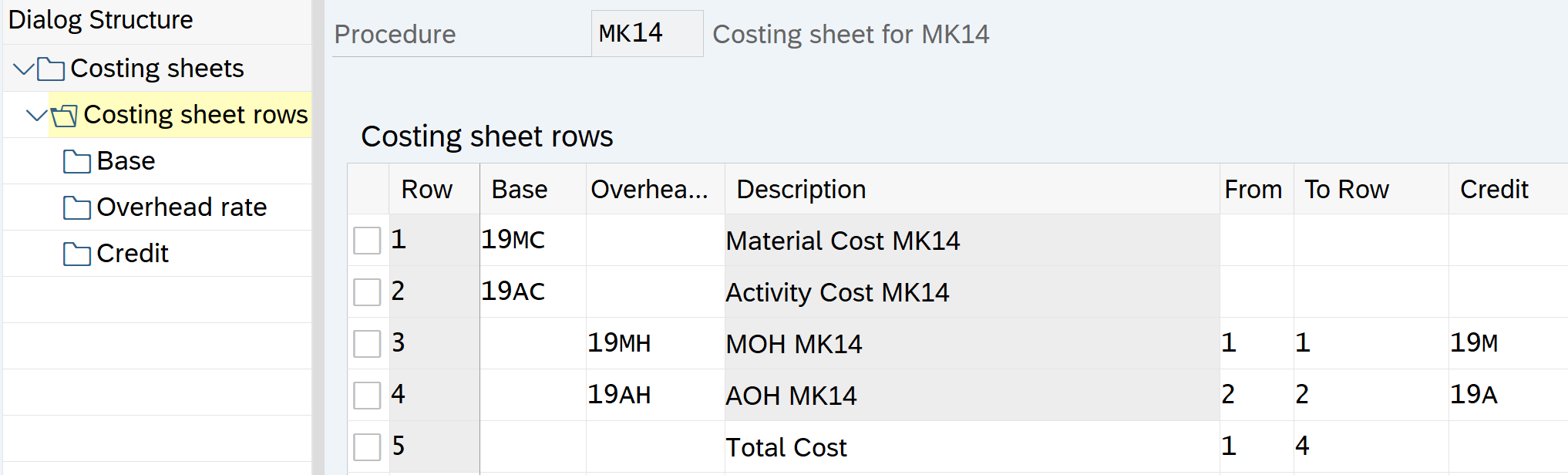

Costing Sheet explanation

What is Costing sheet:

The costing sheet integrates all elements of overhead costing. It consists of the following rows that are processed during the calculation:

- Base Row: This contain the calculation Base. Calculation base is made up of cost elements on which OH is calculated

- OH Rates Row: This contain OH Rates. OH rates contain percentage rate which applied on calculation base to arrive at OH amount

- Total Rows: Used to form subtotal or total of earlier rows. No calculation performed on these rows

| Step | Base | OH Rate | Description | From | To | Credit |

| 1 | 19MC | Material Cost | ||||

| 2 | 19AC | Activity Cost | ||||

| 3 | 19MH | Material OH | 1 | 1 | 19M | |

| 4 | 19AH | Activity OH | 2 | 2 | 19A | |

| 5 | 1 | 4 | ||||

| 6 | ||||||

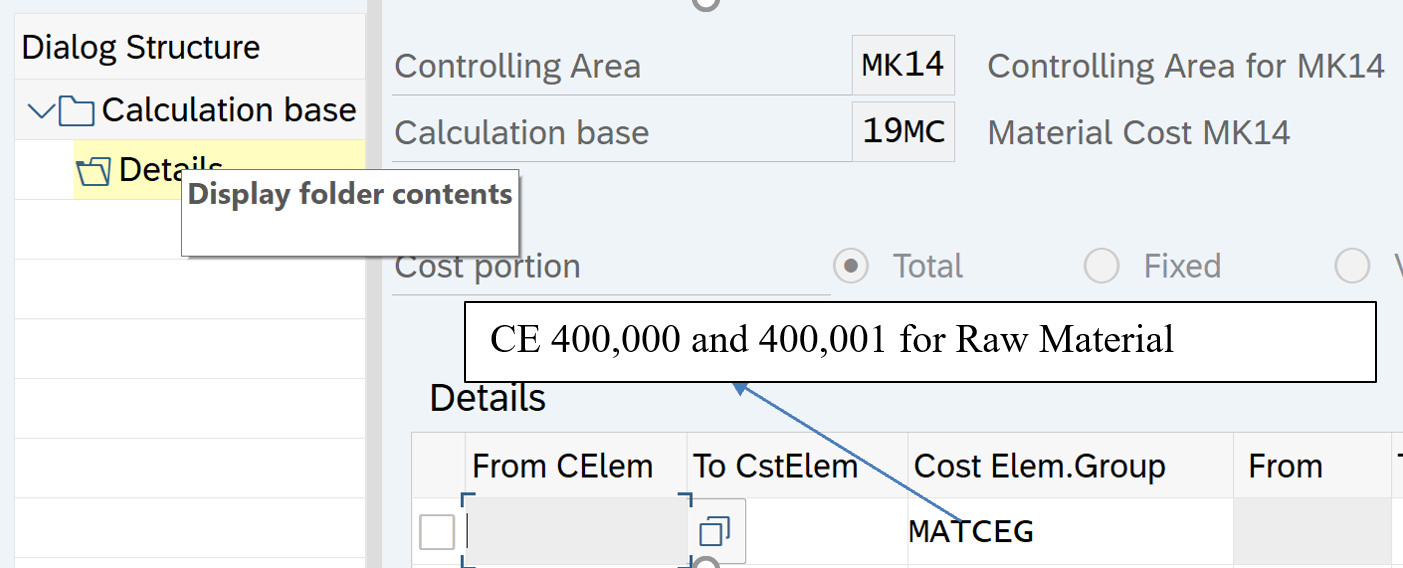

| 19MC: Material Cost: Raw Material Cost (CE from 400000 to 400001) | ||||||

| 19AC: Activity Cost: Machine Cost, Labor cost, Cleaning (CE from 943000 to 943002) | ||||||

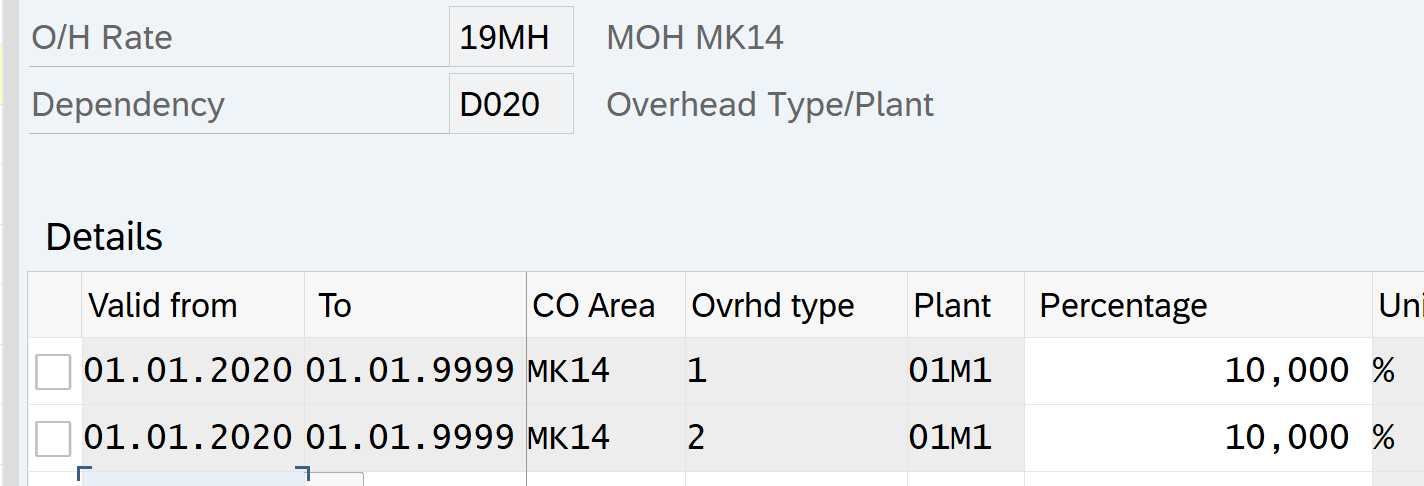

| 19mh Dep Key is D020 Plant (OH Calculation based on %) | ||||||

| Valid Fr | Valid To | CO Area | OH Type | Plant | Percentage | |

| 1042018 | 31129999 | MK14 | 1 | 01M1 | 10 | |

| 1042018 | 31129999 | MK14 | 2 | 01M1 | 10 | |

| 1042018 | 31129999 | MK14 | 1 | 01M1 | 10 | |

| 1042018 | 31129999 | MK14 | 2 | 01M1 | 10 | |

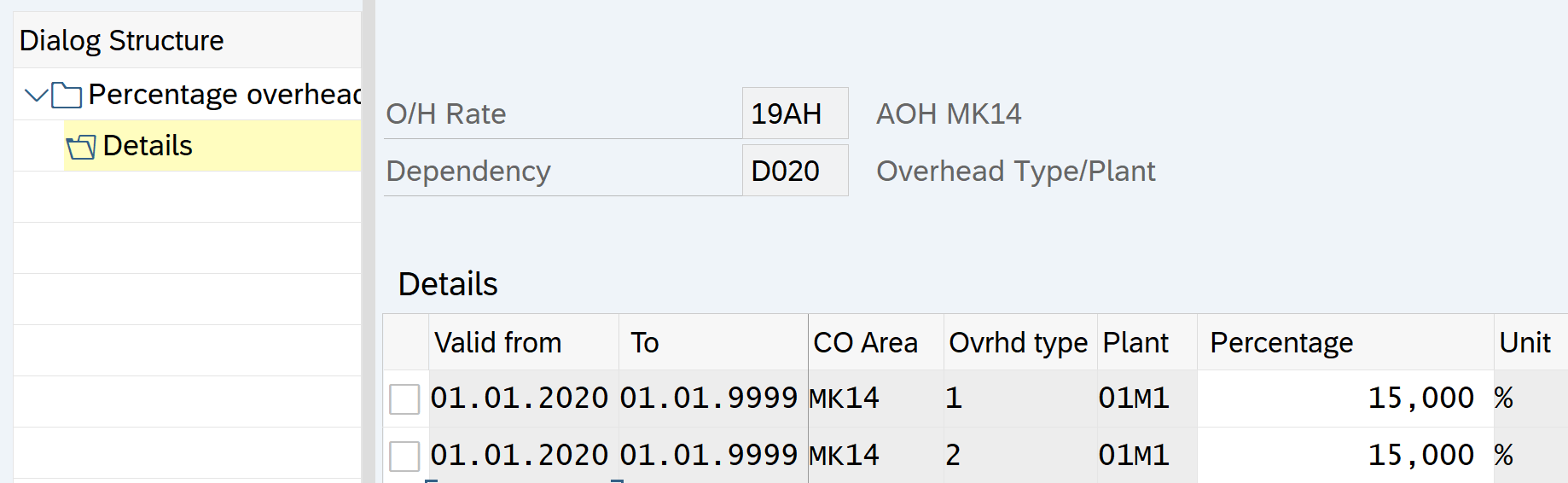

| 19ah Dep Key is D020 Plant (OH Calculation based on %) | ||||||

| Valid Fr | Valid To | CO Area | OH Type | Plant | Percentage | |

| 1042018 | 31129999 | MK14 | 1 | 01M1 | 15 | |

| 1042018 | 31129999 | MK14 | 2 | 01M1 | 15 | |

| 1042018 | 31129999 | MK14 | 1 | 01M1 | 15 | |

| 1042018 | 31129999 | MK14 | 2 | 01M1 | 15 | |

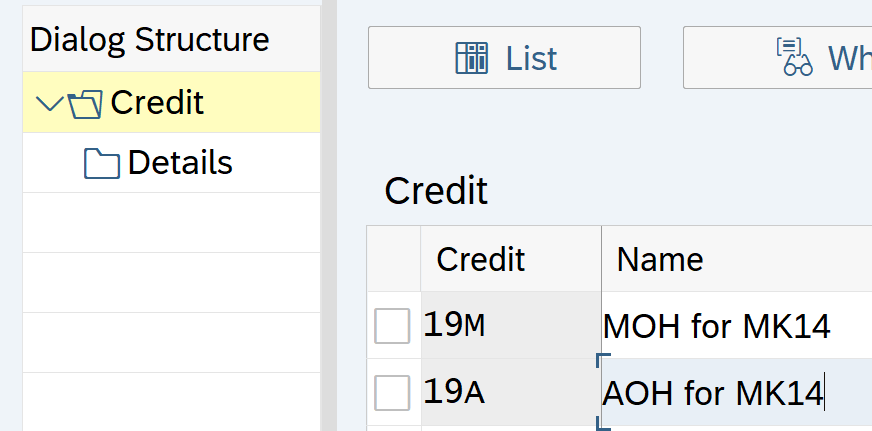

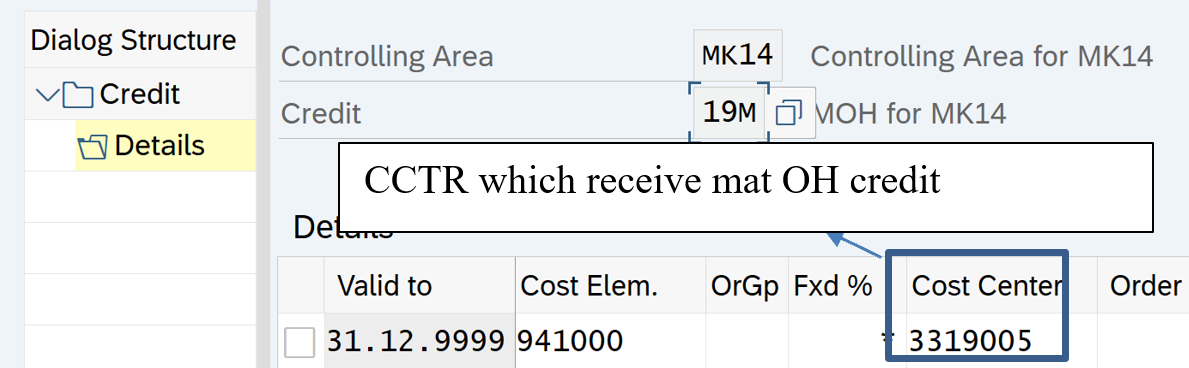

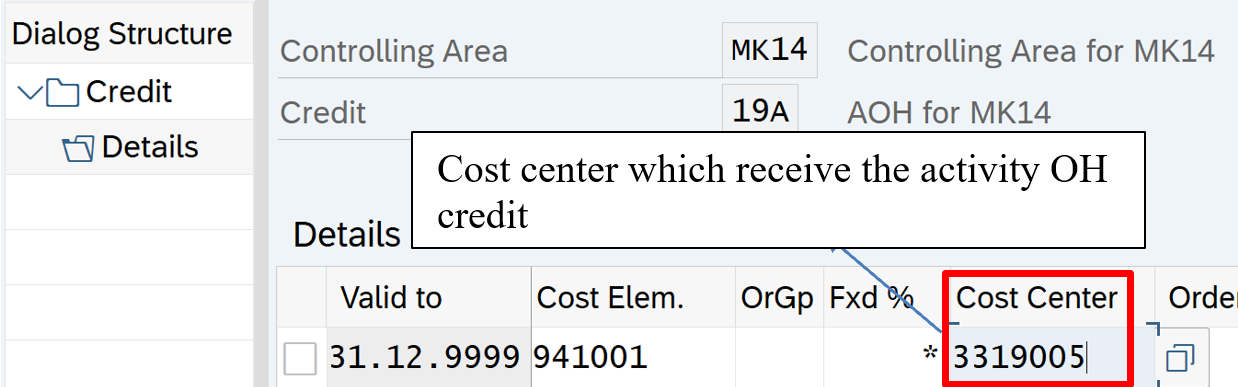

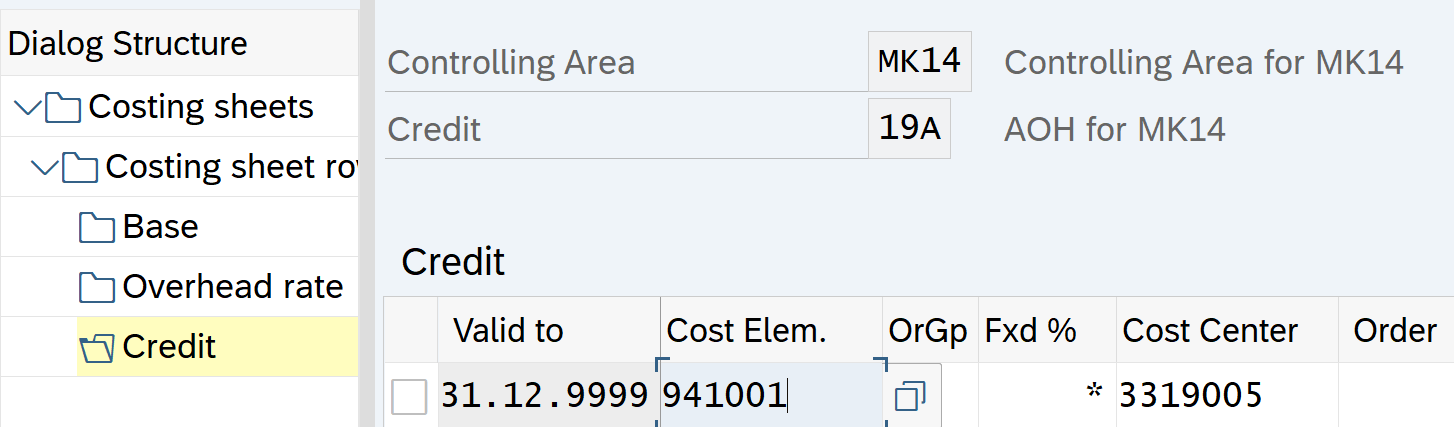

| Credits: Determine which cost center is credited using which credit element | ||||||

| CE | CCTR | |||||

| 19M | 941000 | 3319005 | Cost center 3319005 is credit using CE 941000 | |||

| 19A | 941001 | 3319005 | ||||

Set Controlling Area: OKKS

Controlling area: MK14

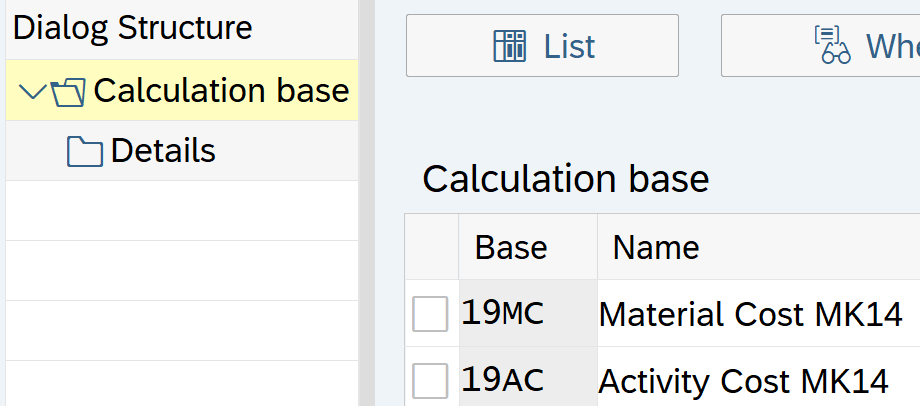

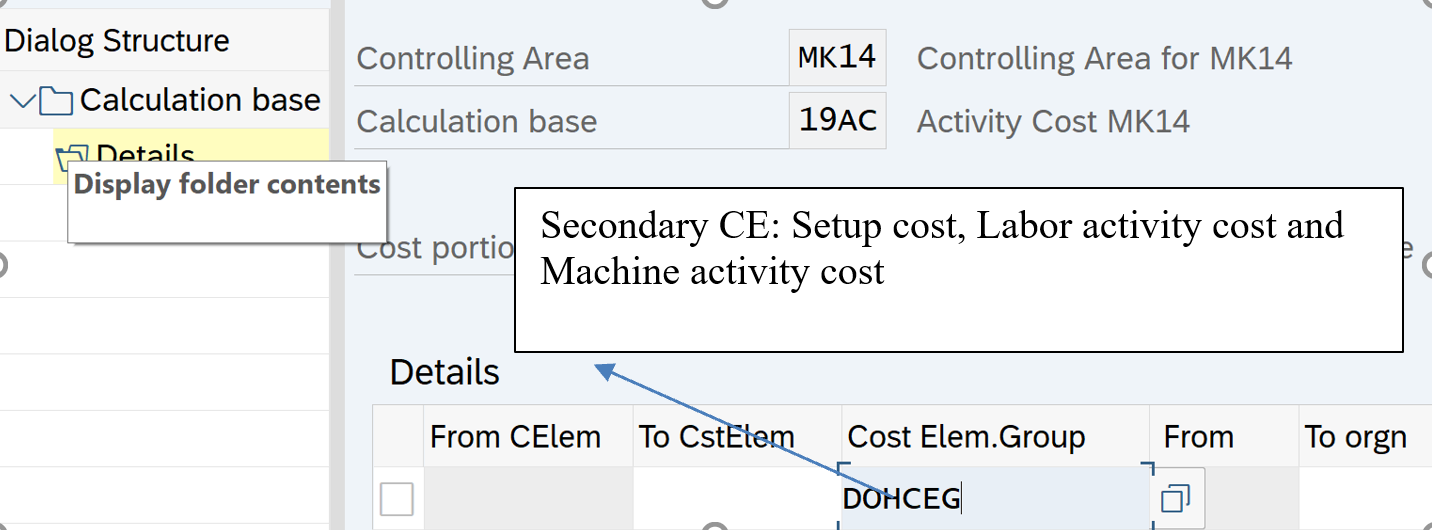

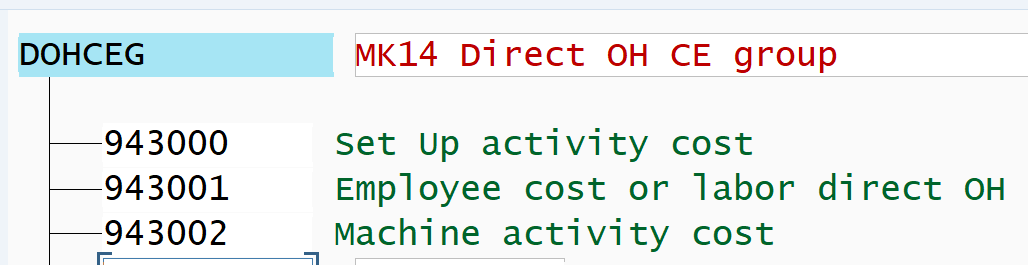

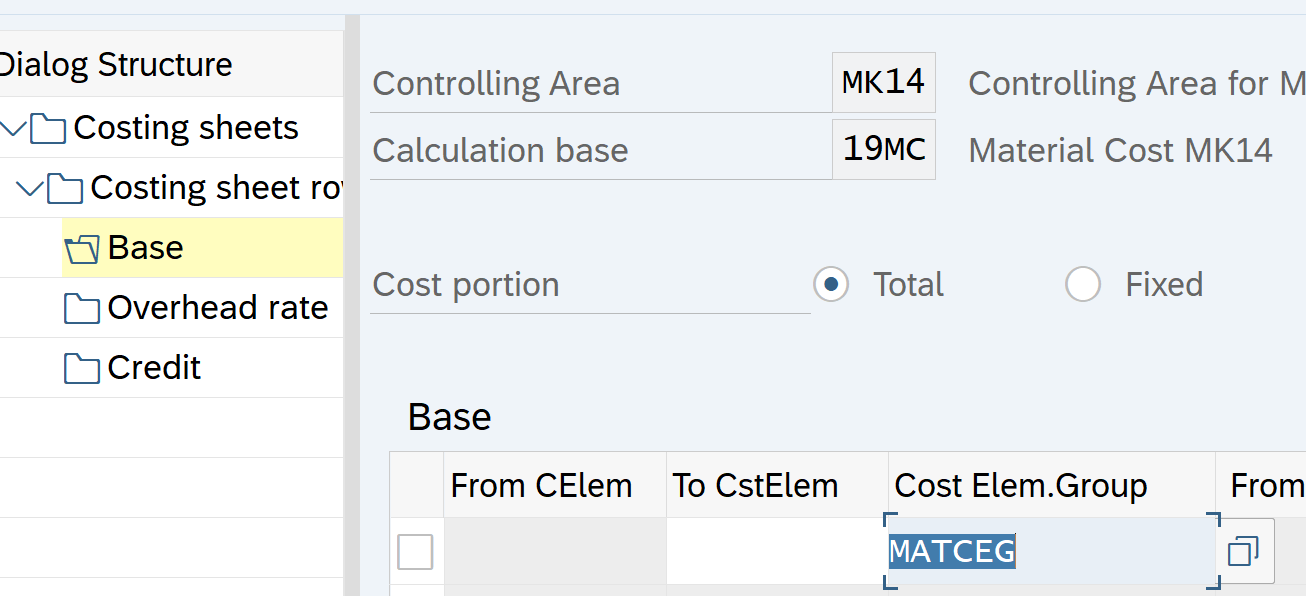

Define Costing Sheet Components- Calculation base

Path: SPRO – Controlling – Product Cost Controlling – Product Cost Planning – Basic settings for material costing – Overhead – Costing sheet components – Define Calculation base

The calculation base determines to which cost elements overhead is applied together.

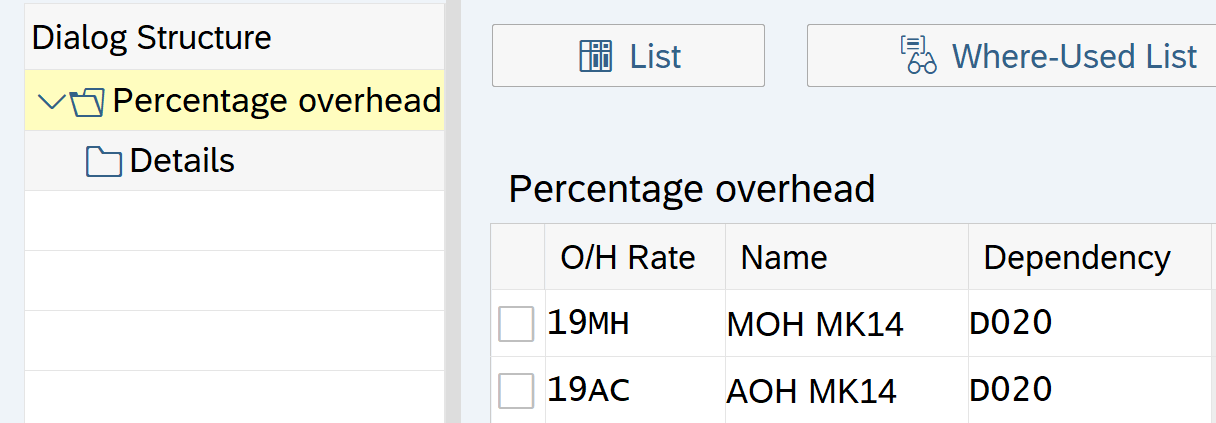

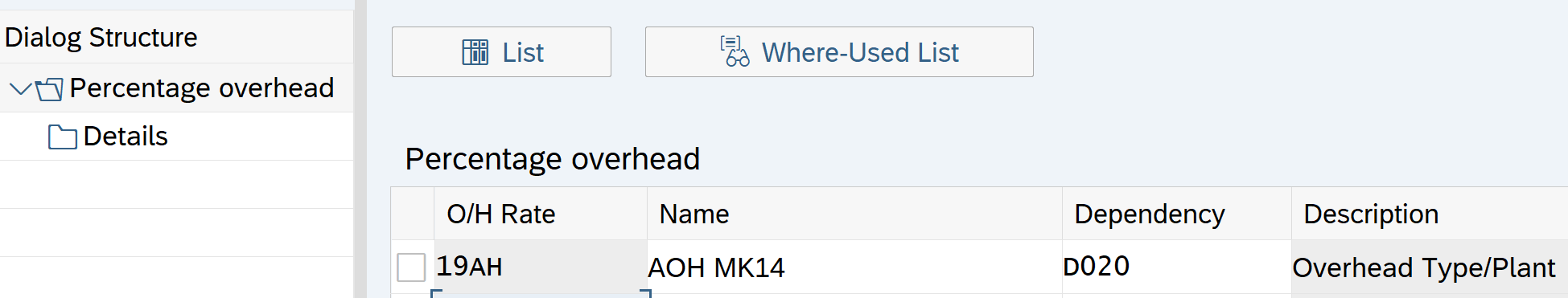

Define Costing Sheet Components- % OH Rates

Path: SPRO – Controlling – Product Cost Controlling – Product Cost Planning – Basic settings for material costing – Overhead – Costing sheet components – Define Percentage OH rates

Define percentage overhead rates, for example, 10% in controlling area AUM1.

Select OH Rate 19MH and below entries

Select 19AH OH rate and make the below entries

Define Costing Sheet Components- Credits

Path: SPRO – Controlling – Product Cost Controlling – Product Cost Planning – Basic settings for material costing – Overhead – Costing sheet components – Define Credits

Here you define Cost center which is to be credited with OH cost. Further this credit is recorded under secondary cost element of category 41 (overhead rates)

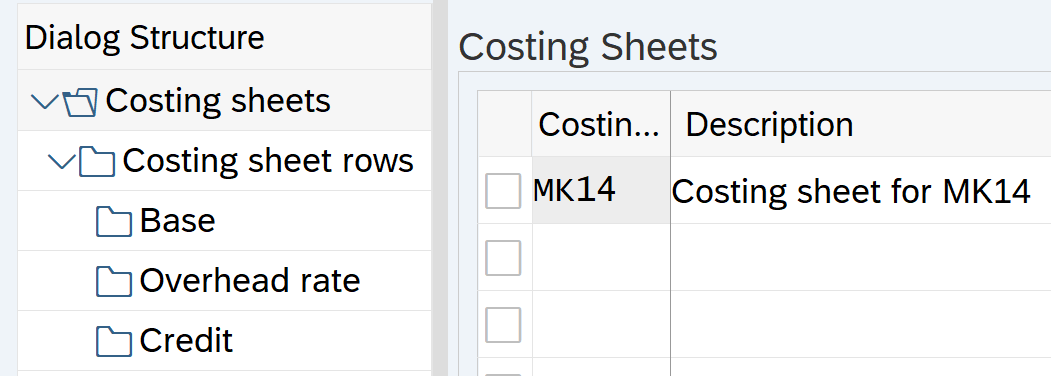

Define Costing Sheet

Path: SPRO – Controlling – Product Cost Controlling – Product Cost Planning – Basic settings for material costing – Overhead – Costing sheet

Select Base, OH or Credit and click the respective row to see the details configured earlier

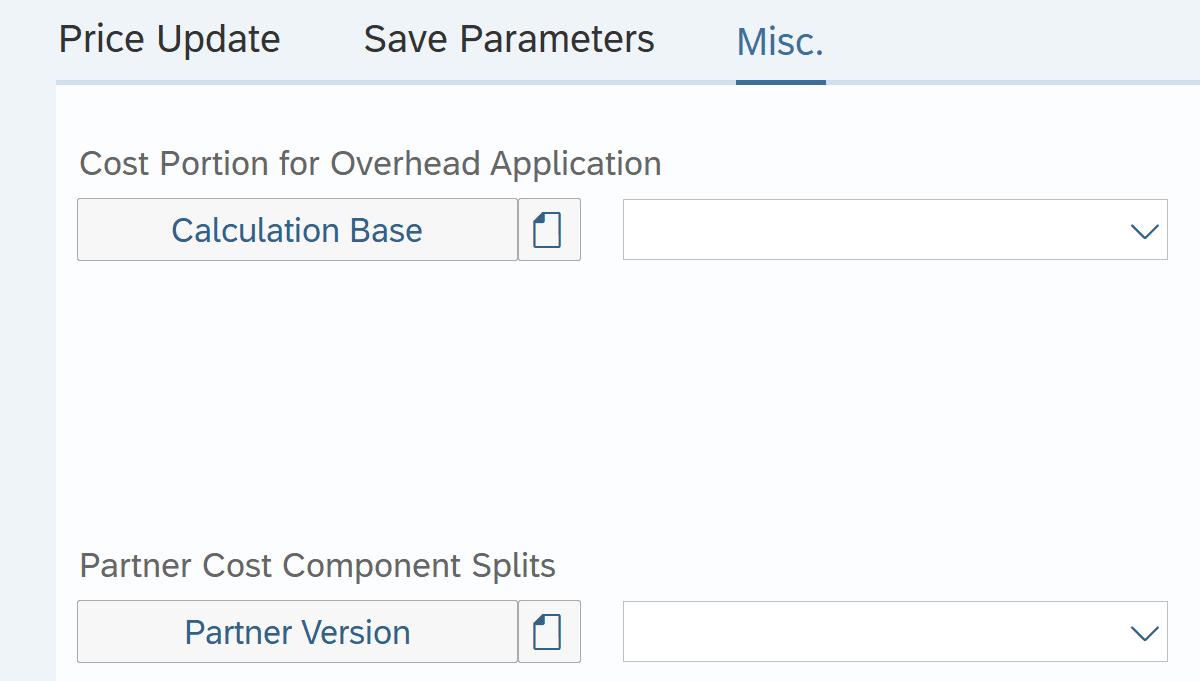

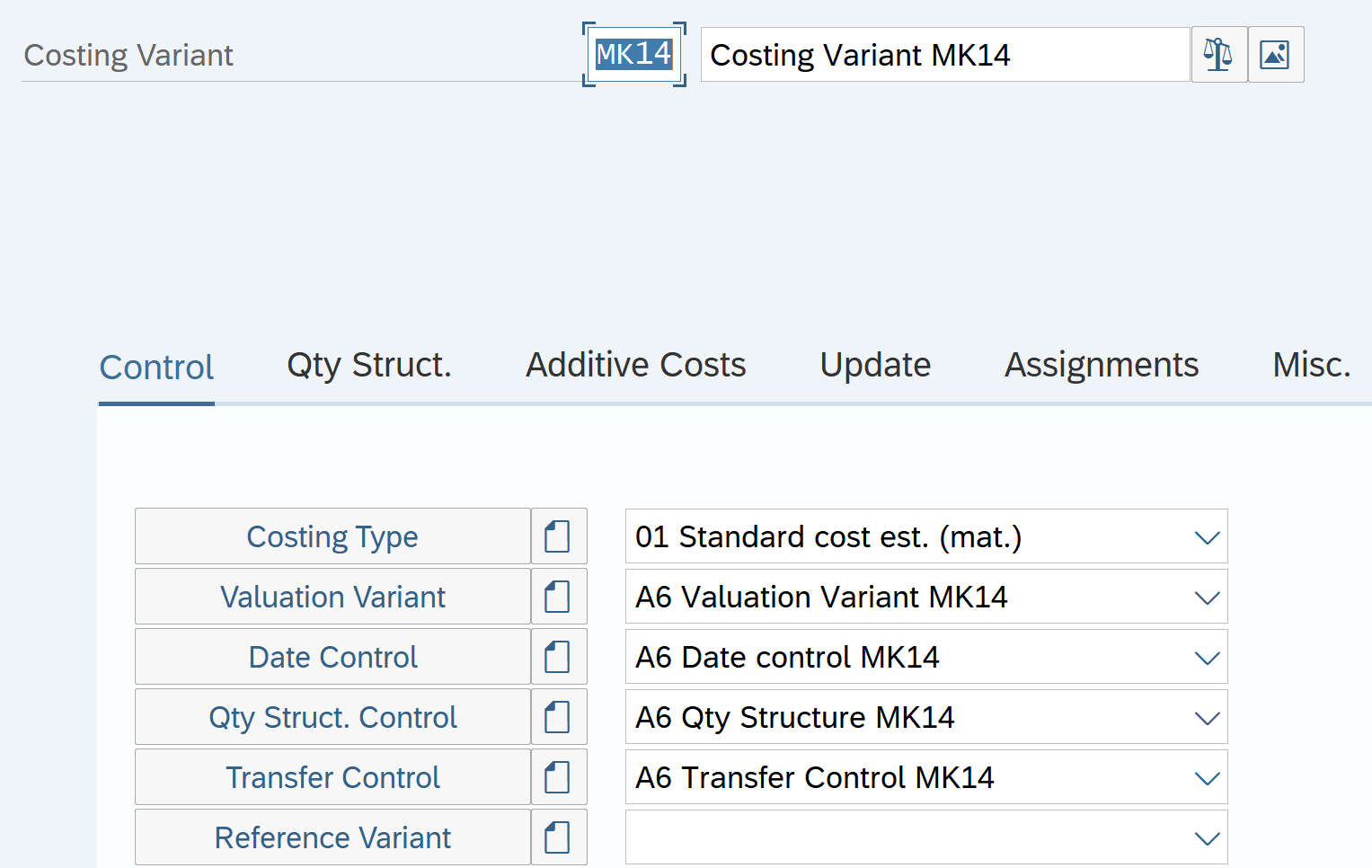

Define Costing Variant

Costing Variant contain Costing Type, Valuation Variant, Date Control, Quantity structure control, Transfer control and reference variant. We will create three costing variants – Standard cost, Planning cost and Actual cost variant

Costing variants is the link between product costing and Customizing,

The costing variant contains all the control parameters for costing.

The costing variant for a material cost estimate contains the following control parameters:

- Costing type

- Valuation variant

- Date control

- Quantity structure control

- (only relevant for cost estimates with quantity structure)

- Transfer control (optional)

- Reference variant (optional)

| Costing Variant (Contain Costing Type, Valuation Variant) | ||||||

| Costing Type Determine | ||||||

| Standard Costing | Other than Standard costing | Costing for reporting | Quotation | |||

| Valuation Variant determine | ||||||

| Material Valuation (Material can have many prices in MM03. Price sequence have to defined here) | Activities Valuation (Can have many price. Priority sequence to be defined) | Subcontract (For e.g. a Semi FG purchased from a vendor). Price sequence to be defined here | External Operations (Operation outsourced to a vendor). Price sequence to b e defined | Over heads | ||

| Mov Avg Price | Avg price for 12 months | PO Price | Price for operation | Costing sheet defined earlier | ||

| Standard Price | Current period price | Purchase Info Record price | Purchase order price | |||

| Pur Info Record Price | Previous period price | Purchase infor record | ||||

| Date Control | Costing Date from | Current Date | ||||

| Costing date To | Maximum Date | |||||

| Qty structure date | Current Date | |||||

| Valuation Date | Current Date | |||||

| Quantity structure control | ||||||

| BOM Application Area | ||||||

| Routing selection ID | Task List Type | N (Product Cost By Order) | ||||

| R | ||||||

| 2 (Product cost by process order) | ||||||

| Transfer Control | Single Plant | Cross Plant | ||||

| Ref Variant | Optional |

Note:

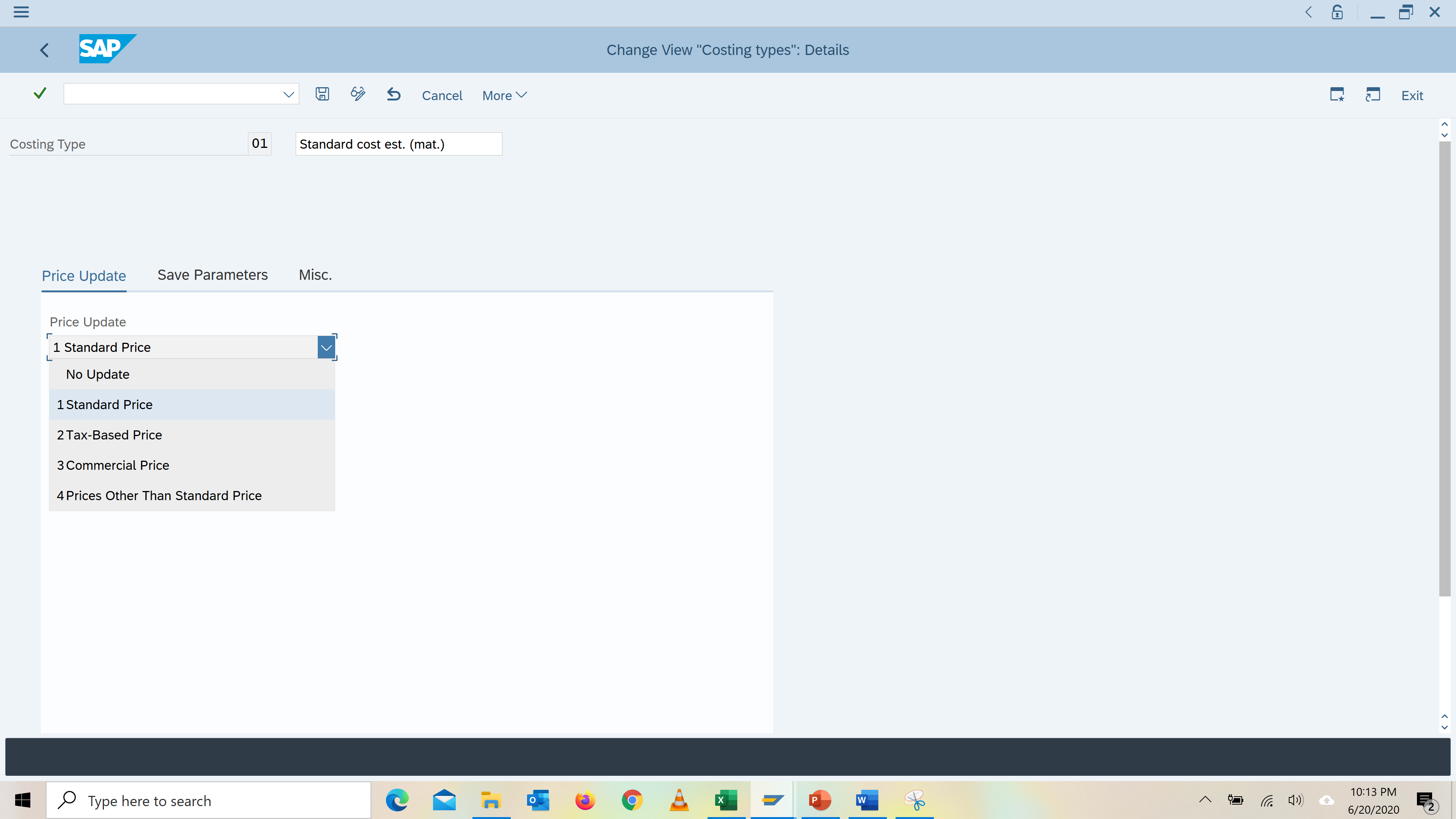

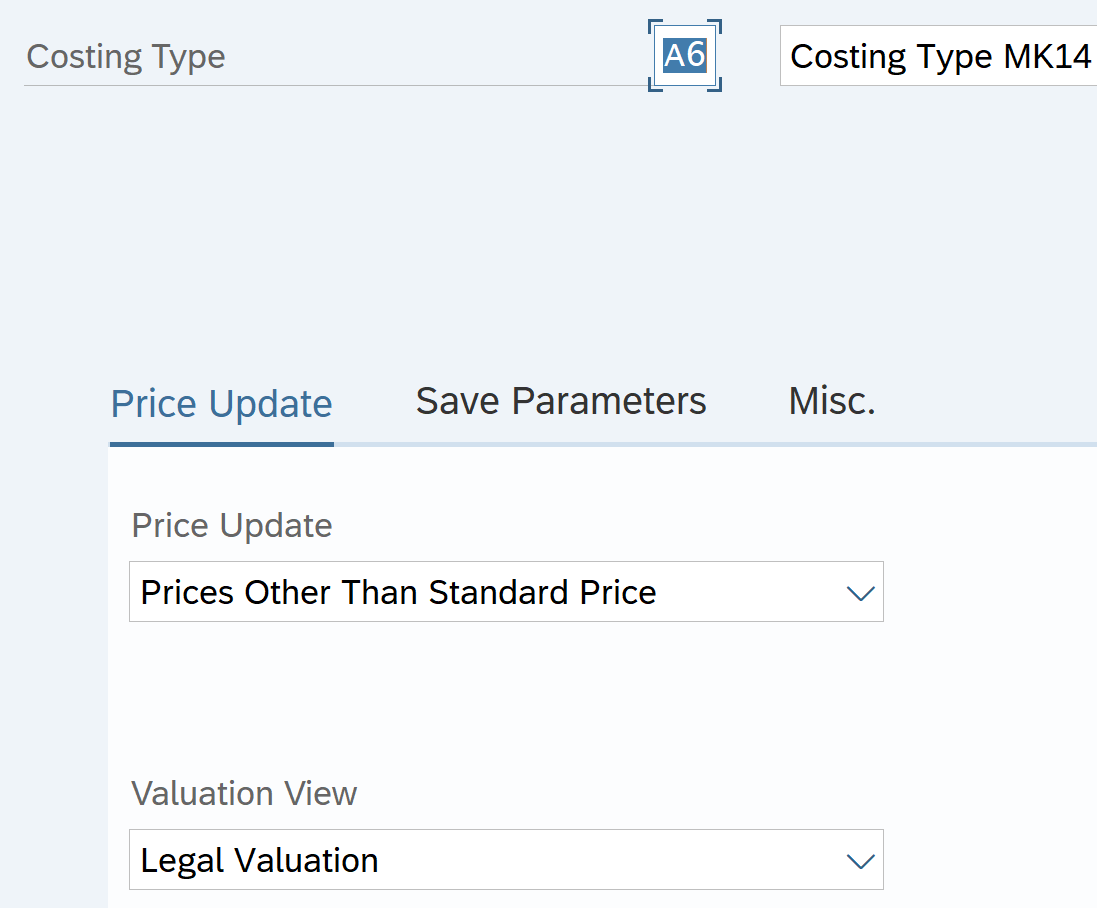

Costing Type: Determine type of cost is calculated., whether standard cost, Cost for reporting, etc.

Valuation variant determine how Material, Activities, Subcontract, External Operations and OH are valued

Date Control: Determine validity period of costing run

Product Costing Training-Advance

Define Costing Variant-Costing Type

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Costing variant components – Define costing type

Here you define the purpose of a material cost estimate by specifying, field in the material master record to which the costing results can be transferred to:

| Update – Material master Fields | Cost Estimate (CK40N) |

| Standard price | Standard cost estimate (01) |

| Tax-based price | Inventory cost estimate |

| Commercial price | Inventory cost estimate |

| Price other than std price | Modified standard cost estimate |

In a client there can be only one costing type for standard price. We will keep SAP standard costing type 01 for standard price

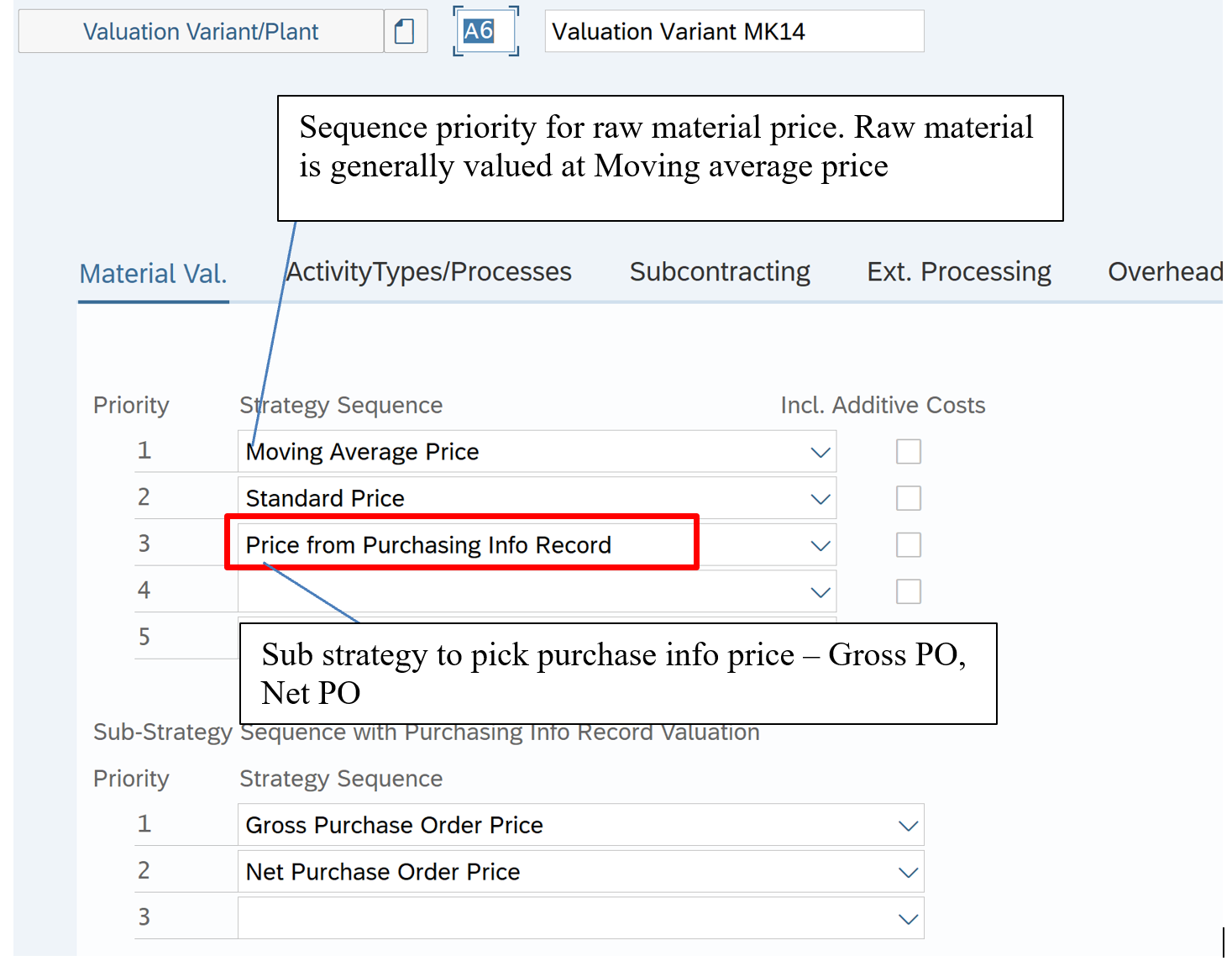

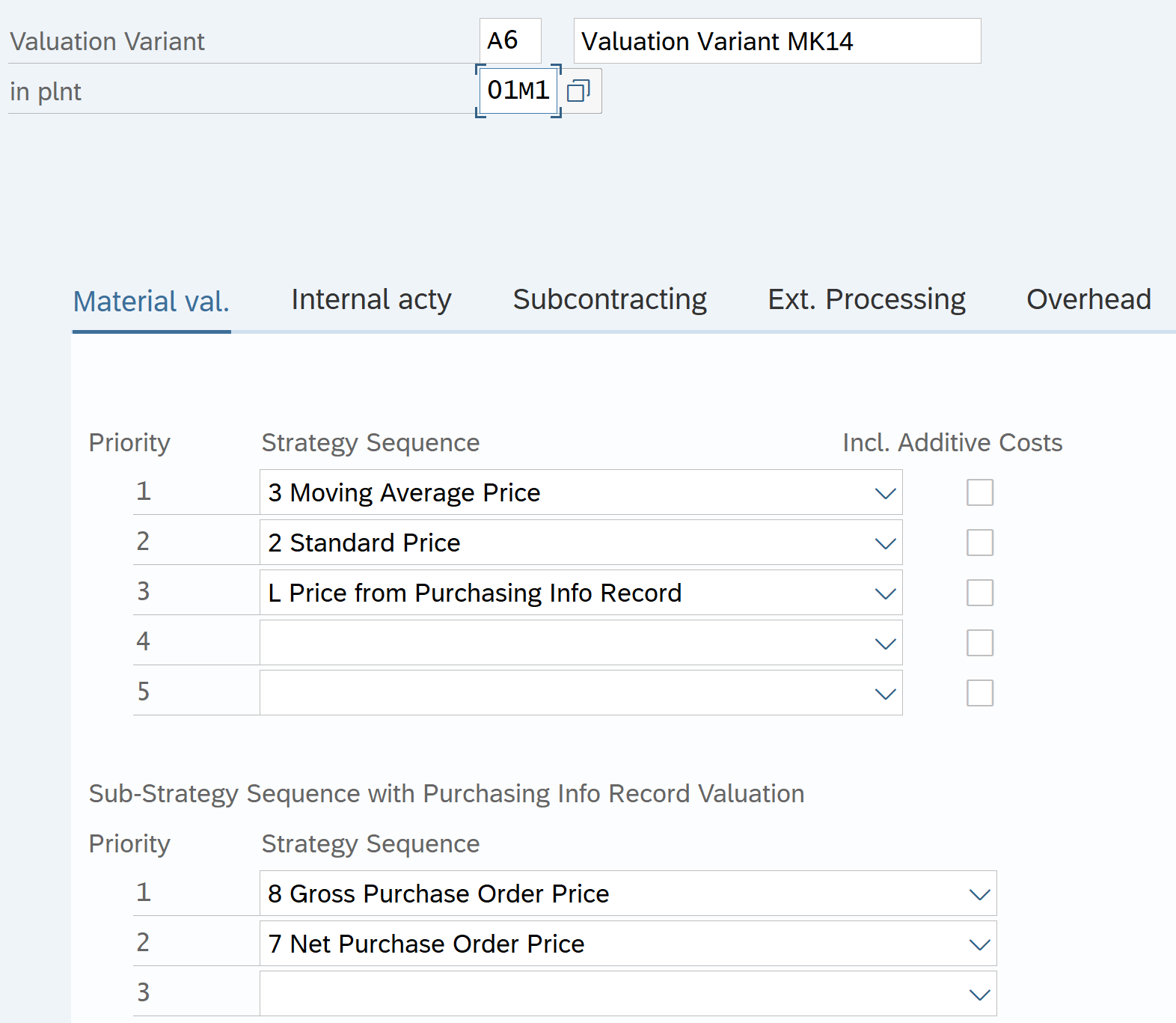

Define Valuation Variant

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Costing variant components

Here you specify parameters to be used for cost estimate

- Material Valuation: define the sequence in which the system searches for prices from the accounting view or costing view of the material master record to valuate materials. E.g. We can specify the sequence in which material price is picked – use moving average price, if not available use Standard Price, if not available use Purchase Info record and so on

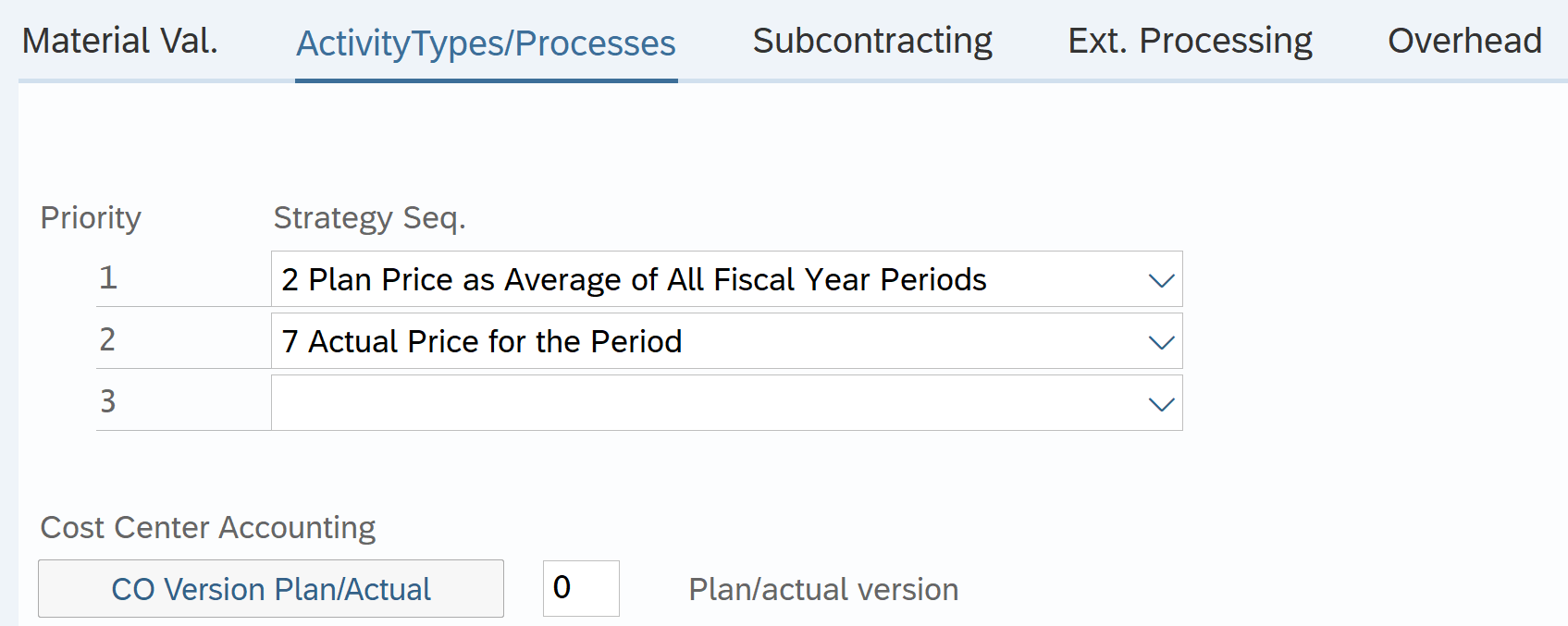

- Activity Price: Sequence in which activity price is picked. For e.g. take Plan activity price, if not available take actual activity price and so on

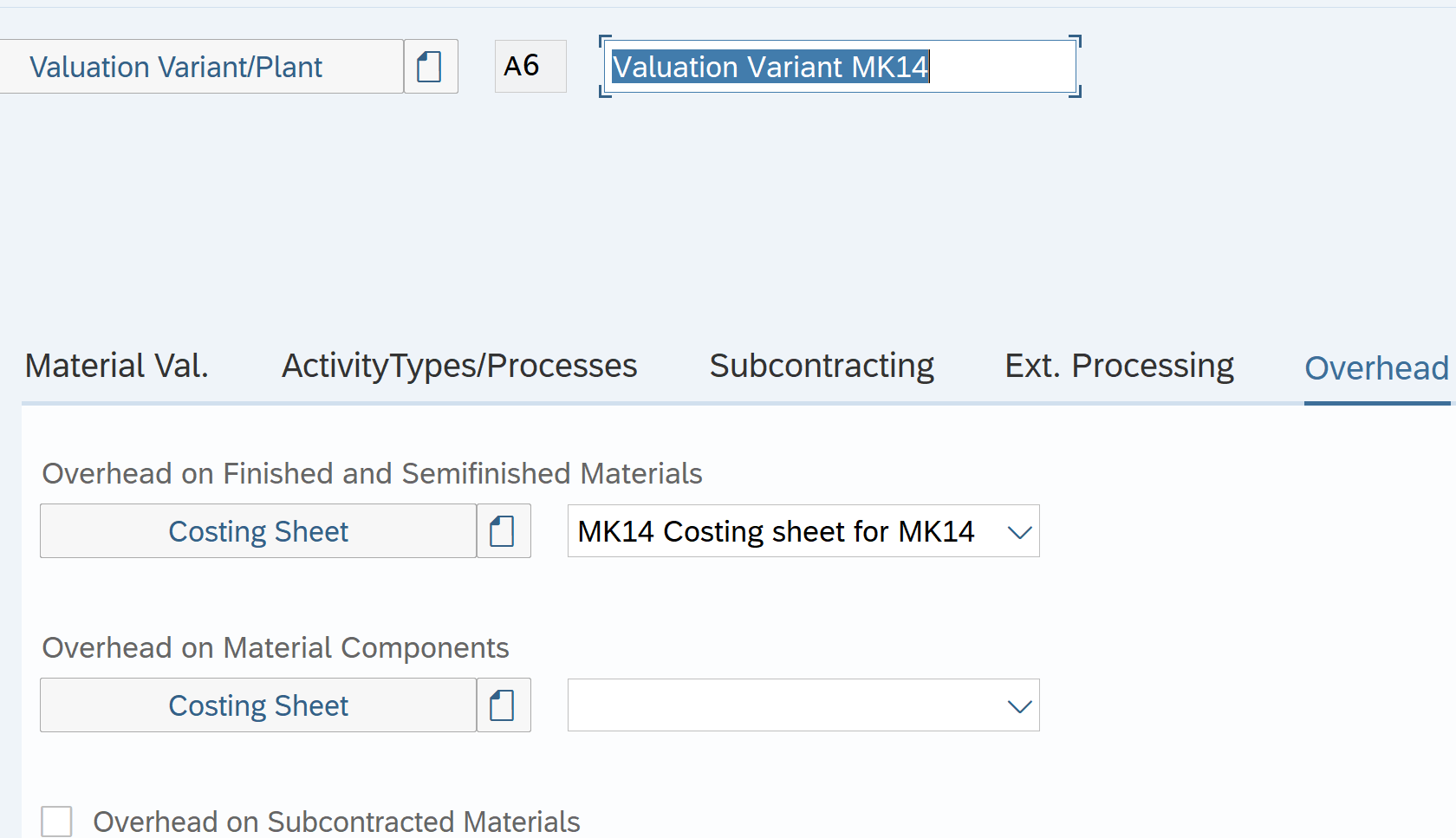

- Overhead costs: Link the costing sheet prepared in earlier steps to pick the OH cost for cost estimates

Activity type price priority

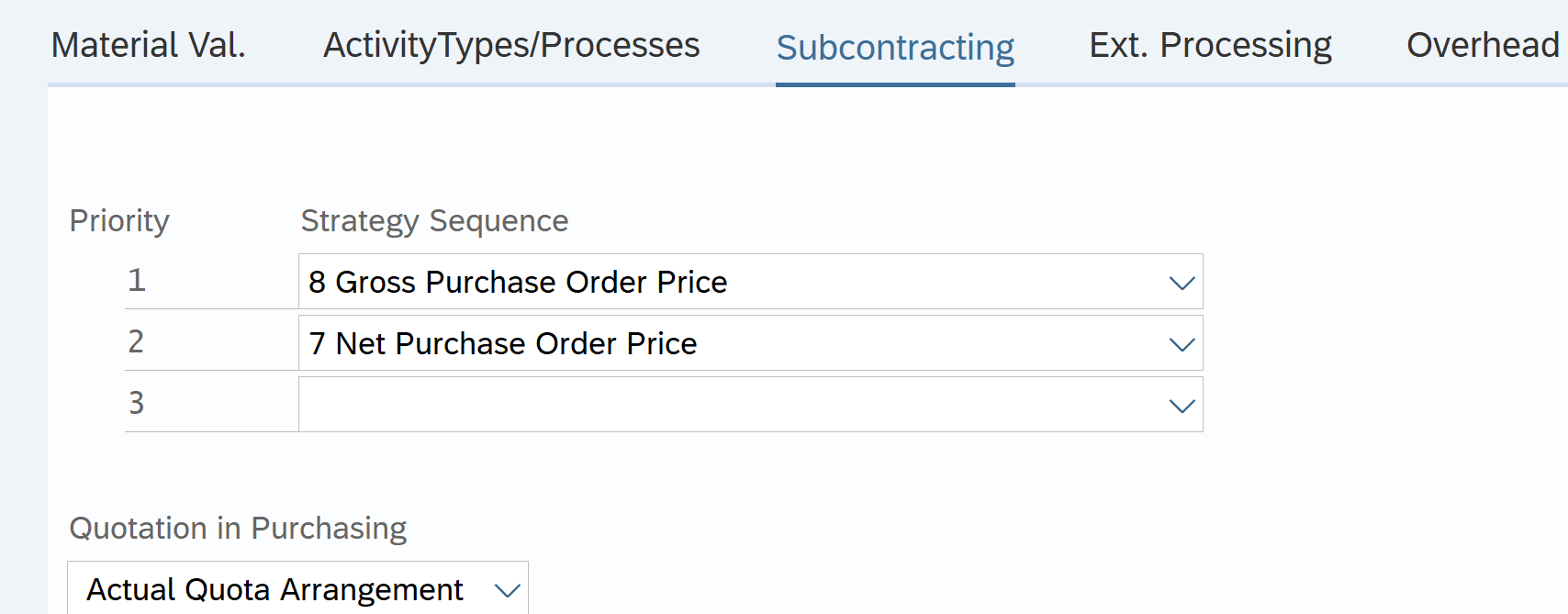

Sub-contracting price sequence

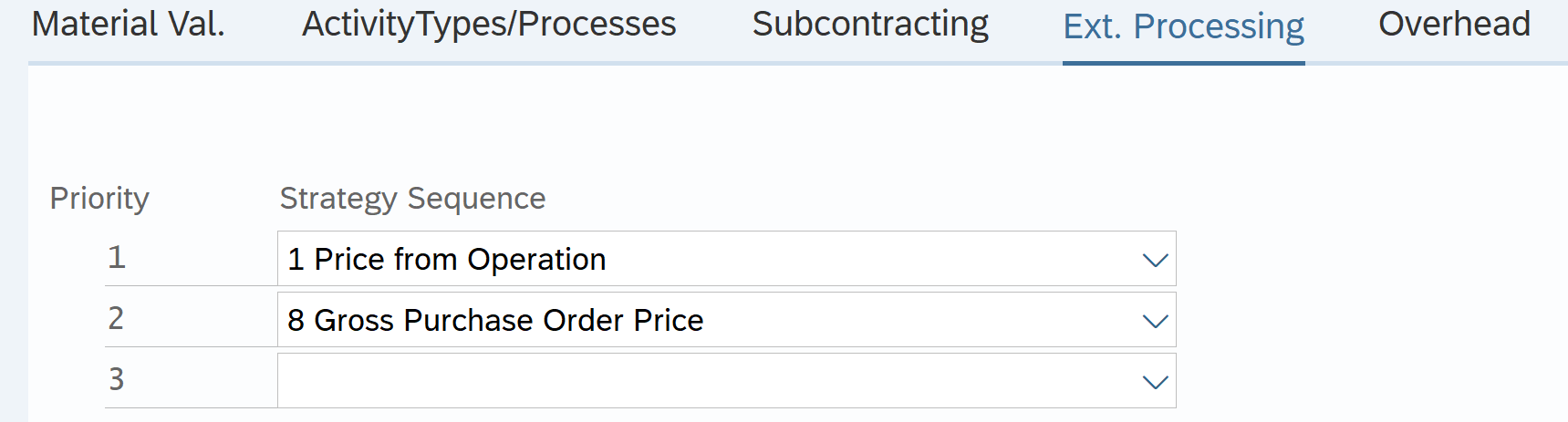

External Operations price sequence

Under OH select the costing sheet created earlier

OH, on Material Components. Not required in our scenario. If costing sheet assigned here OH 10% and 15% defined in costing sheet will be added to the raw material

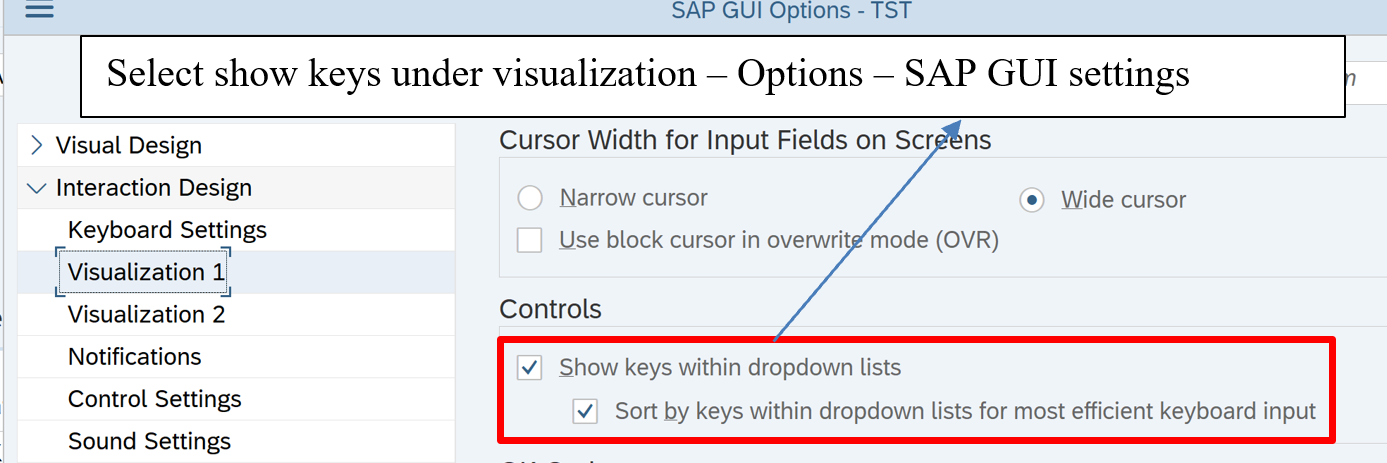

To display Number in the drop down enable visualization in the options as below

Valuation variant is defined at plant level

Click and assign Valuation variant A6 to our plant 01M1

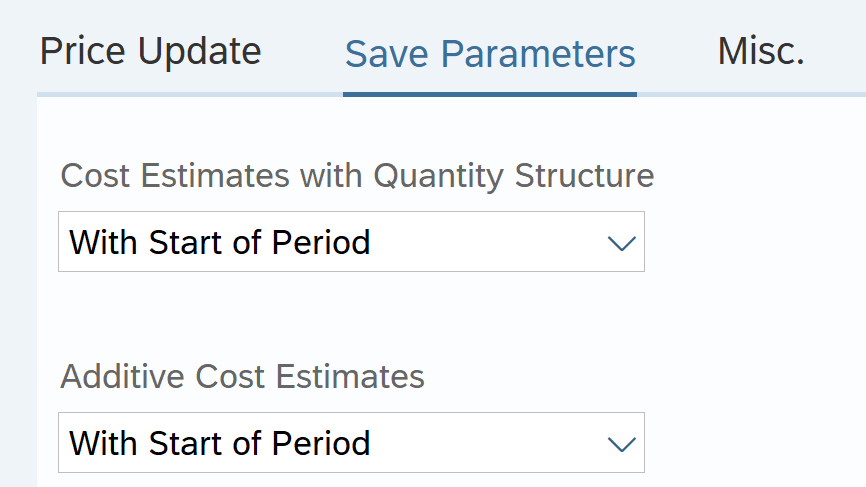

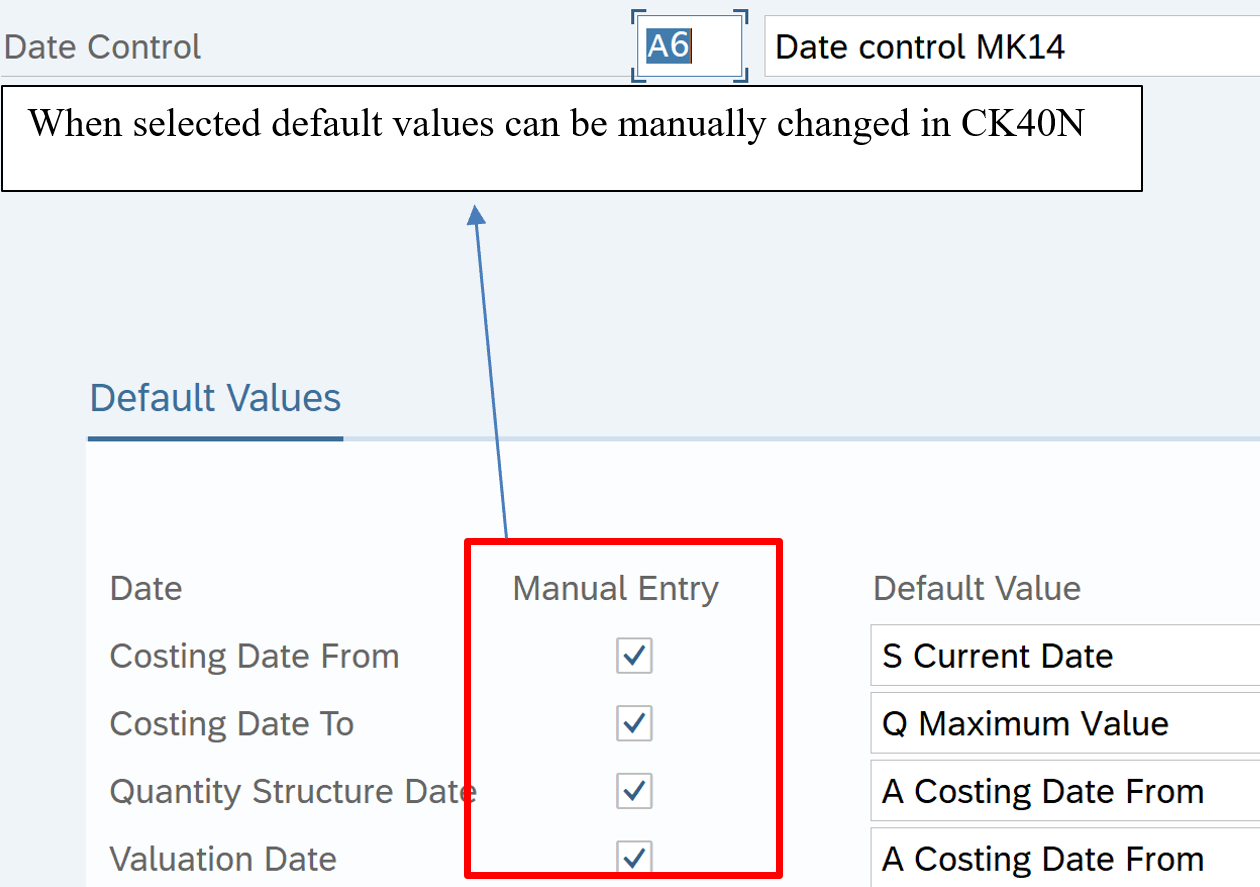

Define Date Control

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Costing variant components

Tcode: OKK6

Date control determines which dates are proposed or displayed when a cost estimate is created, and whether these dates can be changed by the user.

- The validity period of the cost estimate

- The date on which the quantity structure is determined ( quantity structure date)

- The date on which the quantity structure is valuated ( valuation date)

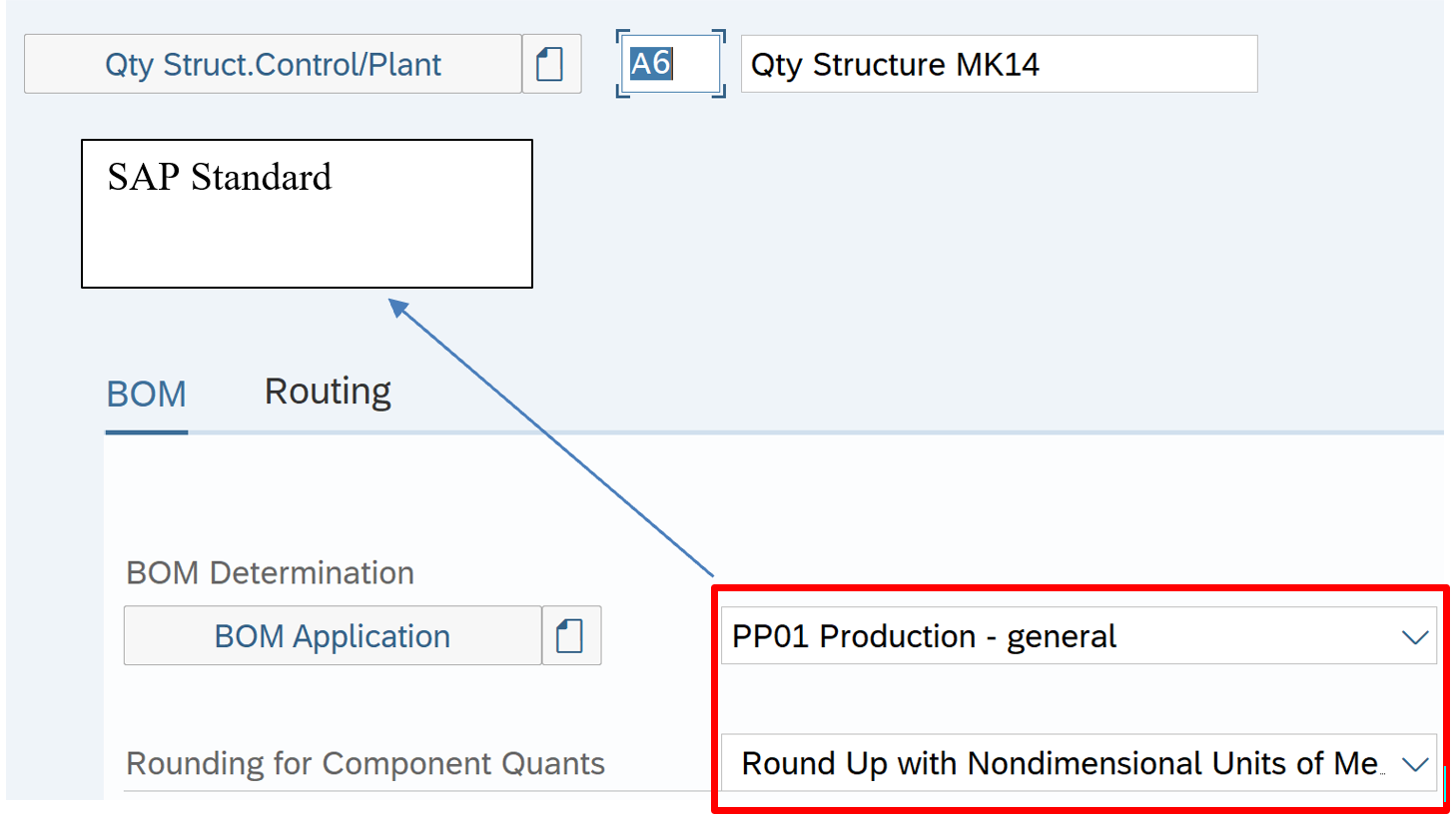

Define Quantity Structure Control

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Costing variant components

Tcode: OKK5

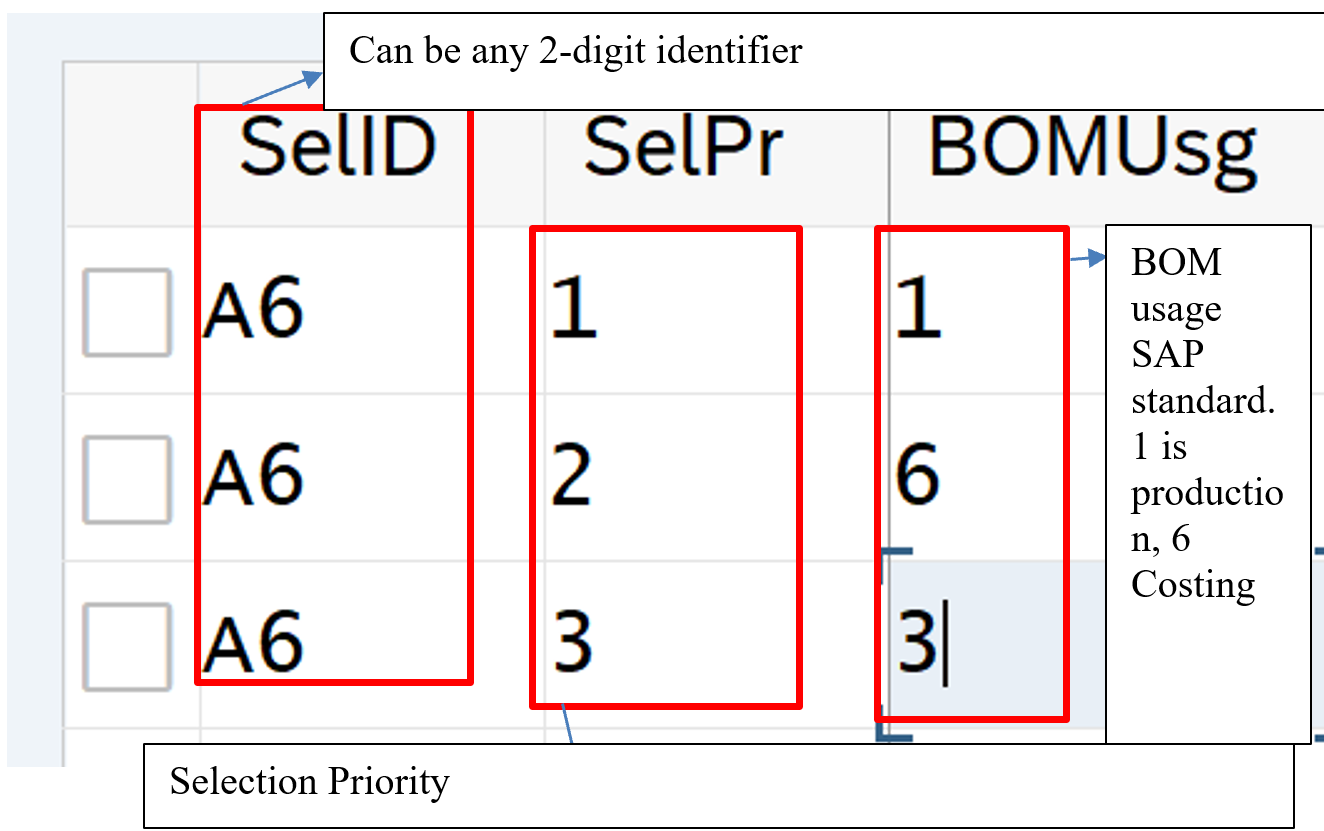

Check BOM Selection

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Settings for qty structure – BOM Selection – Check BOM selection

Tcode: OPJI

BOM: BOM (Bill of Material): This is list of Raw material along with the quantities required to produce Finished Goods

Specify different sequences of priorities of BOM usages according to your requirements

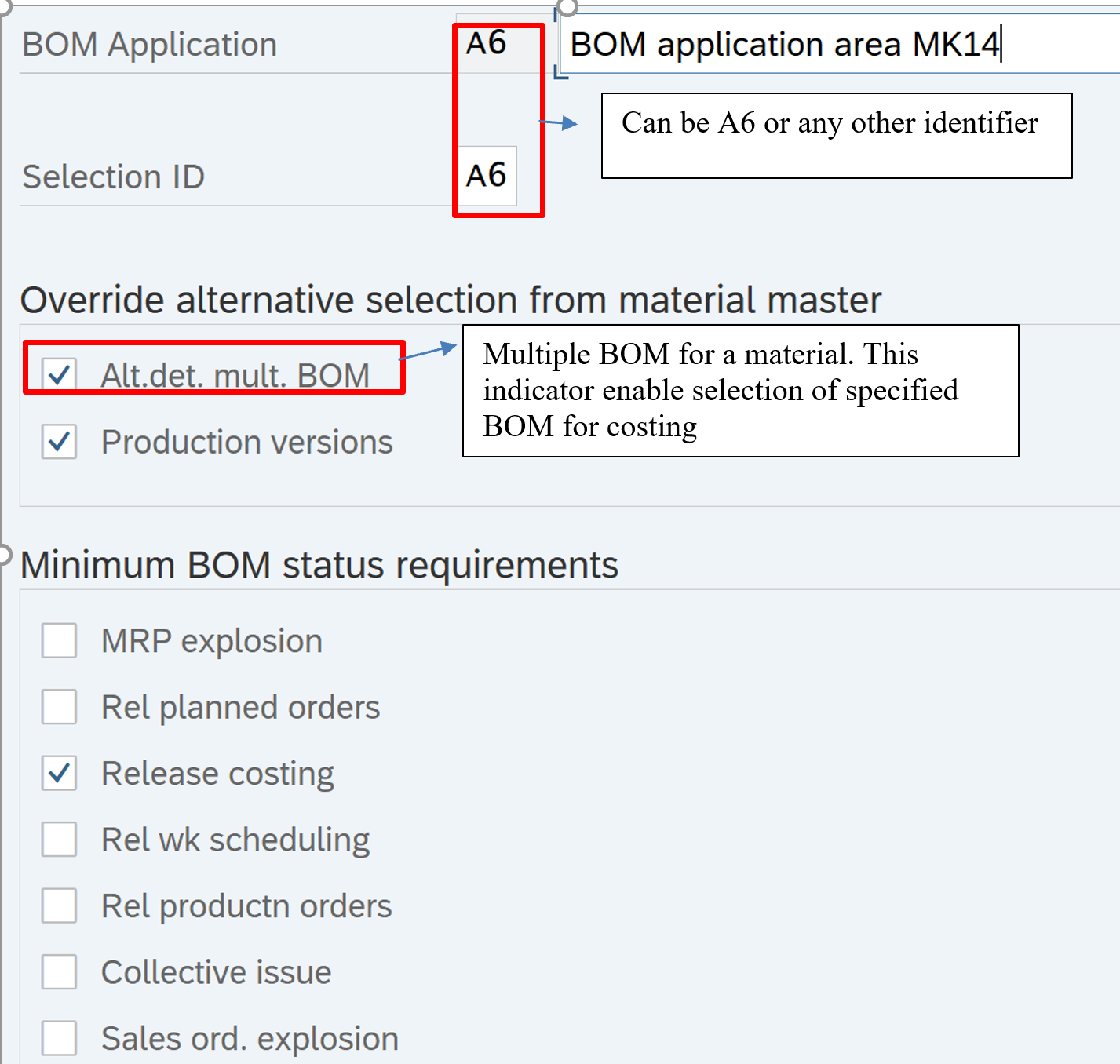

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Settings for qty structure – BOM Selection – Check BOM application

Tcode: OPJM

Here you define BOM application area. Now you assign BOM selection ID created earlier to this BOM application area. Selection ID decides the sequence in which BOM are selected during cost estimate for this BOM application area

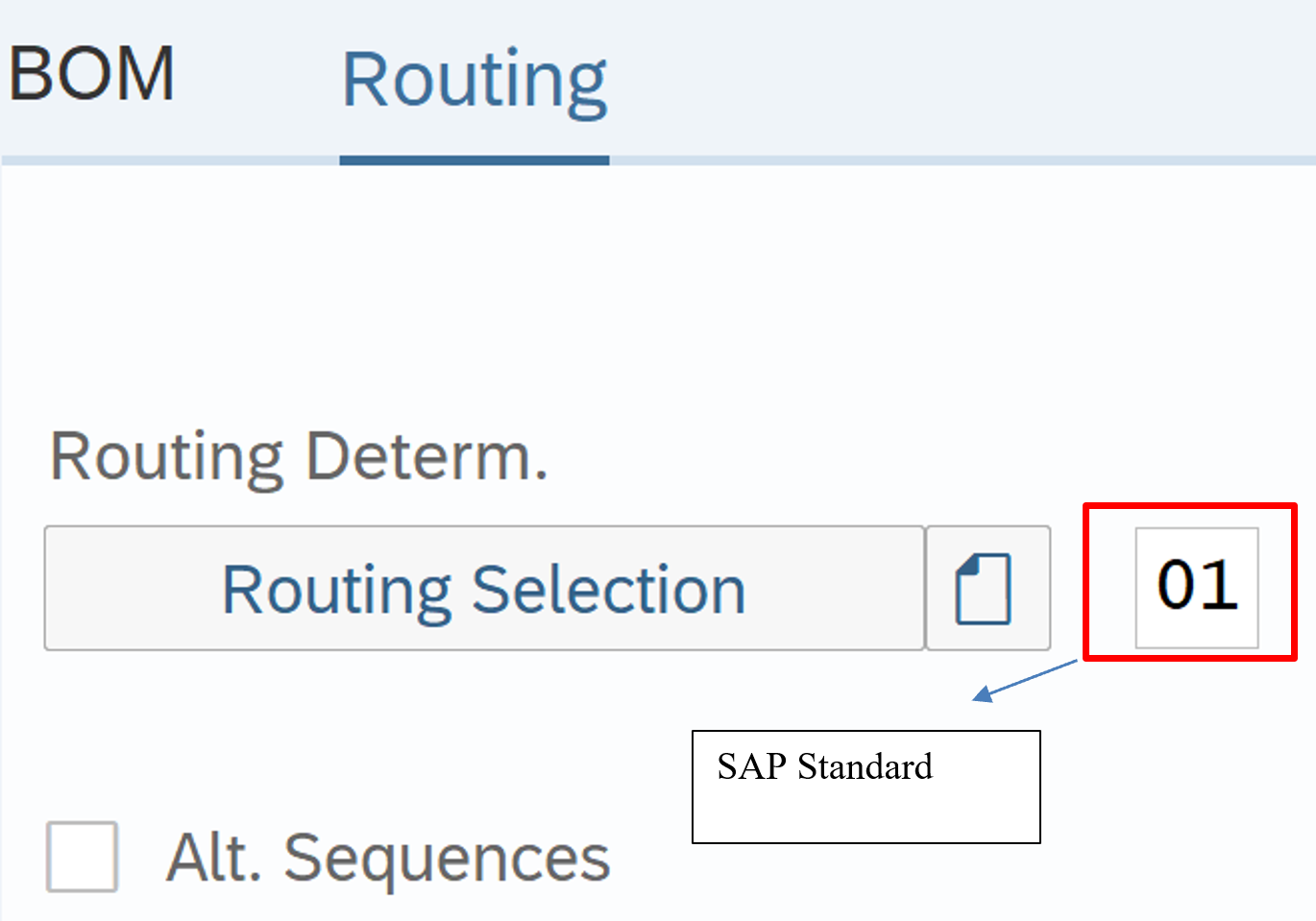

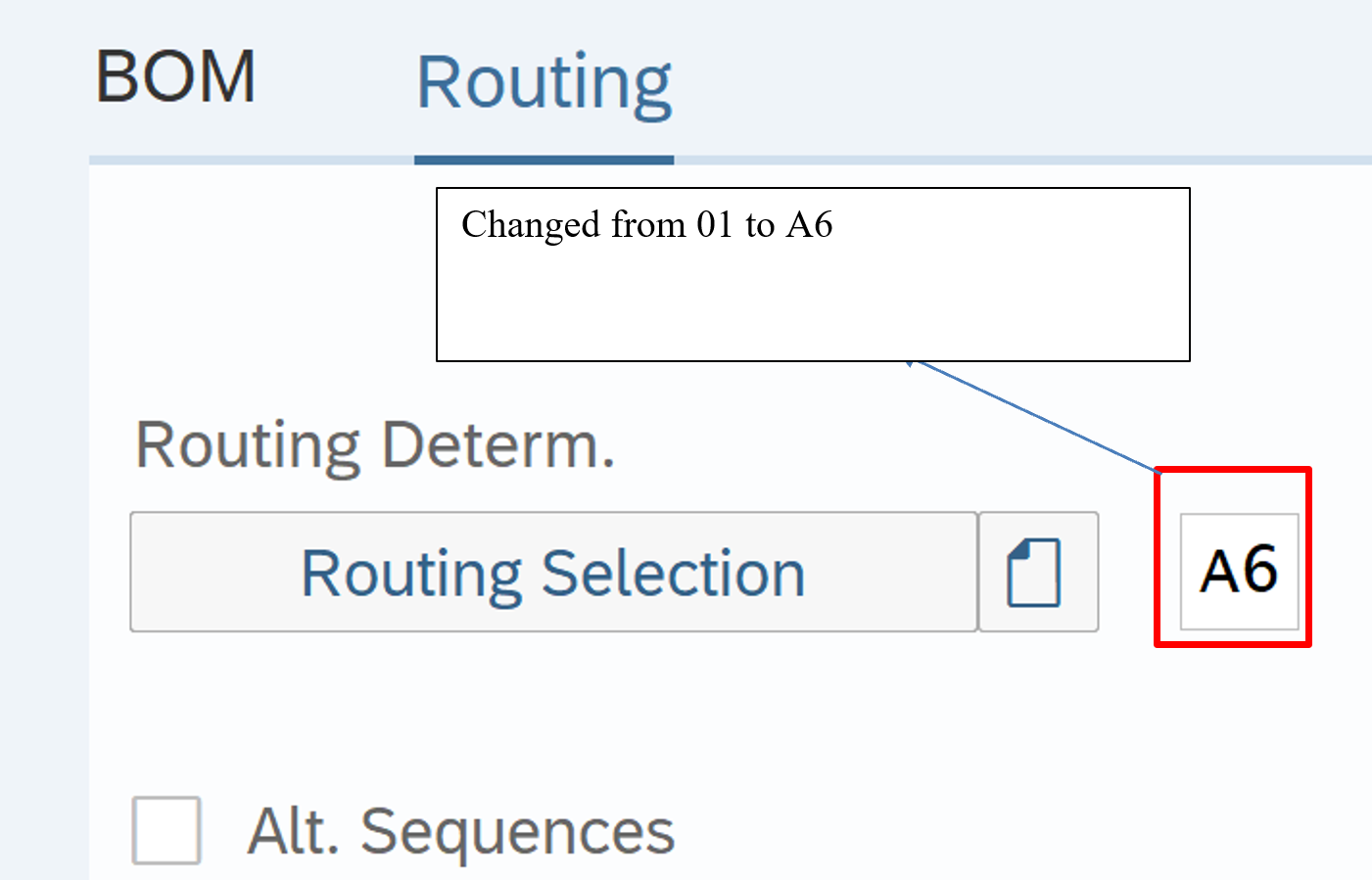

Check Routing Selection

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Settings for qty structure – Routing Selection – Check automatic routing selection

Tcode: OPJF

Routing: It is sequence of activities. It specifies on which Work Center (A work center typically refers to a machine) what activities are to be performed for how many hours. Raw Material is converted into finished goods at work center

Define a Routing selection ID

Assign it to alternative selection priorities

Specify selection priority for each of these scenarios

- ID: A6: Can be any identifier

- SP: Selection Priority

- Task List: N: Routing, R: Rate Routing

- Plan Usage: 1: Production

- Status: 4: Released general

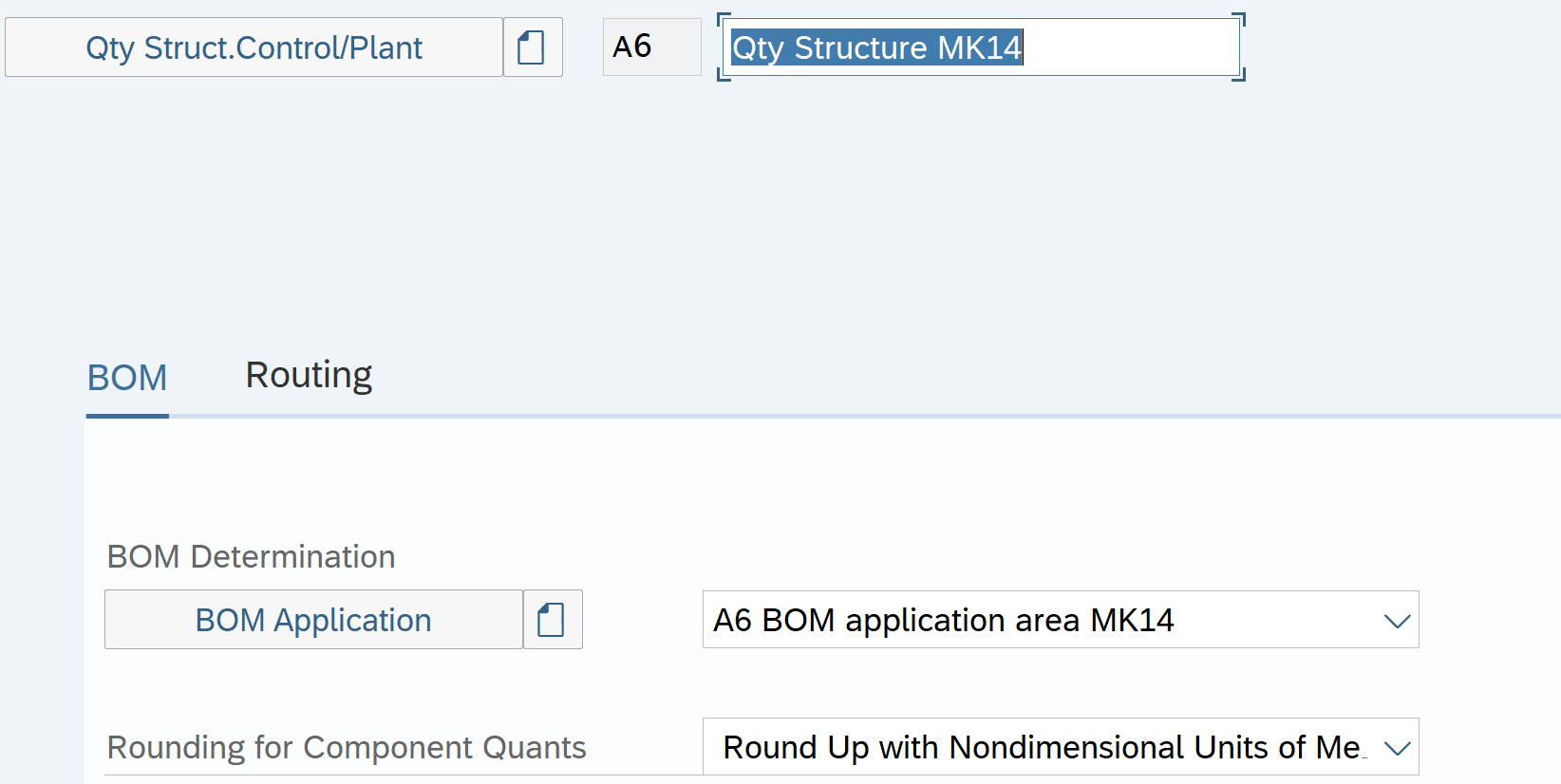

Assign BOM application ID and routing selection ID in Quantity structure control

Tcode: OKK5

PP01 replaced with A6

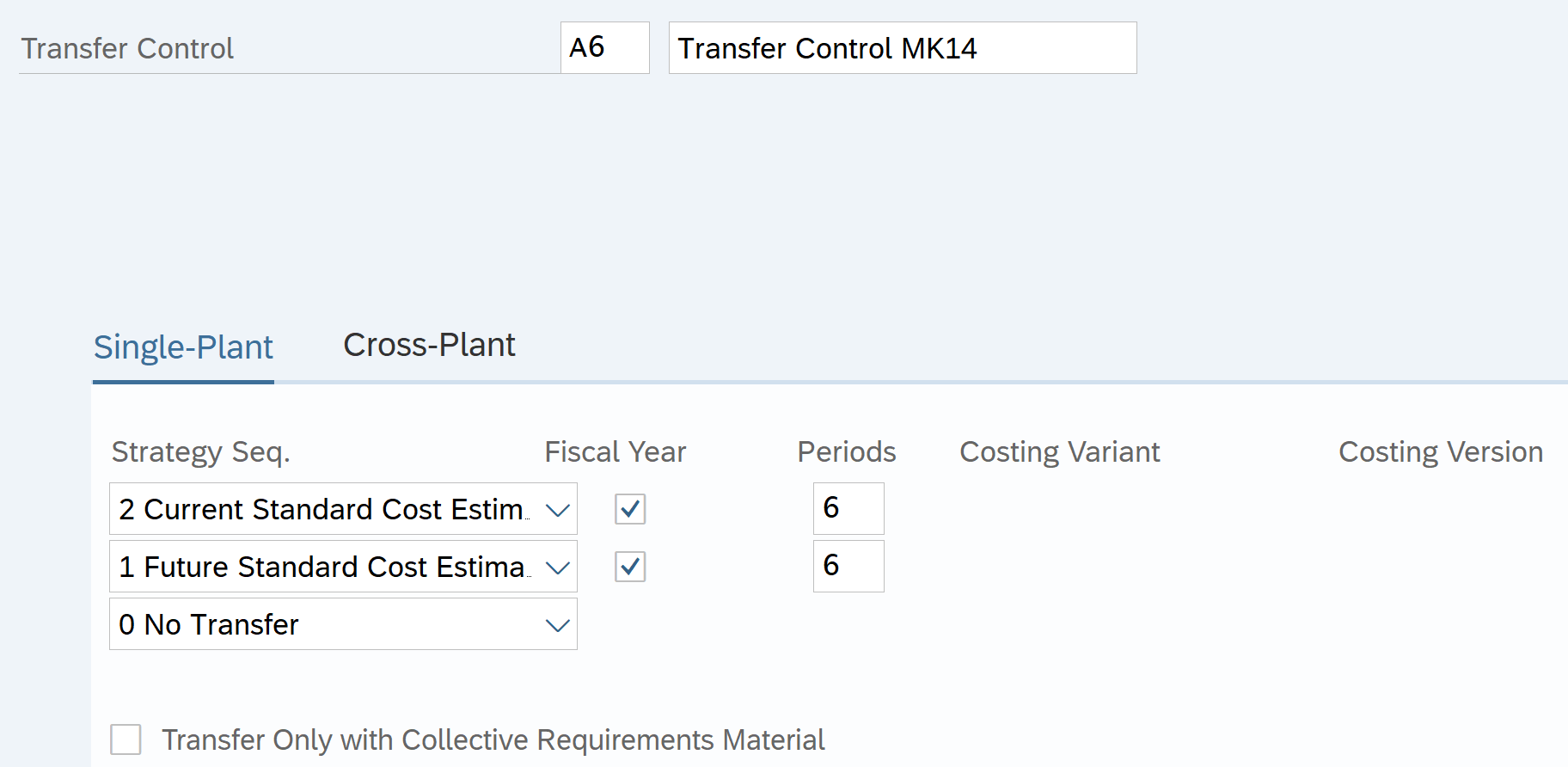

Define Transfer Control

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – costing variant component – define transfer control

Tcode: OKKM

Transfer Control: The transfer control specifies how the existing cost estimate is to be used in the cost estimate of the other product. For e.g. Costing done at beginning of the year. All components of the product cost have to be costed to arrive at final Standard Cost. Costing of new component during the year. We can use standard cost of components costed at the beginning of the year if they are being used in manufacture of this new Product. Here we will use the transfer control

In this step you define parameters for partial costing. The purpose of partial costing is to prevent the system from creating a new cost estimate for a material when costing data already exists. Instead, the existing costing data is simply transferred into the new cost estimate. This improves performance.

Current and Future cost kept for 6 months before archiving

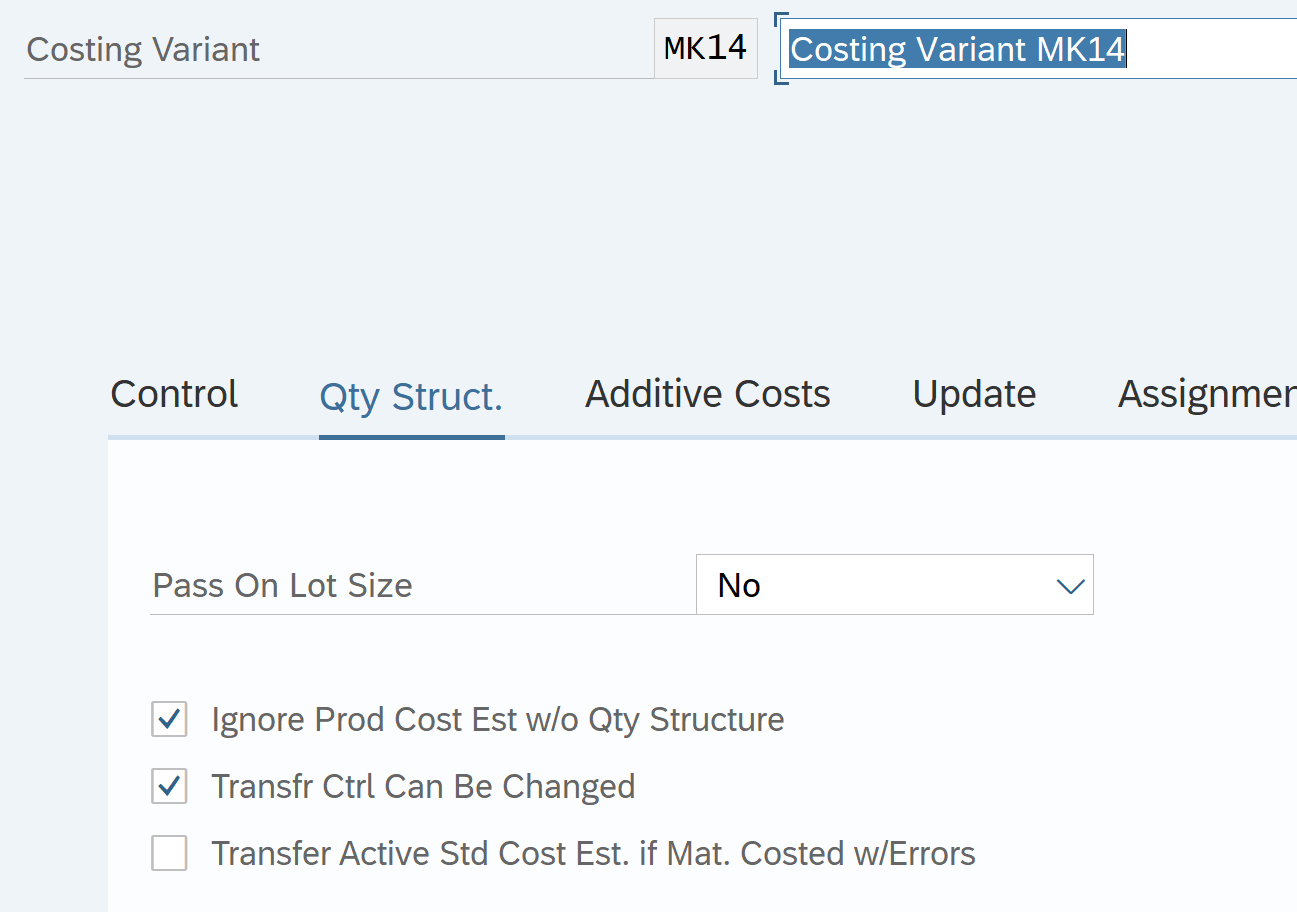

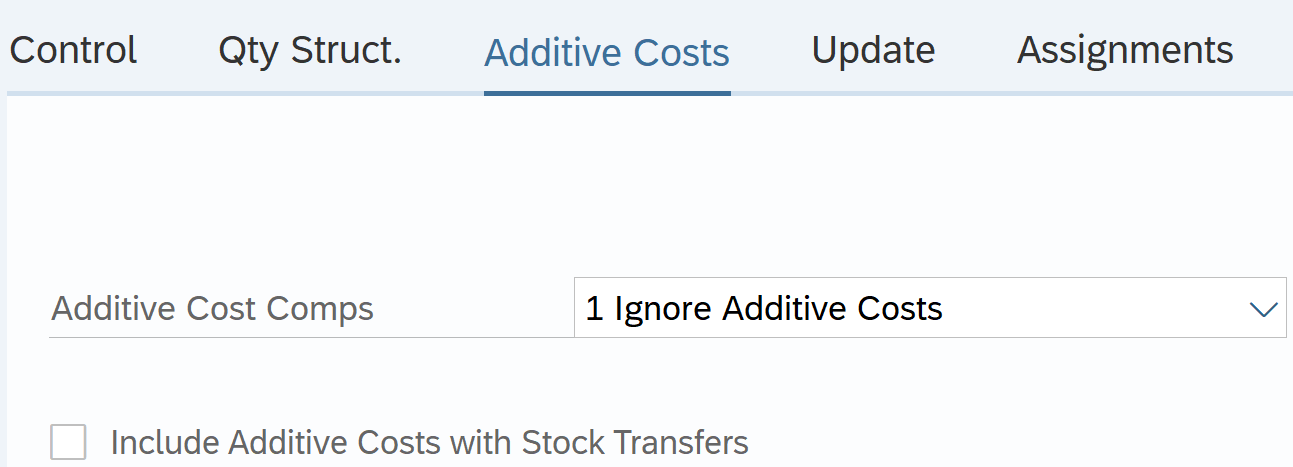

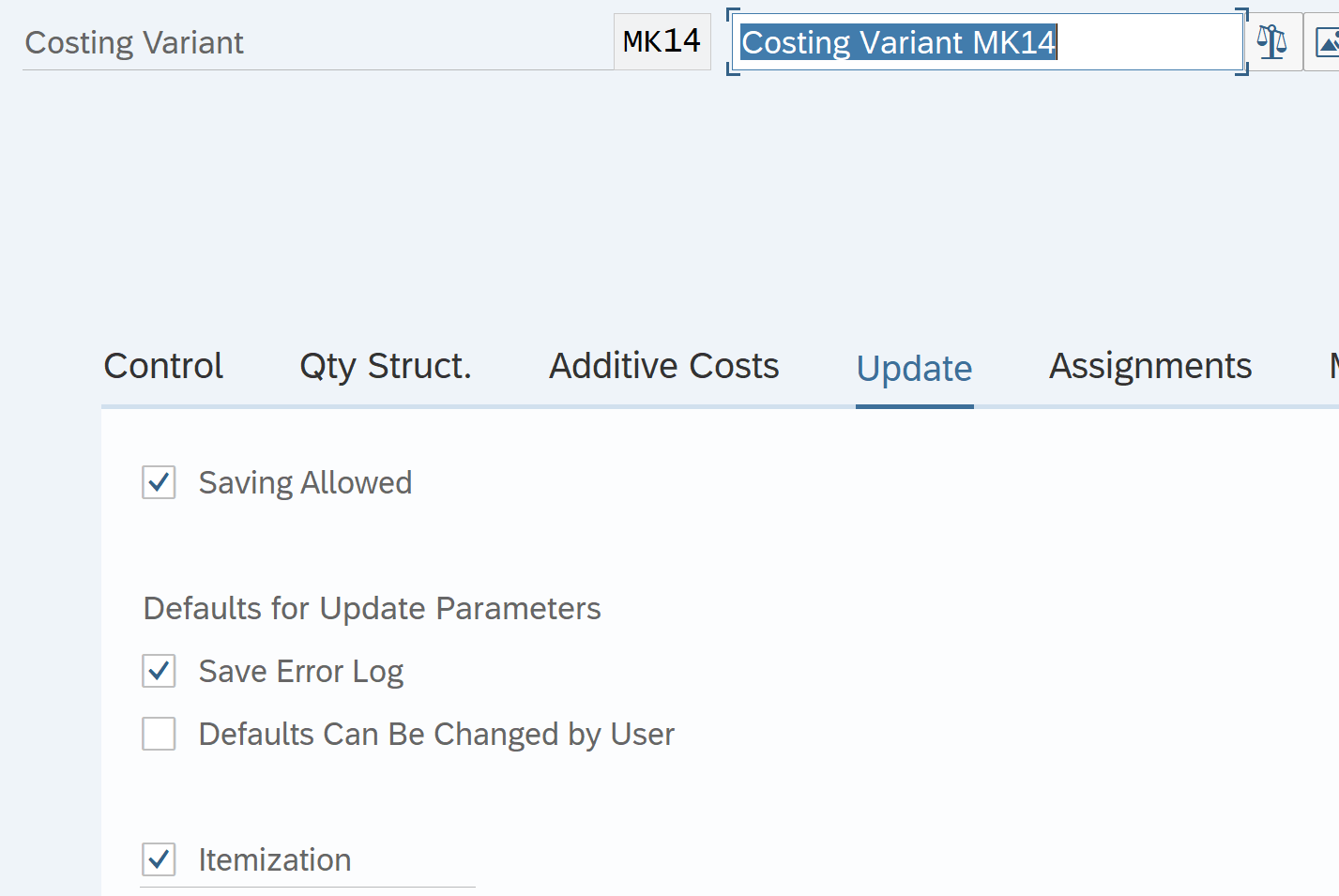

Define Costing Variant

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Define costing variant

Tcode: OKKN

Select costing component created in earlier steps and assign to Costing variant MK14. Costing type assigned is 01 Standard Cost and not one created earlier as we want to do standard costing

Qty Structure selection

Additive cost. These are transportation, packing cost added to COGM.

Update selection

Itemization: Detailed break up of cost based on its components

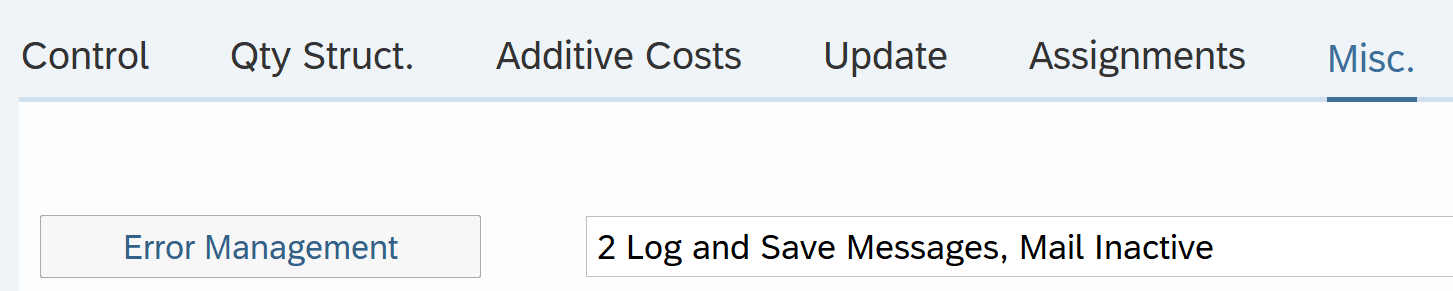

Error management selection

Assignment are optional so ignored for now

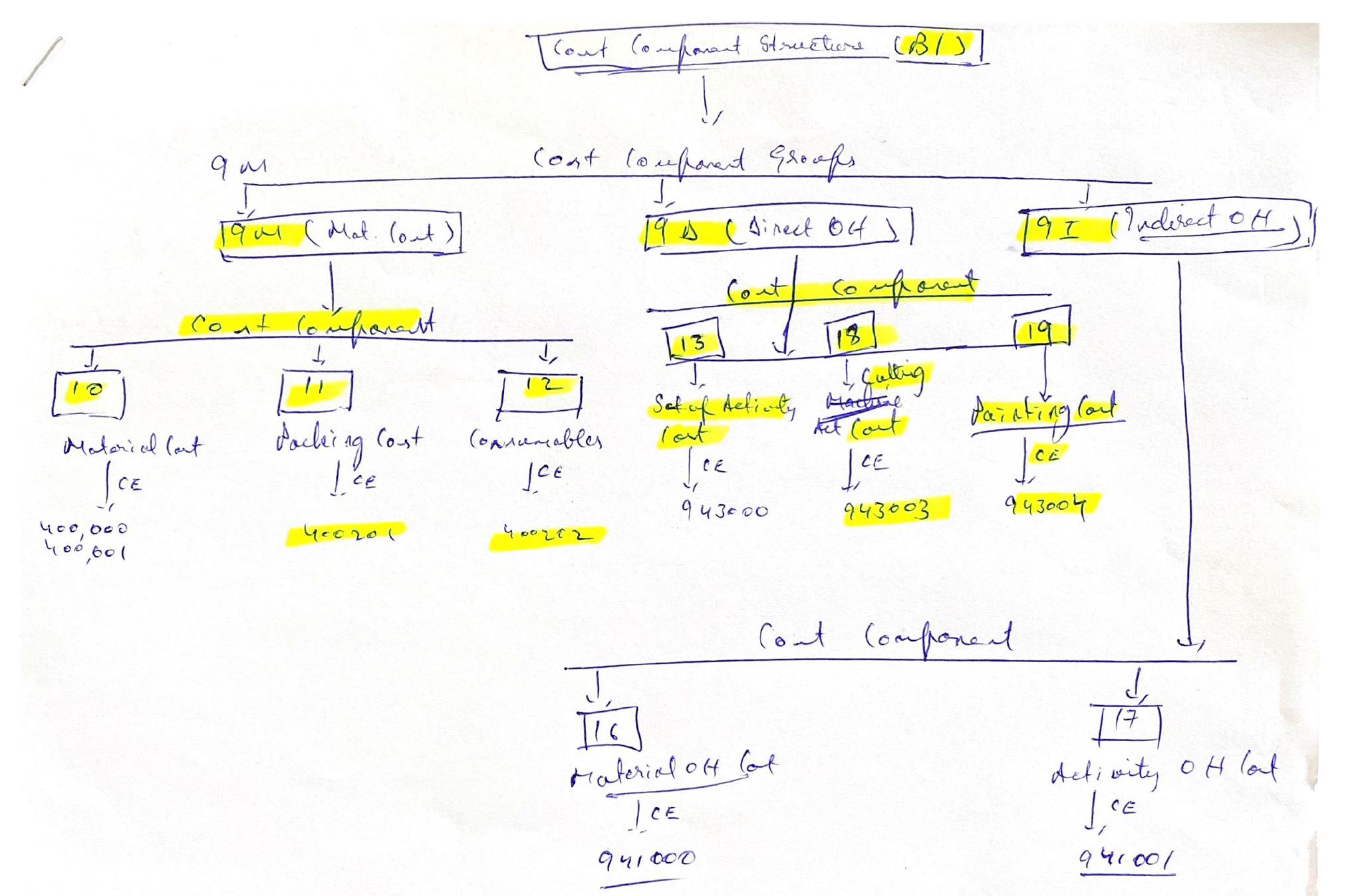

Define Cost Component Structure

Path: Controlling – Product Cost controlling – Product Cost planning – Basic settings for material costing – Define Cost component structure

Tcode: OKTZ

It gives the breakup of the cost estimate of products like material cost, packing mat cost, consumables, Mach. Cost etc. The cost component structure contains the cost components (grouping of costs or cost elements)

Each cost component specifies whether it is relevant for valuation of inventory or not and also it specifies under which cost components to be updated. E.g.. COGM, COGS, Inventory, and Tax inventory etc. Each cost component specifies whether it is to be rolled up or not.

Any component which is relevant for inventory should be rolled up and shown under COGM view.

The cost component can have maximum of 40 components in case of all components are variable. In case of all components are fixed, then the CCS can have maximum of 20 components.

| Cost Component Structure: Break up of component cost | |||||||

| Cost Component Group (CCG): Group of cost components | Views | ||||||

| FC / VC: Fixed / Variable Cost | |||||||

| Cost Component | Cost Element | CCG | FC/ VC | COGM | Inv Val | Comm Inv | Tax Inv |

| Material Cost | 400000-400,001 | 9M | VC | Y | Y | Y | Y |

| Packing Cost | VC | Y | Y | Y | Y | ||

| Consumables | VC | Y | Y | Y | Y | ||

| Set up Activity cost | 943000 | 9D (Direct OH) | FC & VC | Y | Y | ||

| Machine Activity cost | 943001 | FC & VC | Y | Y | |||

| Labor activity cost | 943002 | FC & VC | Y | Y | |||

| Material OH | 941000 | 9I (Indirect OH) | VC | Y | Y | Y | Y |

| Activity OH | 941001 | FC & VC | Y | Y | |||

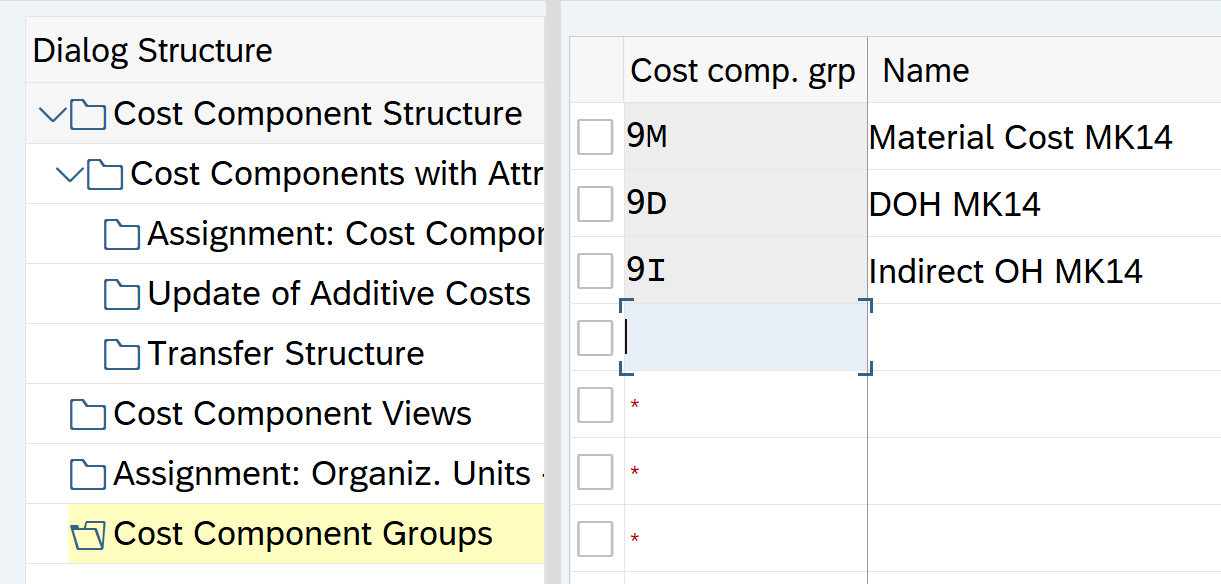

Define cost component Group (CCG)

Path: Controlling – Product Cost controlling – Product Cost planning – Basic settings for material costing – Define Cost component structure

Tcode: OKTZ

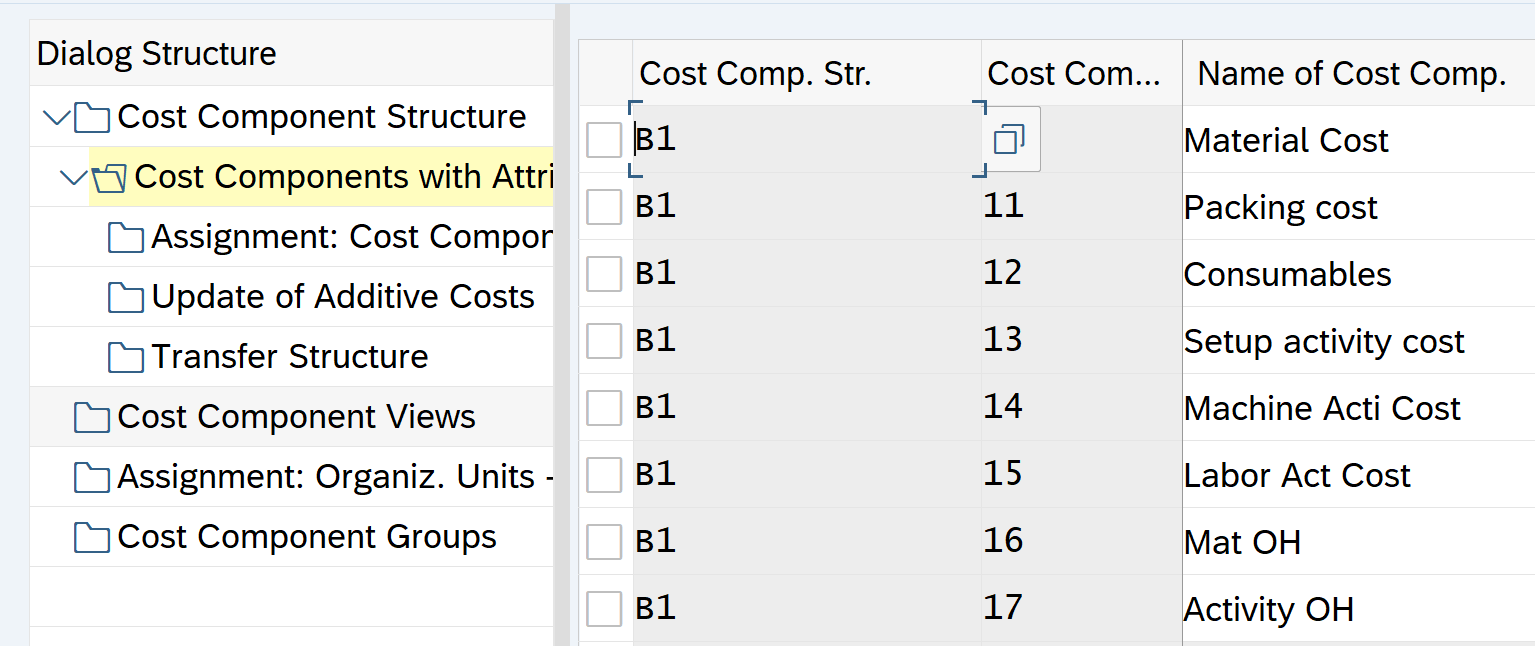

Define Cost Component Structure

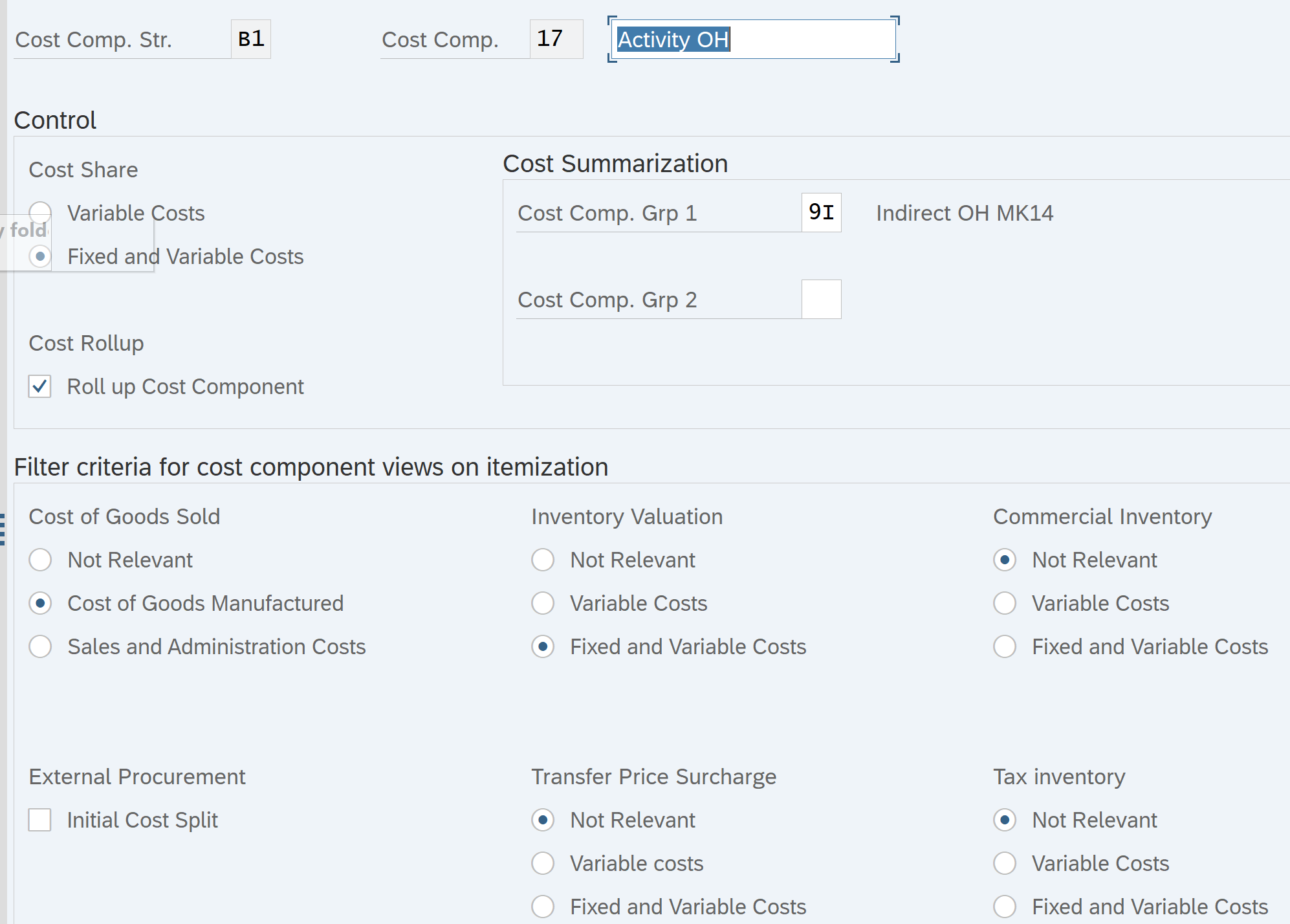

Define Cost Component with attributes

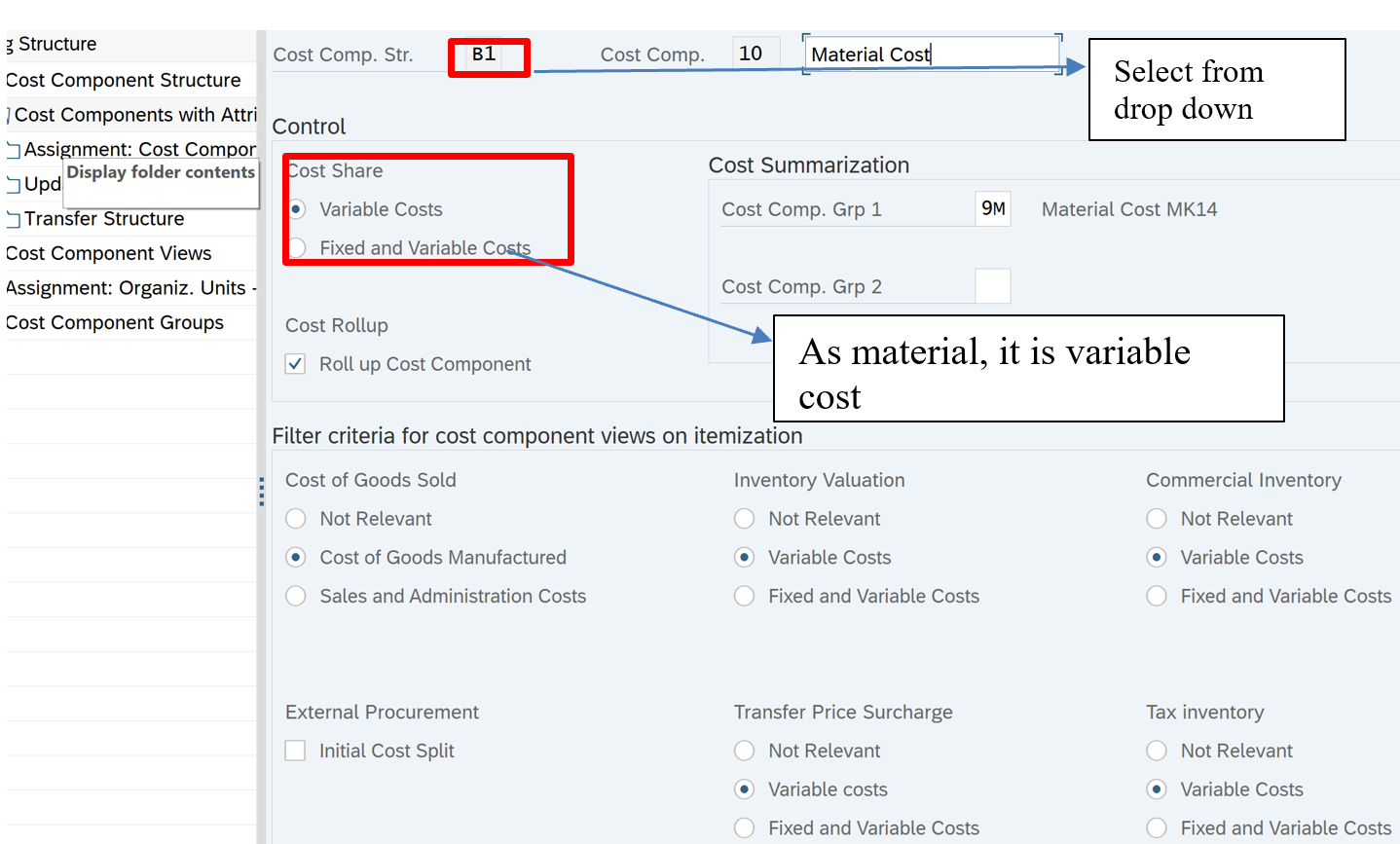

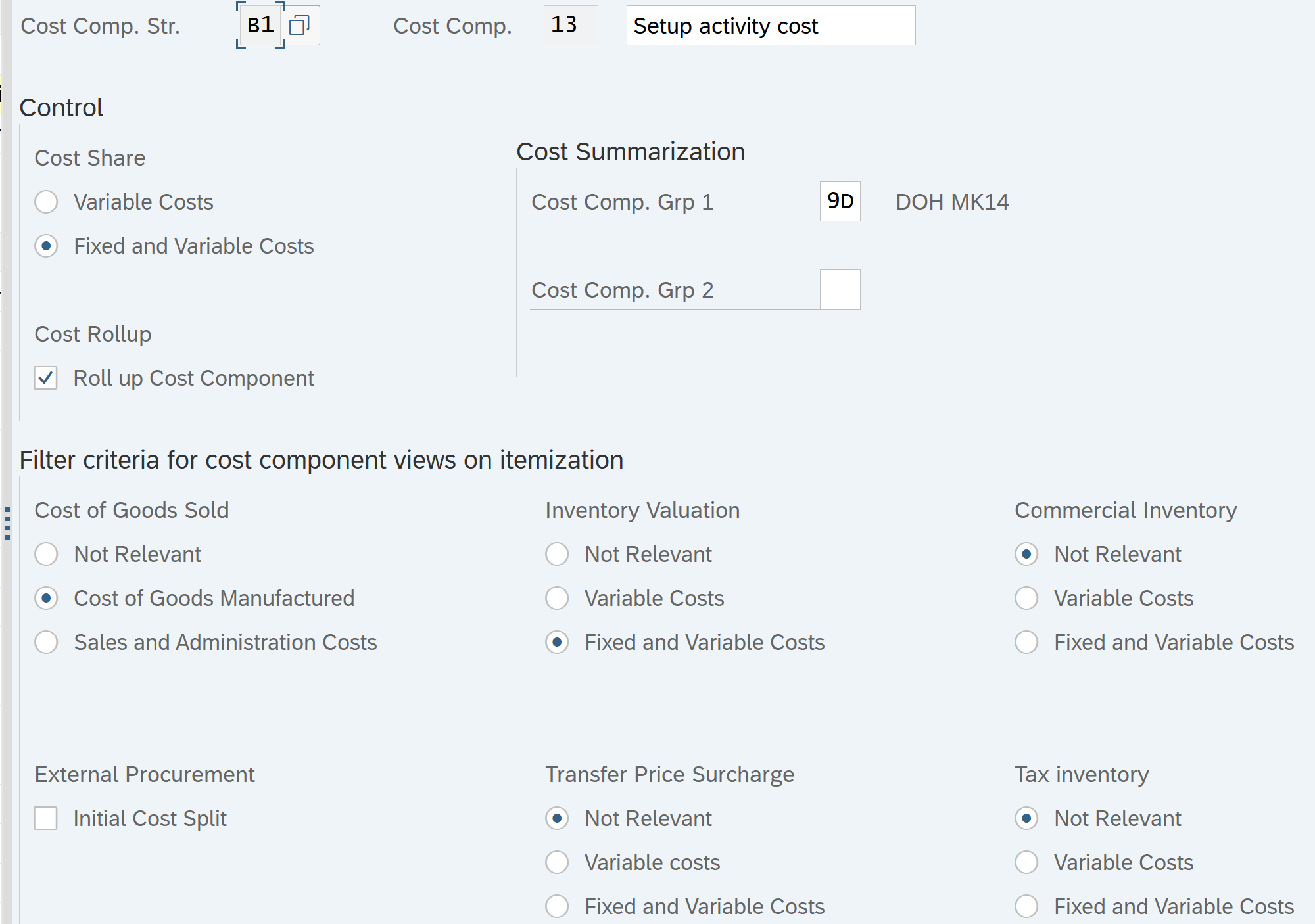

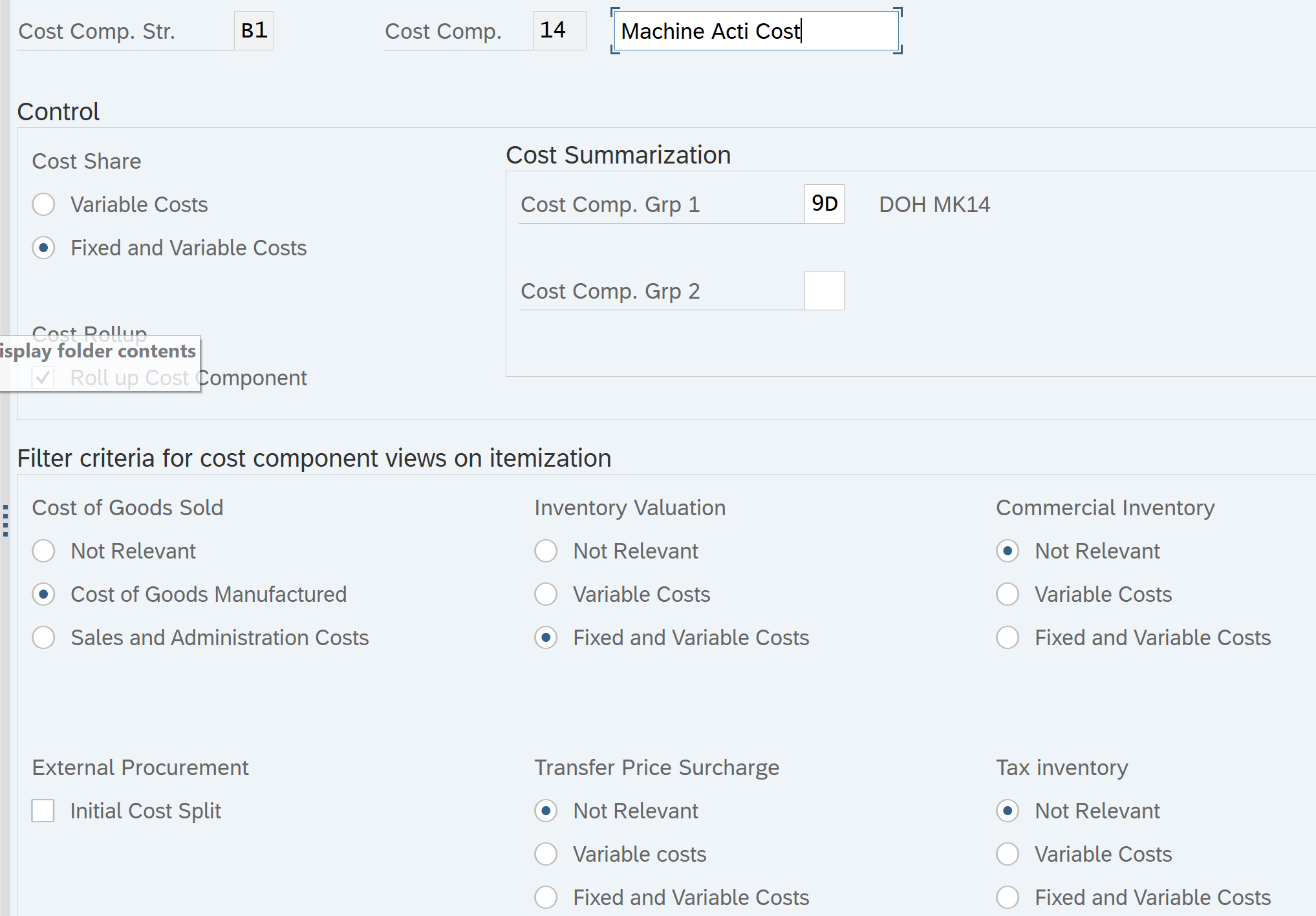

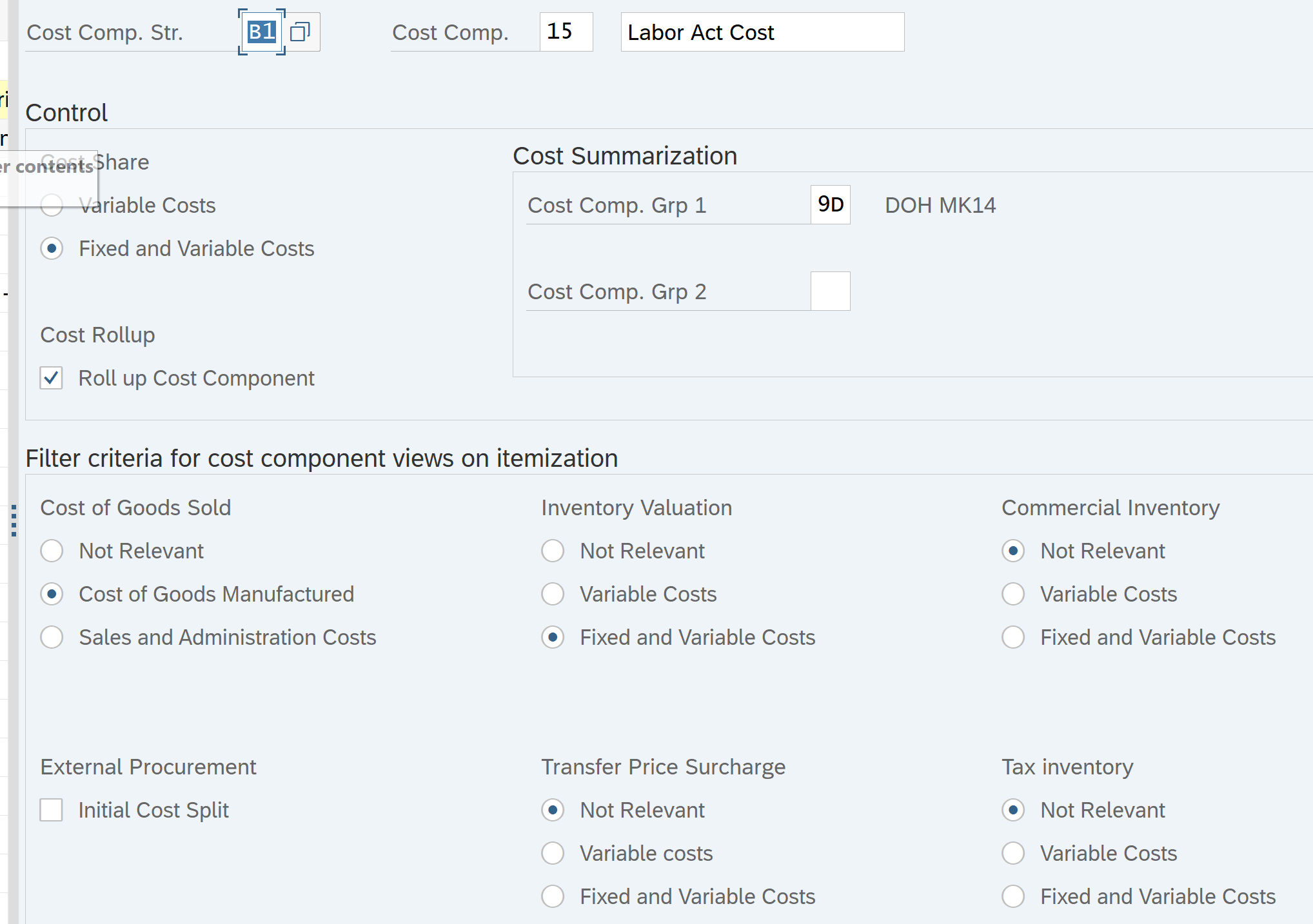

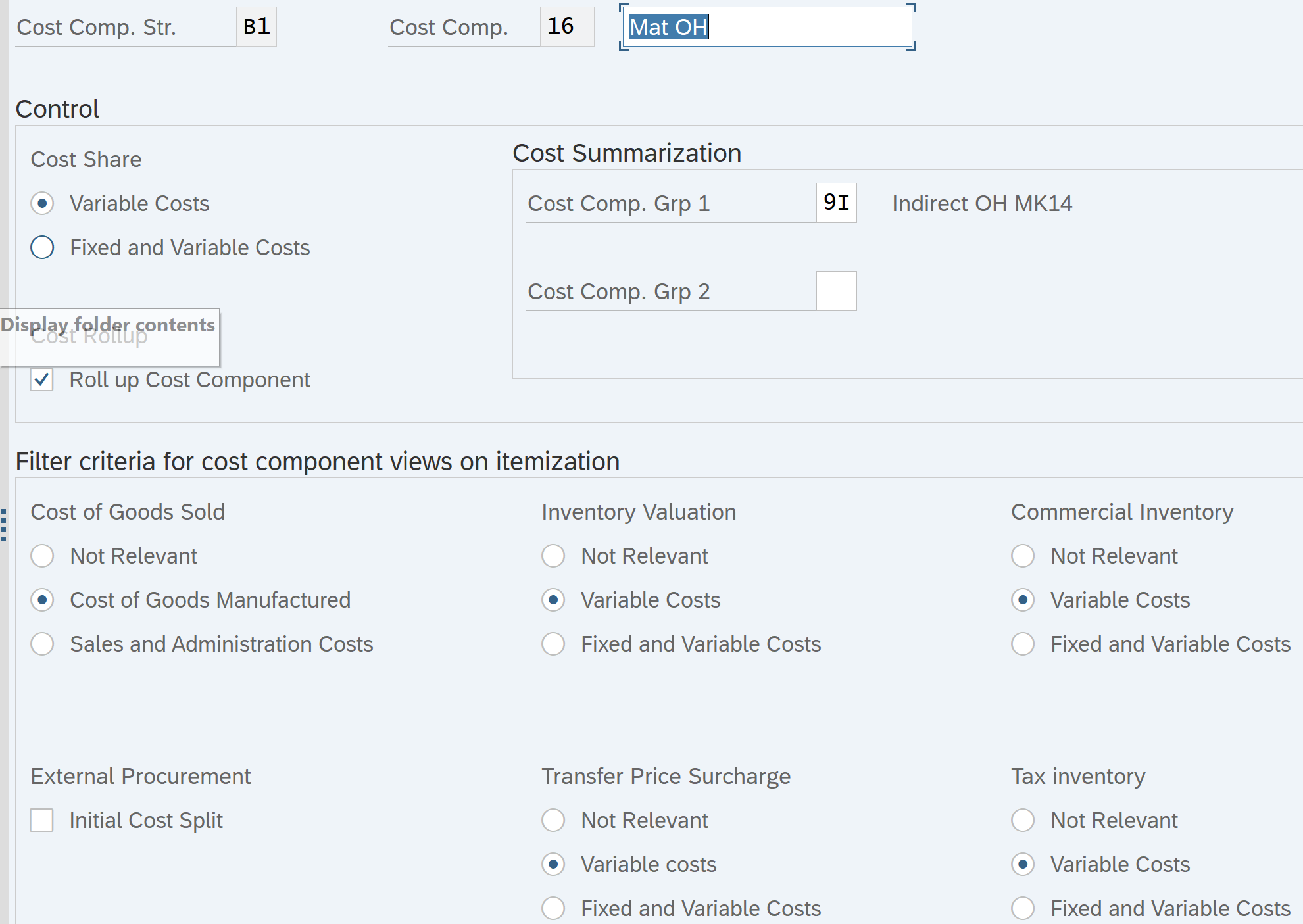

Select CCS B1 and double click Cost component with attributes. Define as below:

Cost displayed in CCG 9M in cost break up

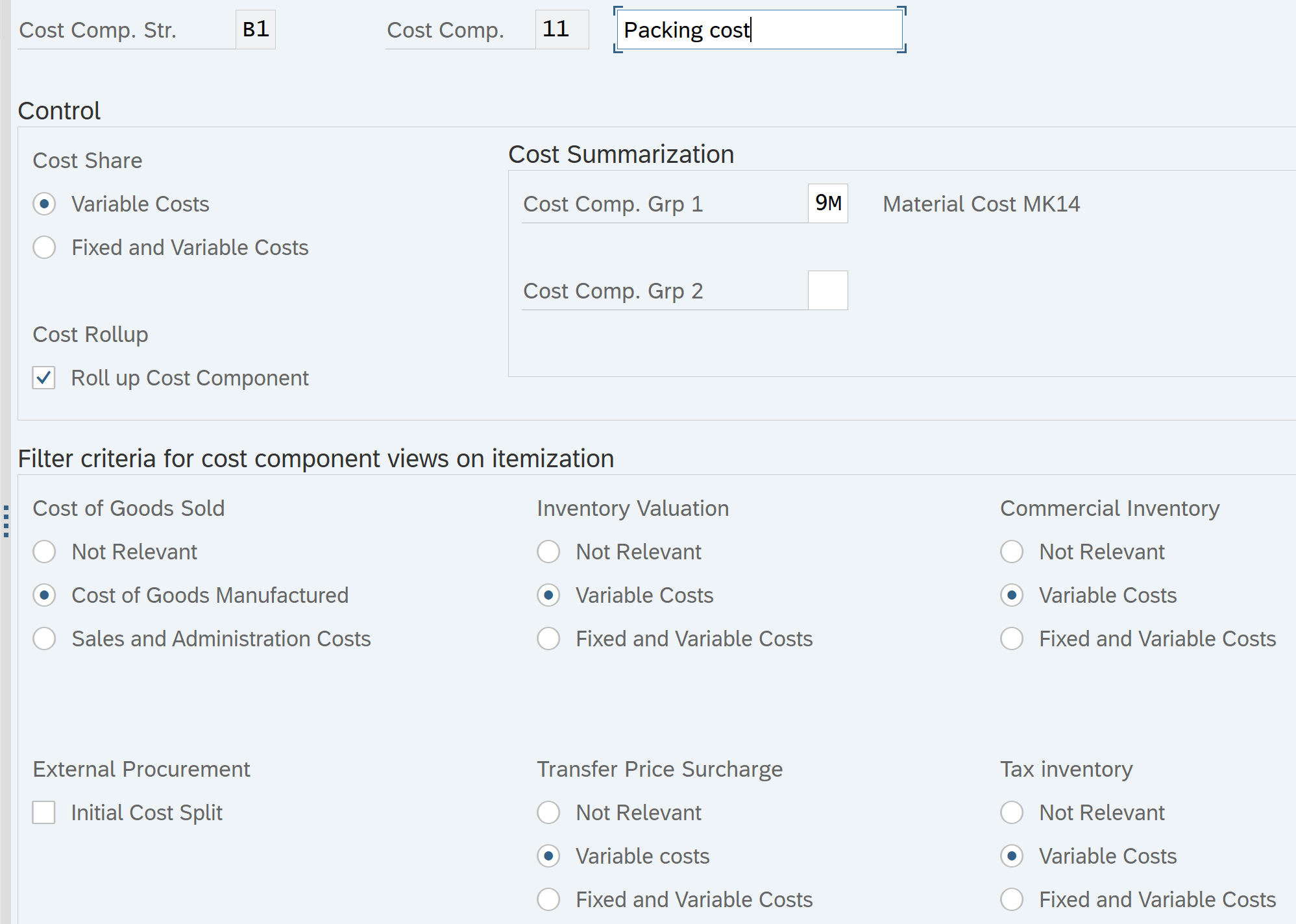

Packing Cost component

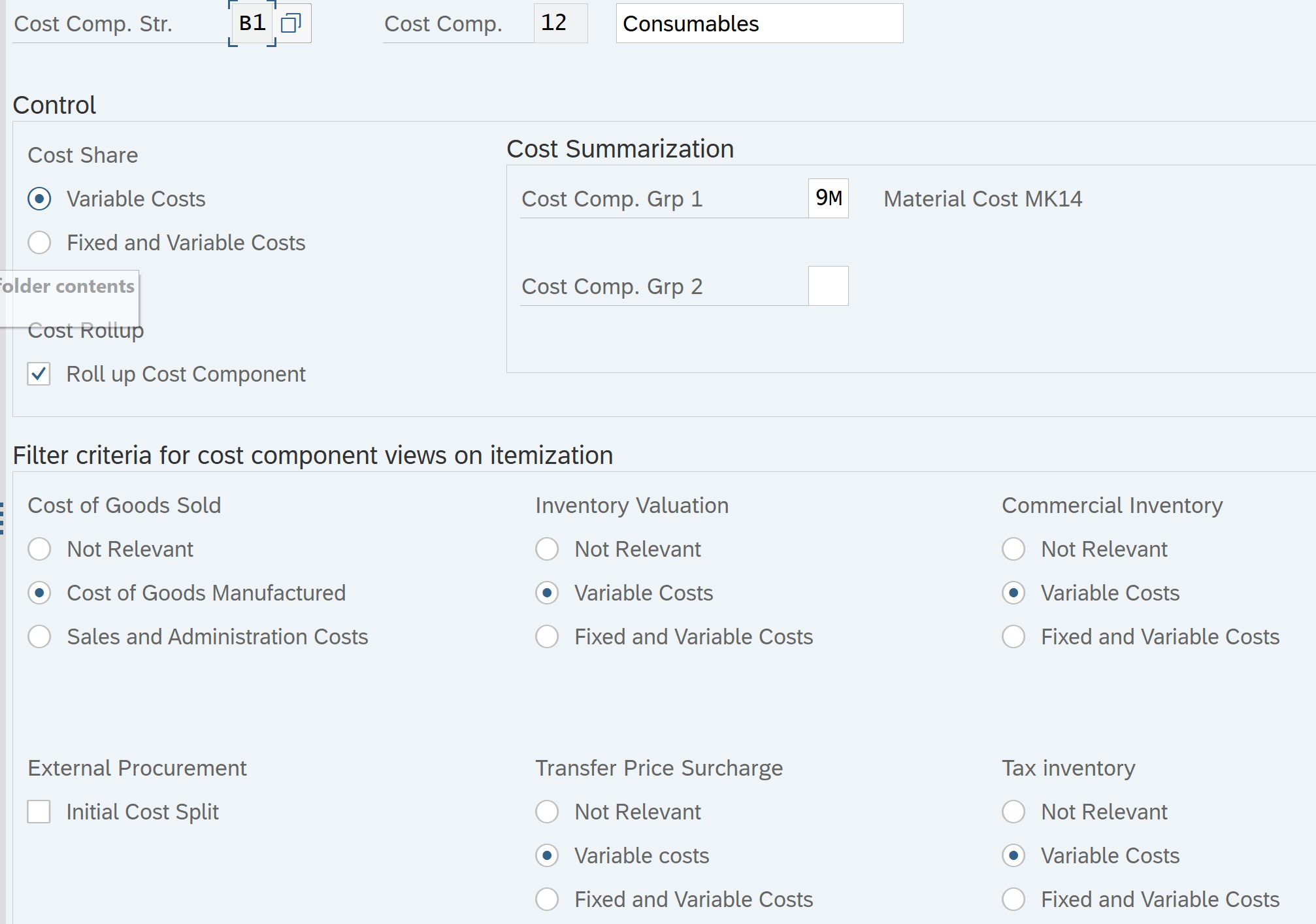

Consumables cost component

Setup Activity Cost

Machine Activity Cost

Labor Activity Cost

Material OH

Activity OH Cost Component

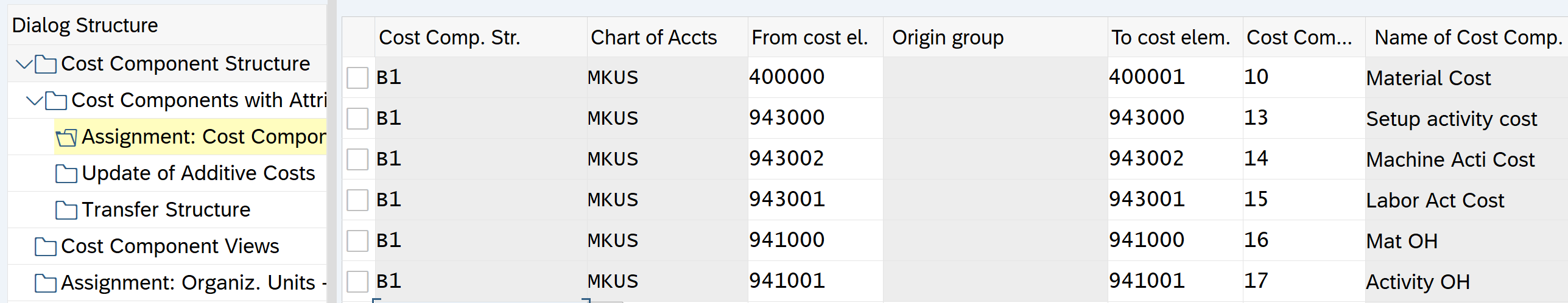

Assign Cost Components to Cost Elements

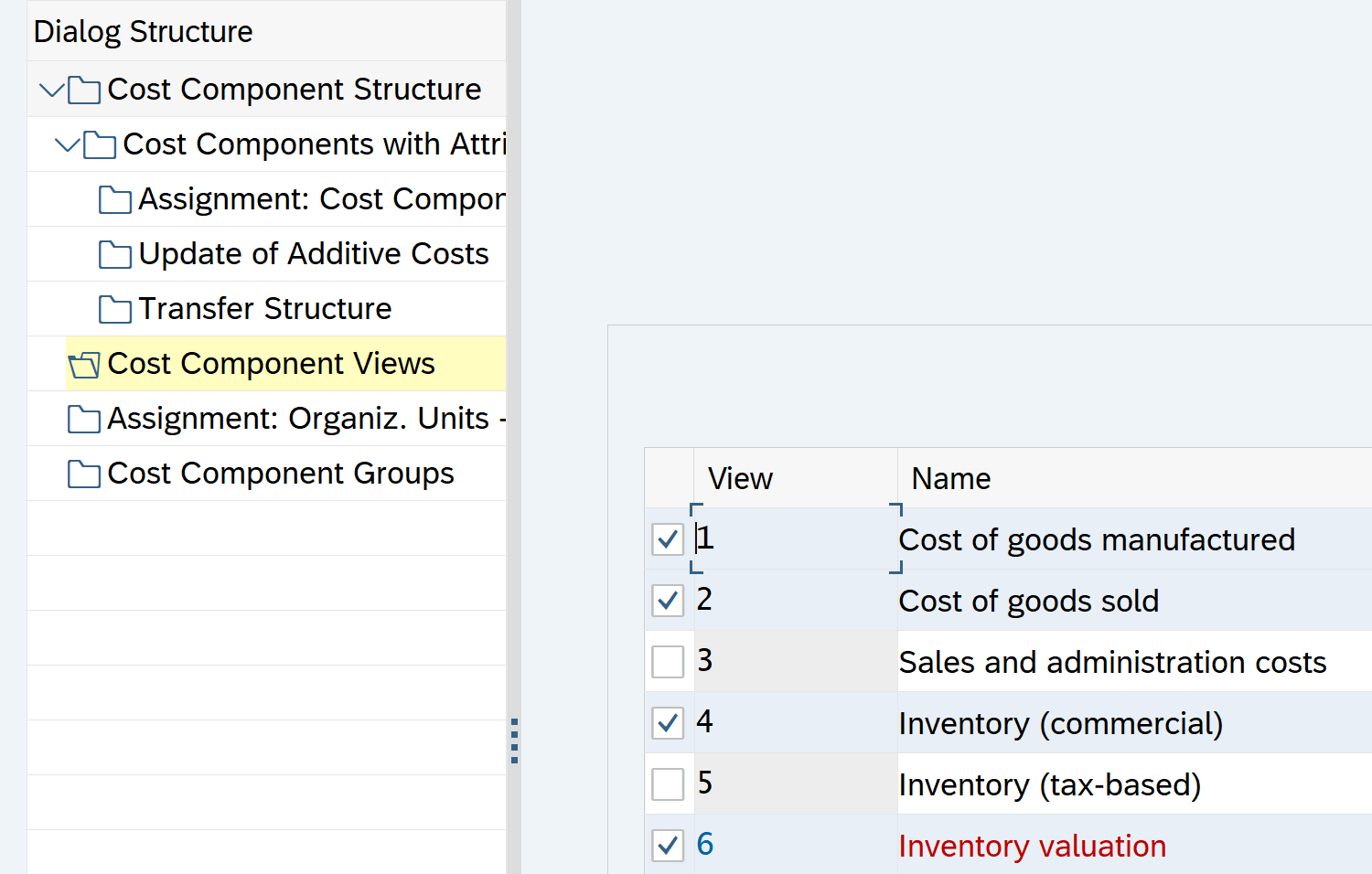

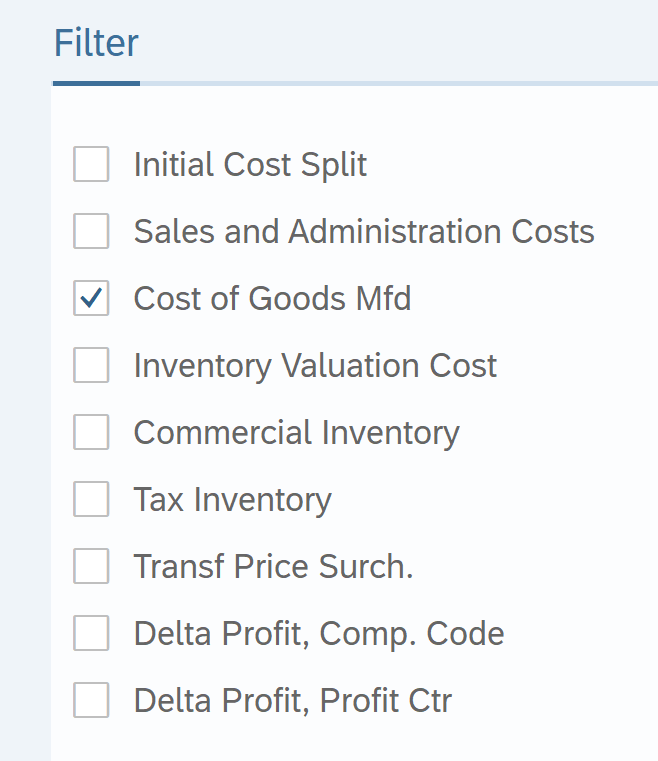

Select the views for this cost component structure

COGM: Select COGM

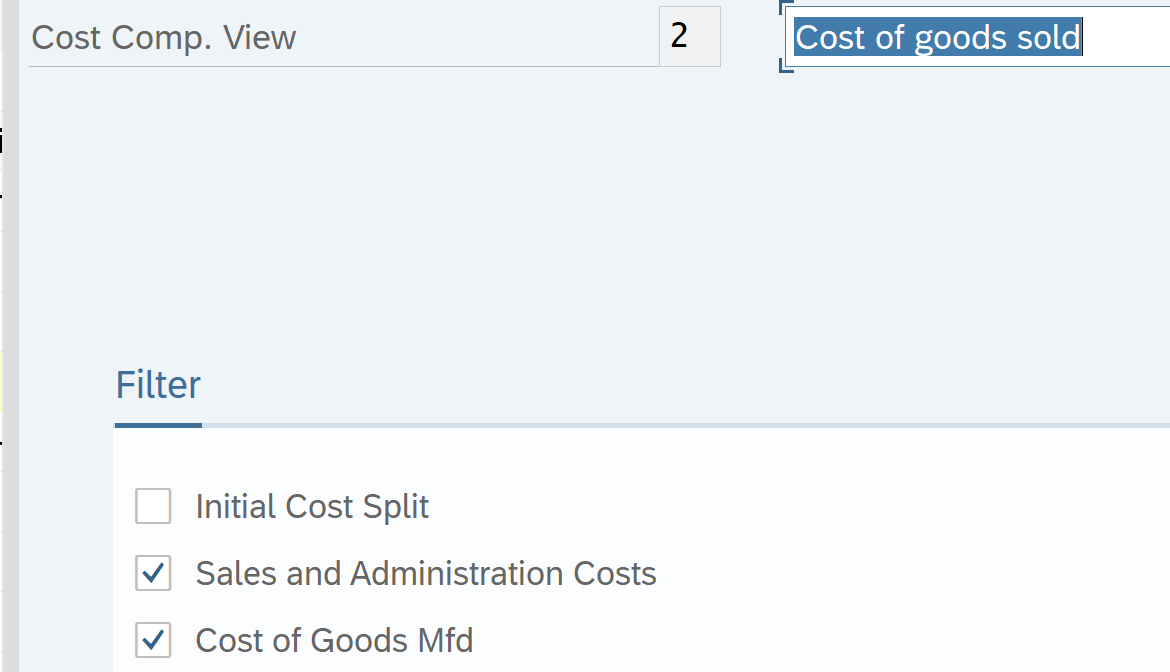

COGS: Cost of goods sold = COGM + Selling and Admin cost

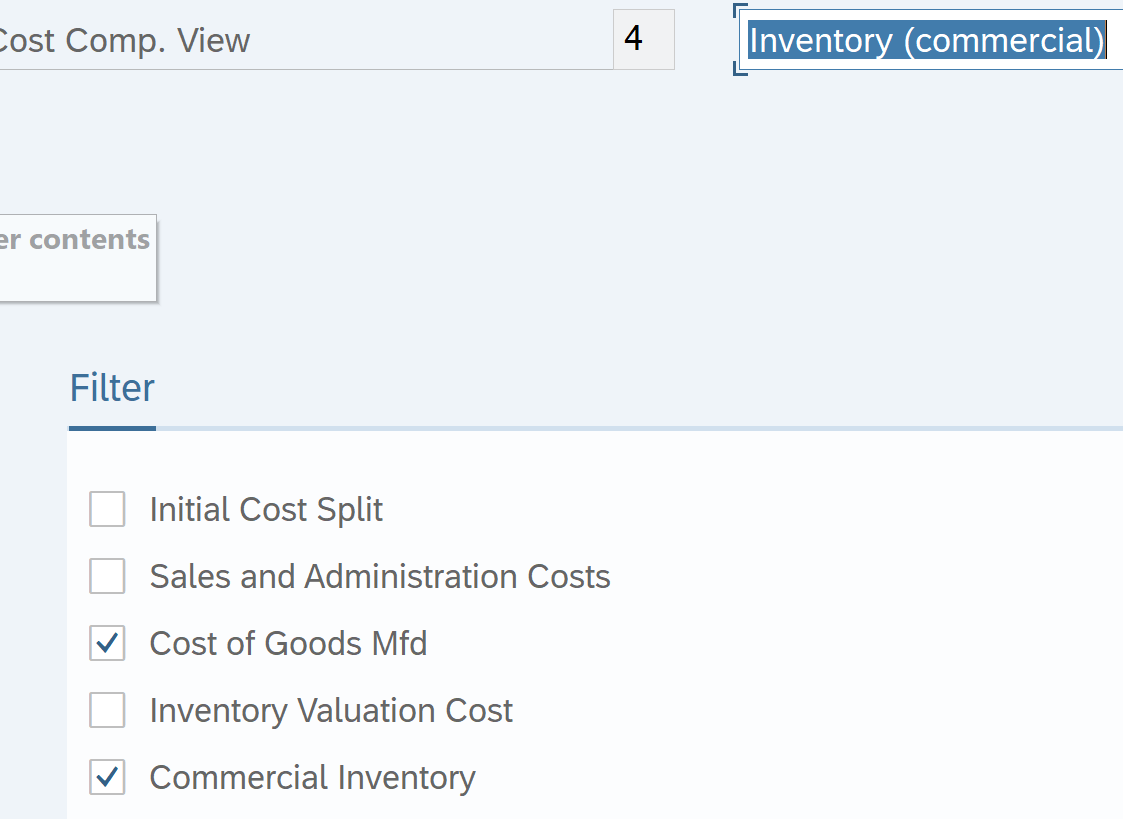

Inventory commercial view = COGM + Inventory commercial

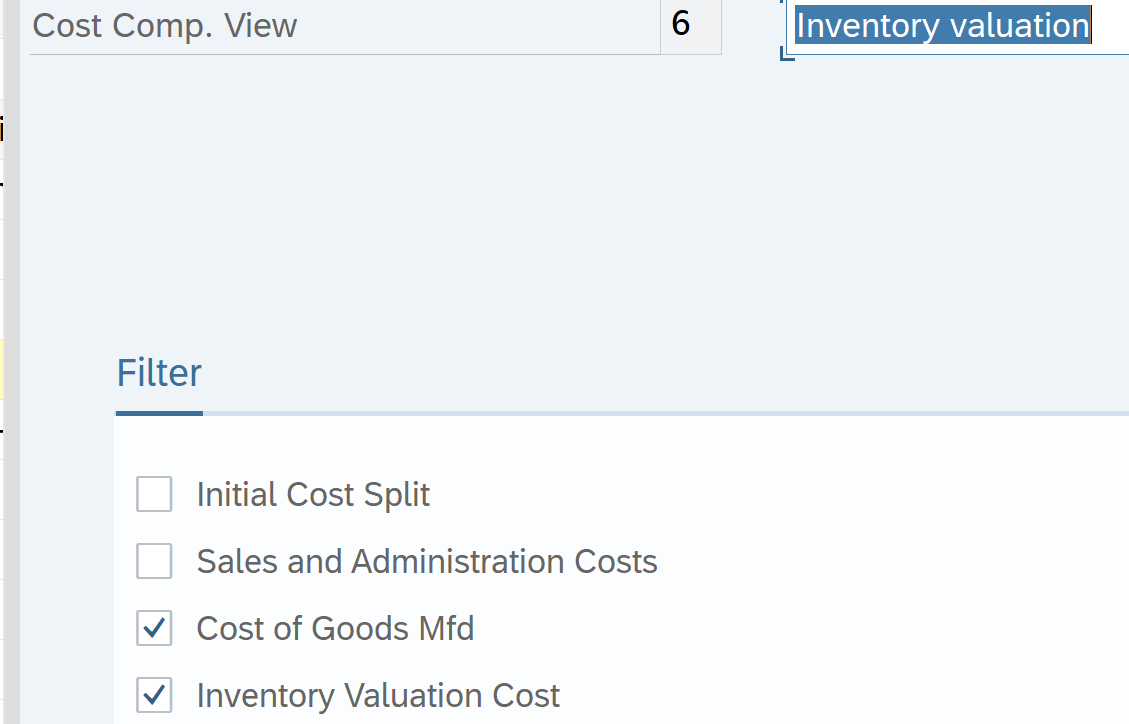

Inventory valuation

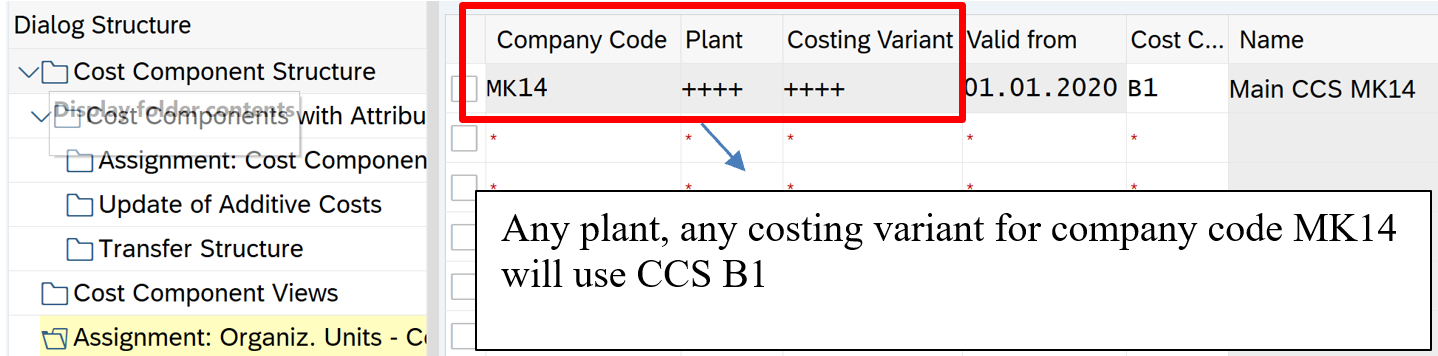

Assign Cost component structure to Organizational Units (Co Code and Plant)

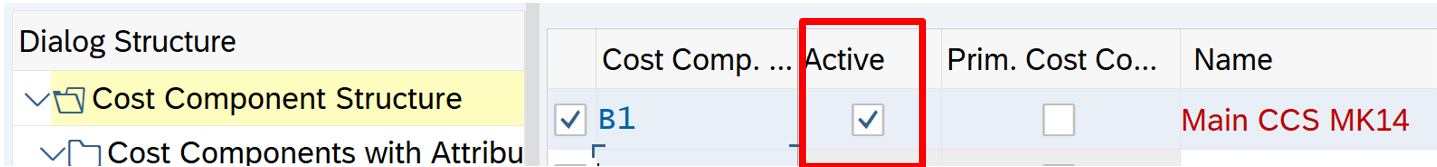

Activate Cost Component structure

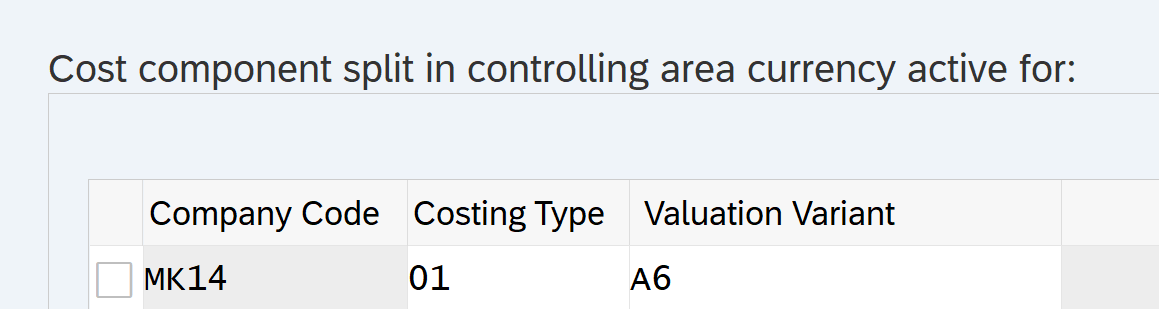

Activate CCS to Controlling area currency

Path: Controlling – Product Cost controlling – Product Cost planning – Select functions in material costing – activate CCS in CO Area currency

Difference between Plan Cost, Standard Cost and Actual Cost

| Plant Cost | Standard Cost | Actual Cost |

| Plan cost for a job order | Estimated cost per unit | Actual cost |

Difference between plan cost and actual cost is of Fixed Cost. Fixed cost does not change in plan cost

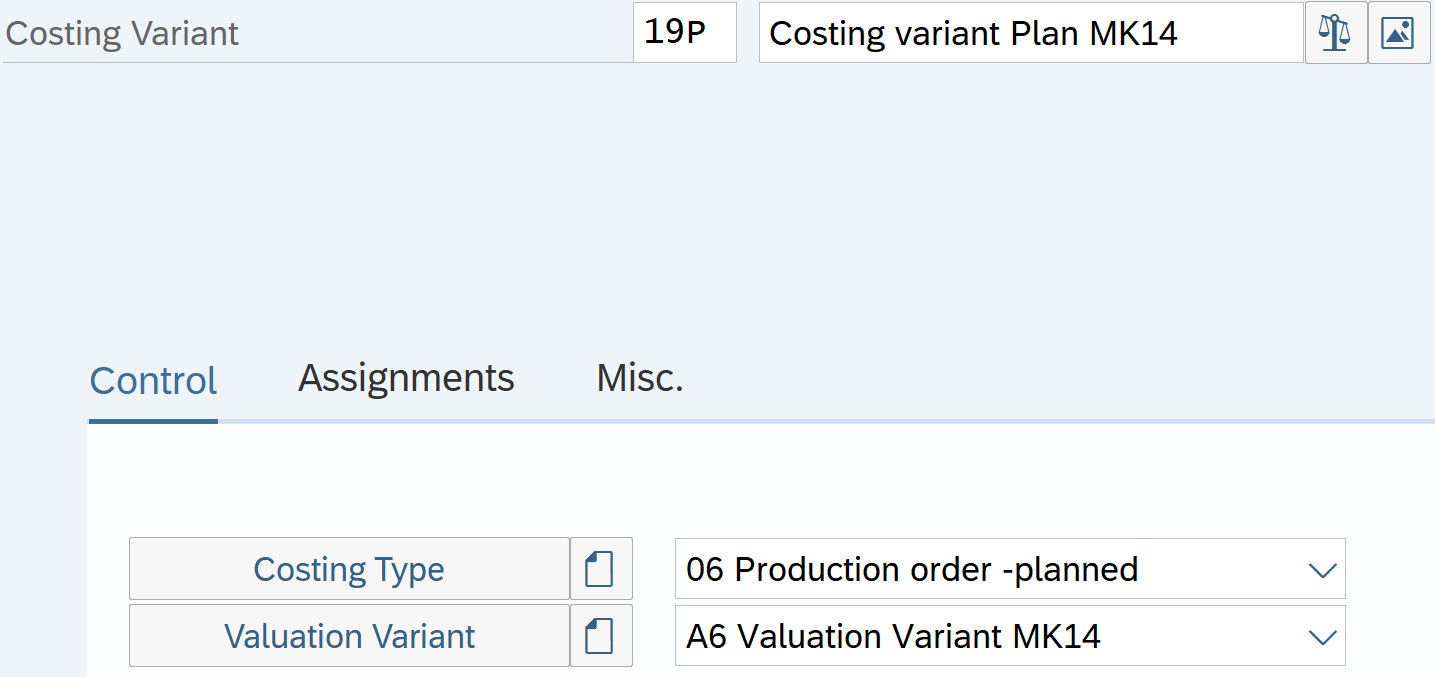

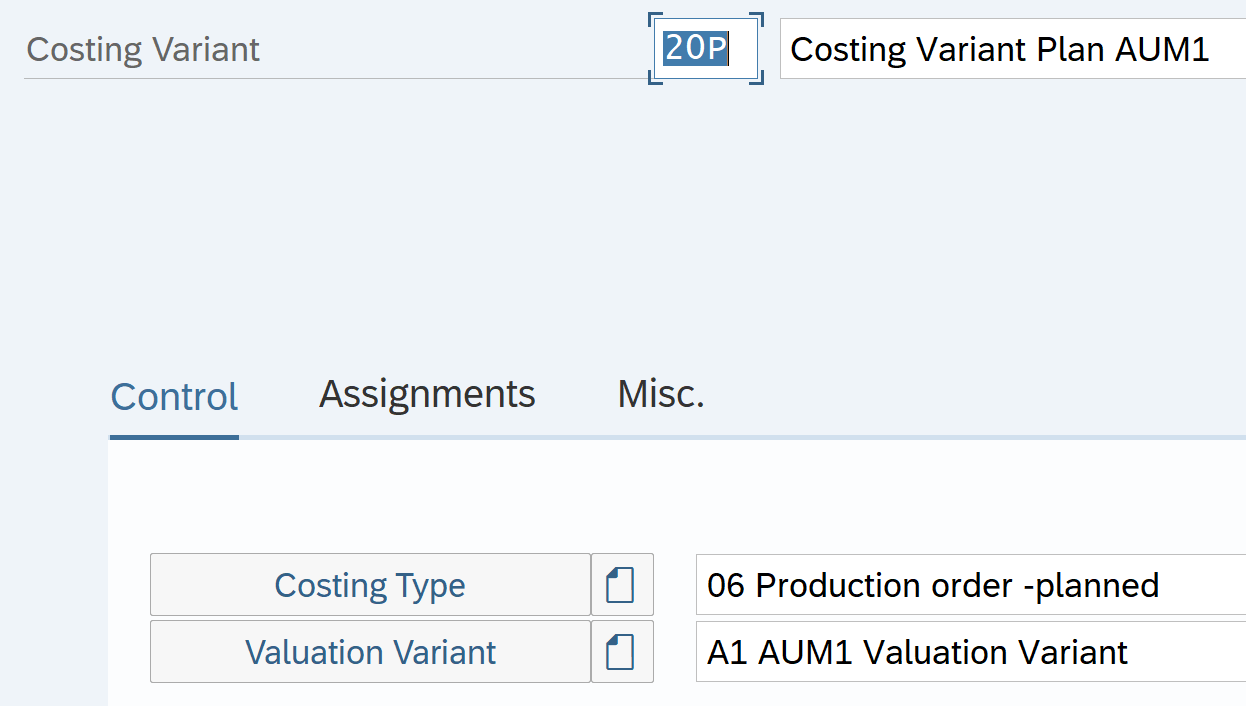

Define Costing variant for Plan

Tcode: OPL1

Path: Controlling- Product Cost Planning – Cost Object Controlling – Product Cost by order – manufacturing orders- Check costing variant for manufacturing orders – new entries

We will use Valuation variant A6 created earlier

Costing Type we will use SAP standard: 06 Planned Production Order

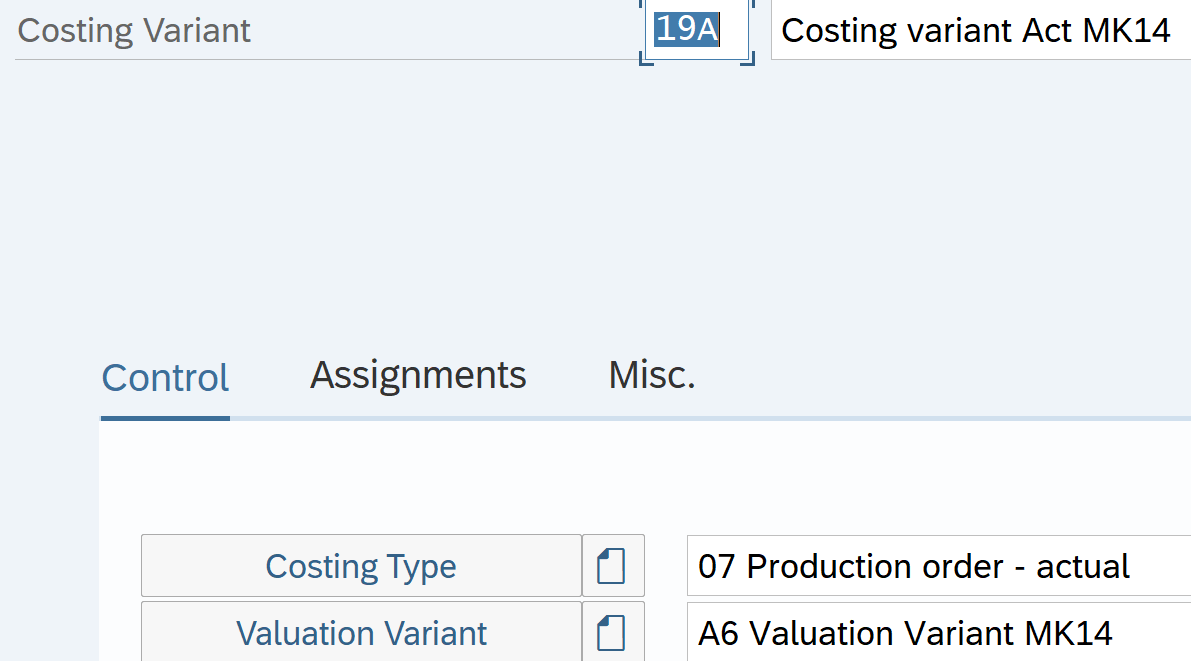

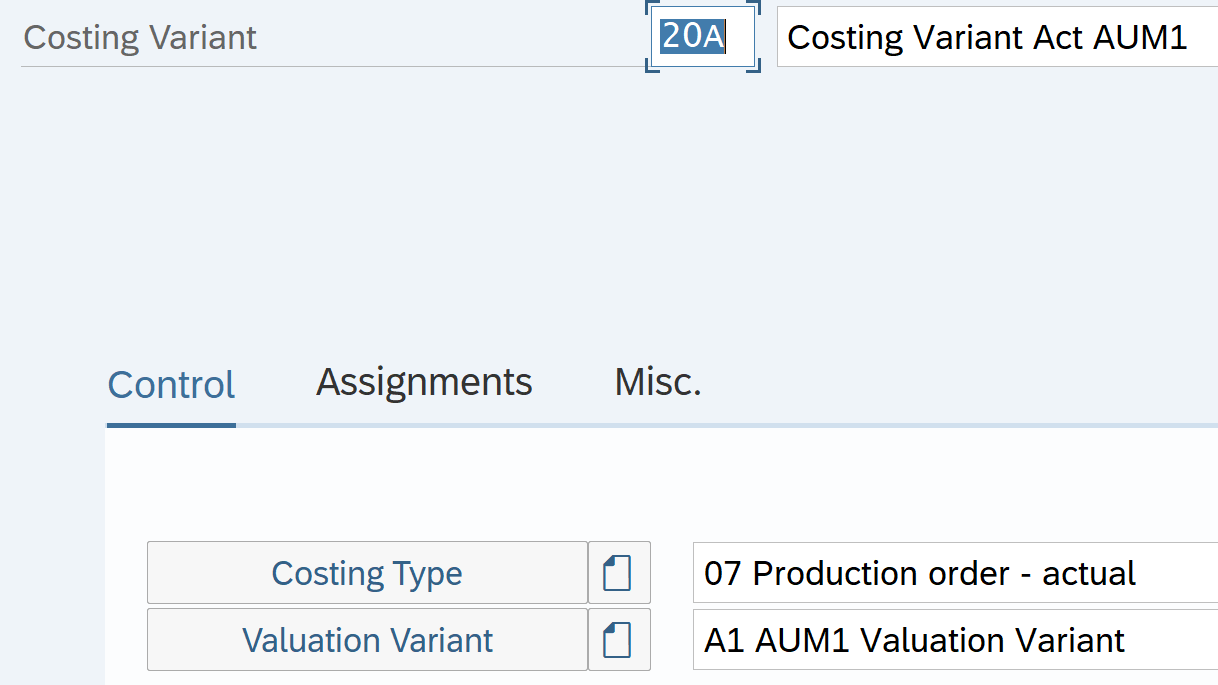

Define Costing variant for Actual

Tcode: OPL1

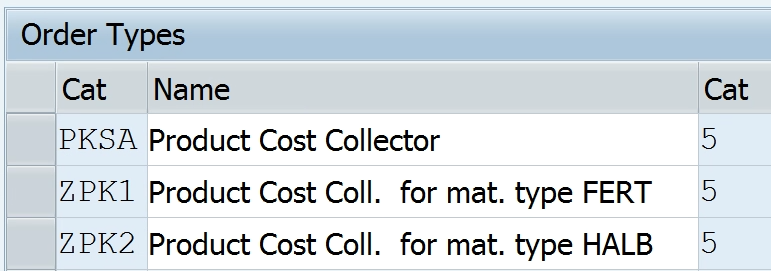

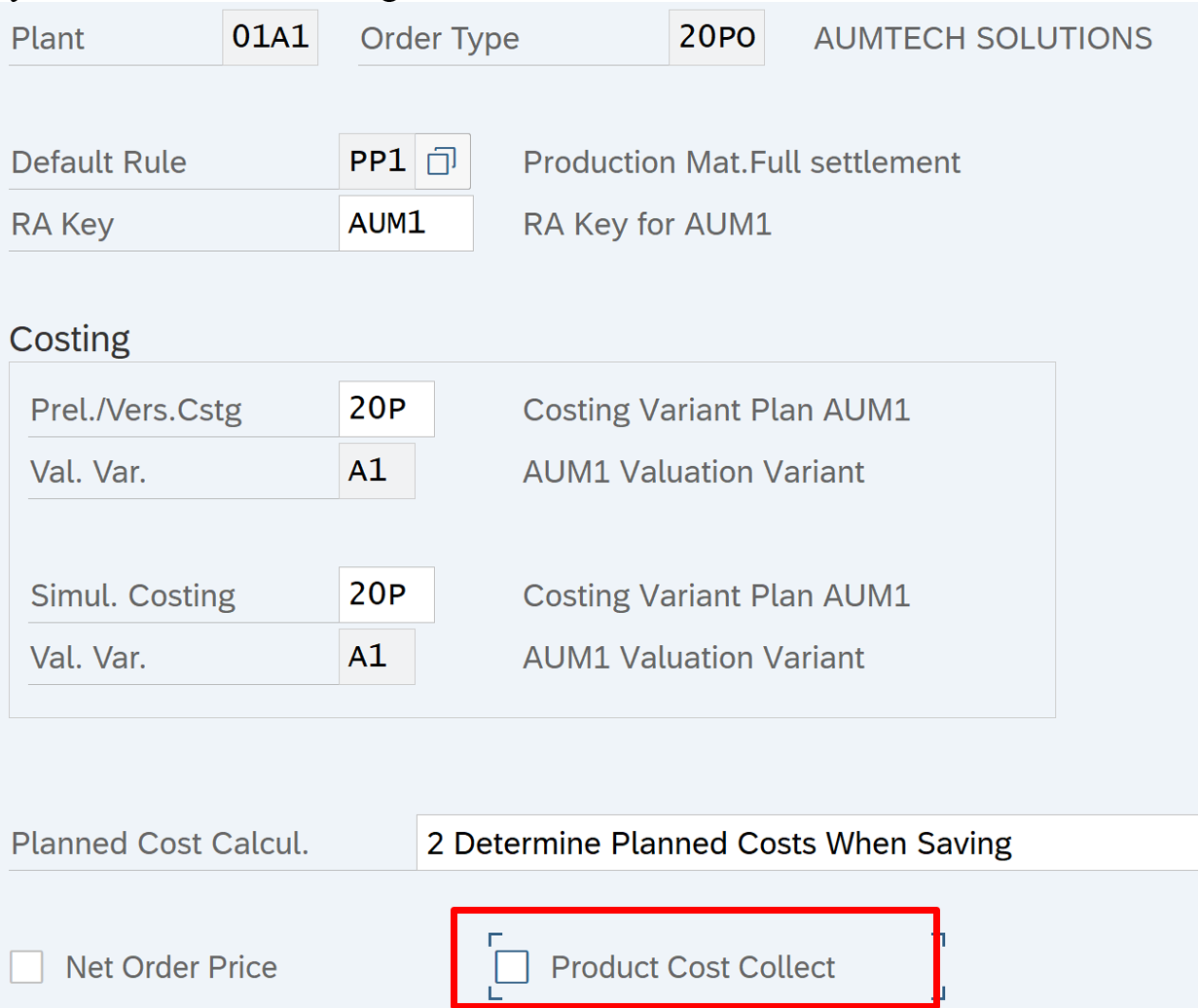

Create Product Cost Collector

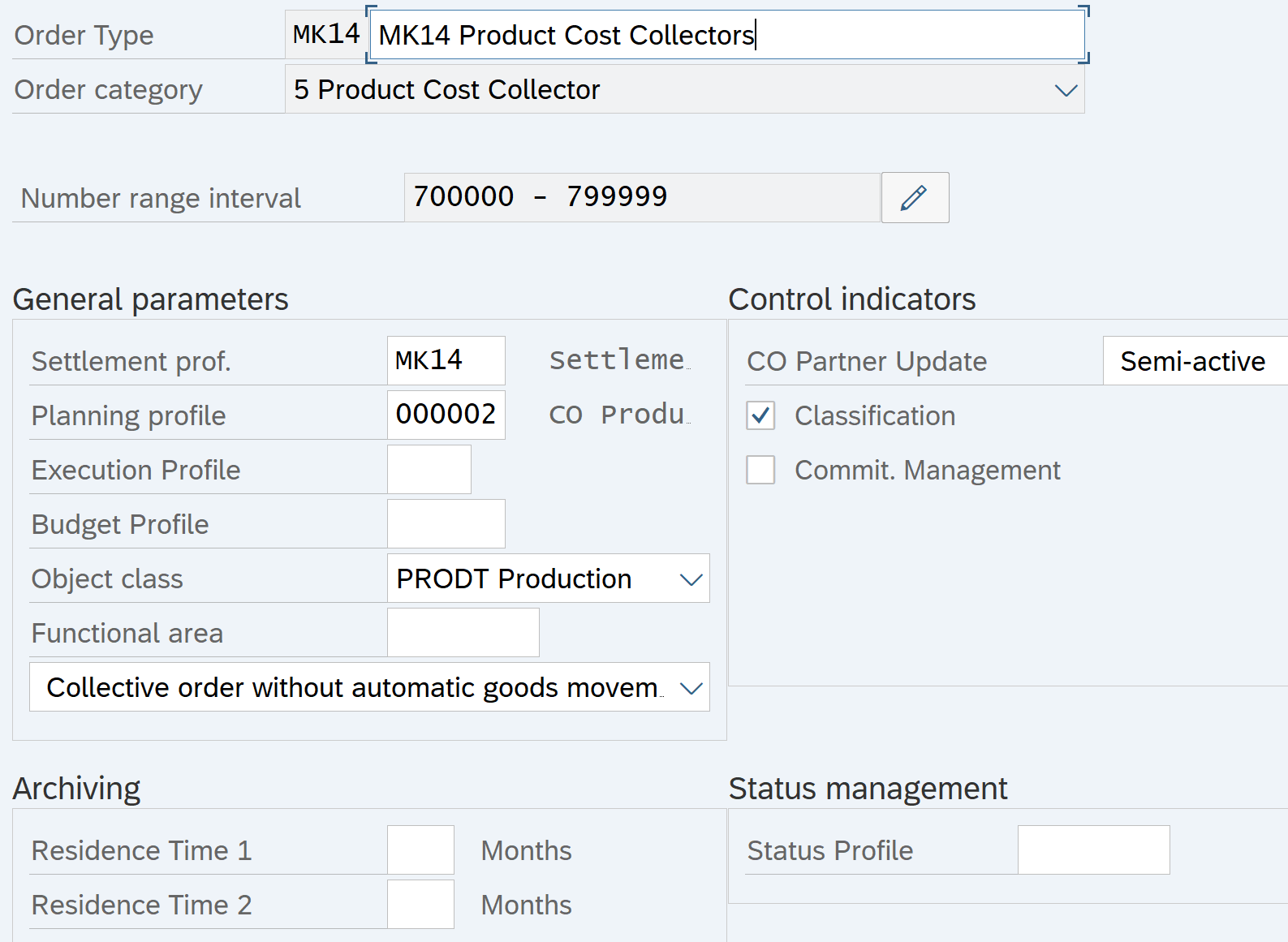

Create / Check Order Types

Path: Controlling – Product Cost Controlling – Cost Object Controlling – Product Cost by Period – Product Cost Collector

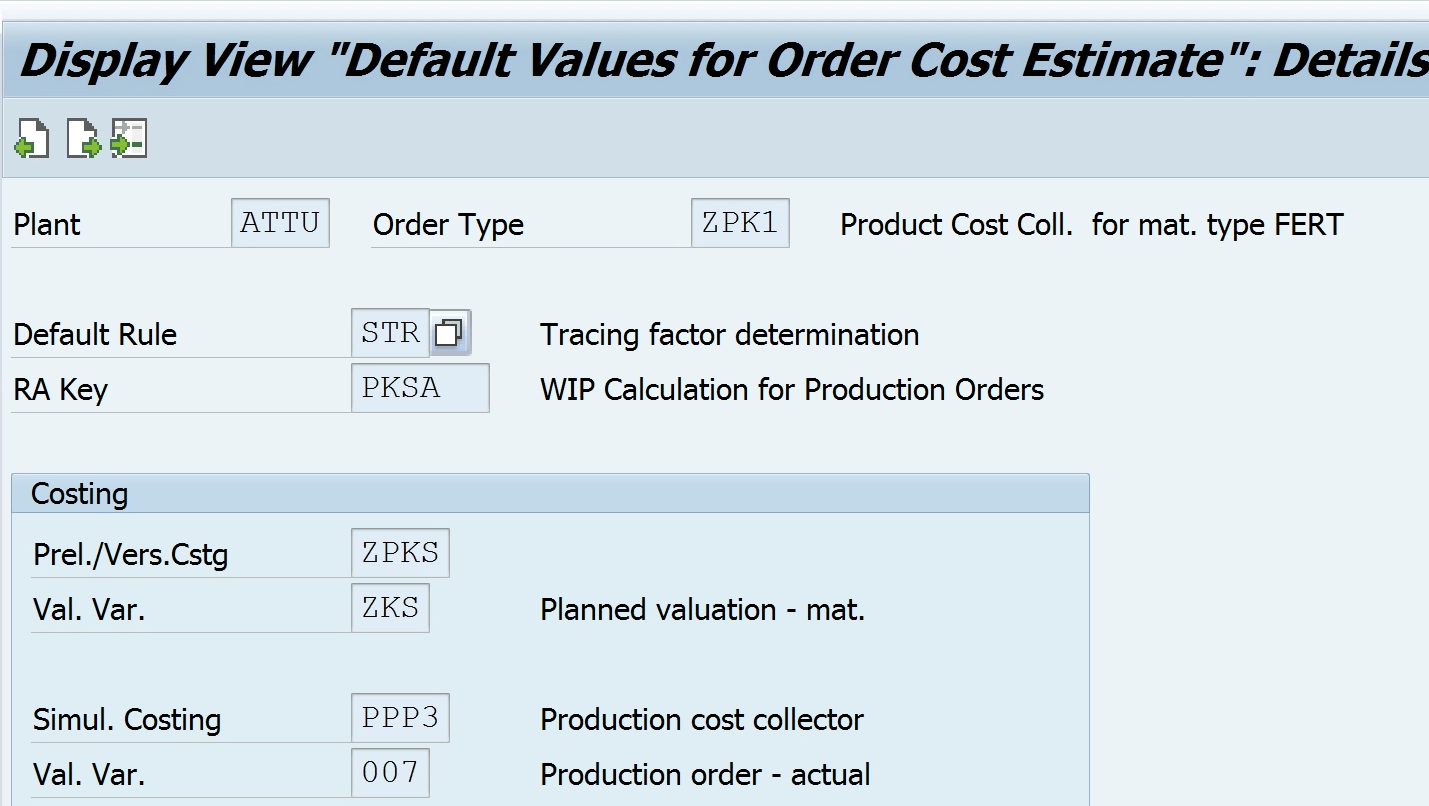

Default values for Order cost estimate

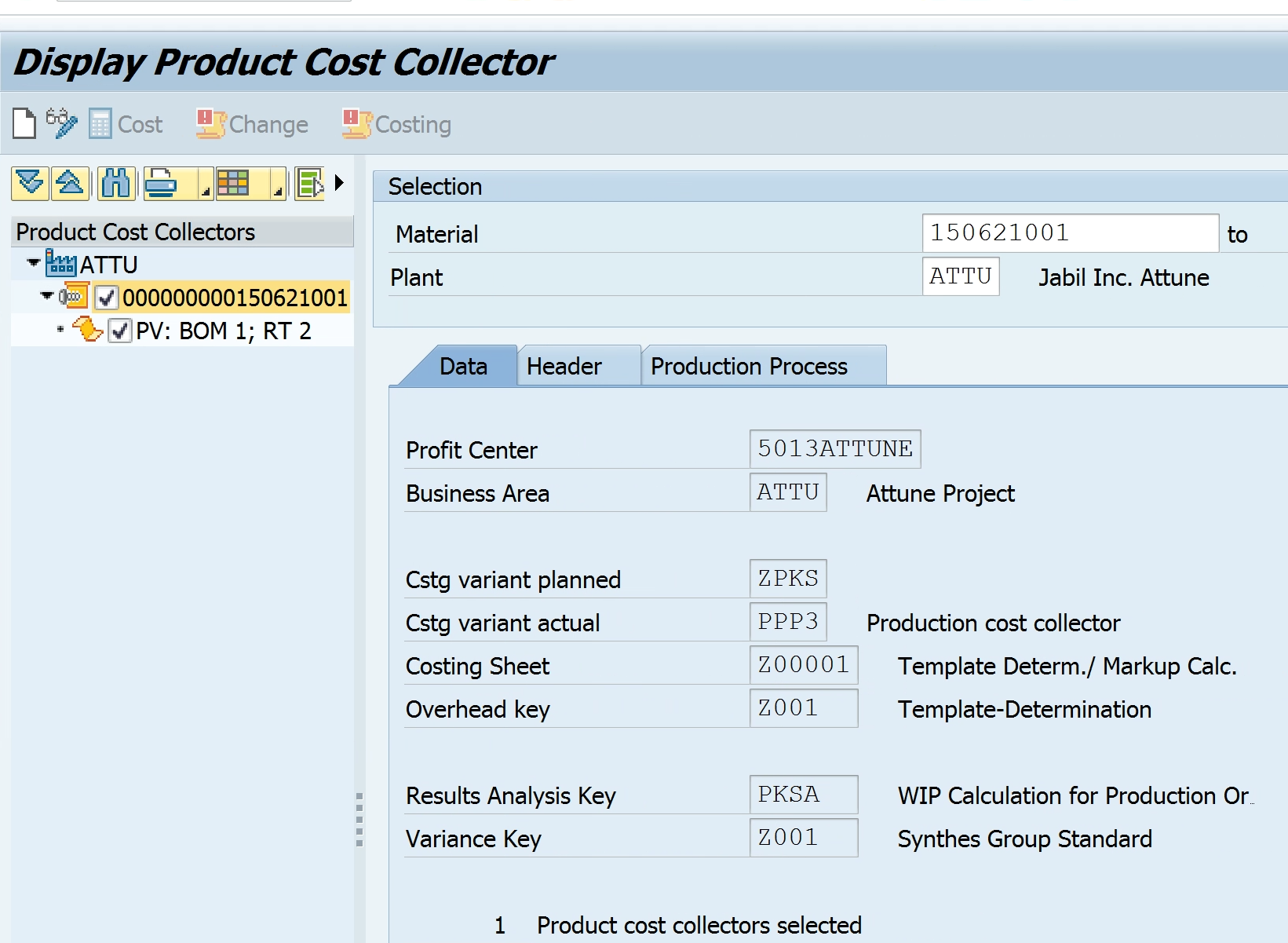

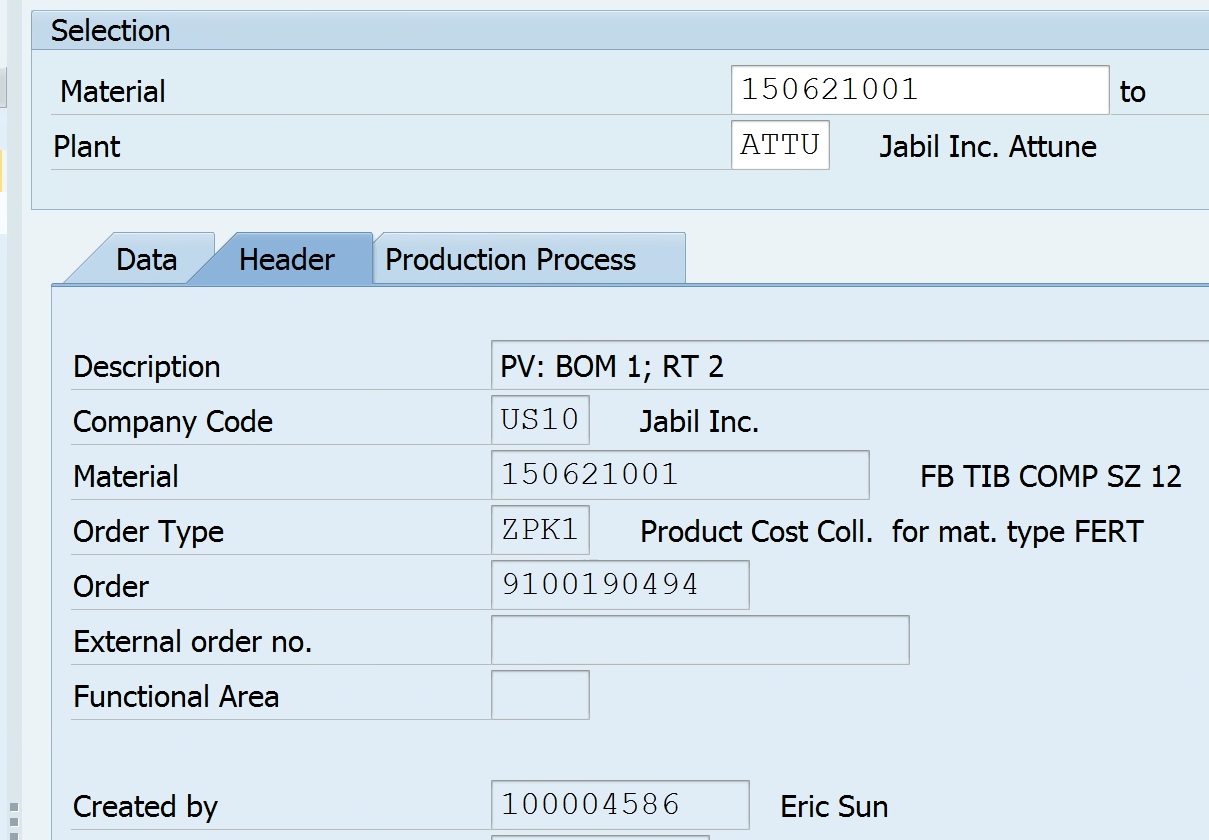

Create Product Cost Collector: KKF6N

Select Product Cost Collector in Production Order type and Plant default values

Path: Controlling – Product Cost Controlling – Cost Object Controlling – Product Cost by Order – Manufacturing Orders

Product Costing Period End Process and WIP

| Mth 1 | Mth 2 | Mth 3 | Std Cost | ||

| Standard Cost | 1 Kg (Std Cots is per 1 Kg) | 10000 | |||

| Production Order | 10 Kg | 6 Kg | 4 kg | ||

| Release | Partial DLV | Full DLV | TECO | Close | |

| 1st Month Cost (Rmatl, OH, Activity Cost) | 20000 | 20000 | 20000 | 20000 | |

| 2nd Month Cost | 70000 | 70000 | 70000 | ||

| 3rd Month Cost | 30000 | 30000 | |||

| OH Cost (Can be added to Order even at TECO) | 10000 | ||||

| GR (6 kg Goods received by inventory) | -60000 | -100000 | -100000 | ||

| Period End Process | |||||

| Order Balance at ME | 20000 | 30000 | 20000 | 30000 | |

| WIP ( Equal to Order Balance) | 20000 | 30000 | Nil ( Order fully delivered) | 0 | |

| Variance (Cal only at FULL DLV, TECHO) | NA | NA | 20000 | 10000 | |

| Settlement (Production Order cost transferred from CO to FI GL Accounts) | |||||

| FI Acct Entries | |||||

| WIP Material (B/S) DR | 20000 | 10000 | |||

| WIP P/L CR | 20000 | 10000 | |||

| Full DLV – WIP is zero, so above entries reversed at settlement | |||||

| WIP P/L DR | 30000 | ||||

| WIP Material (B/S) CR | 30000 | ||||

| Balance is removed from Production order through variance posting | |||||

| Production Variance DR | 20000 | 10000 | |||

| To COGM CR | 20000 | 10000 | |||

| CO Document Posting – FULL DLV- Settlement | Prod Order – CR (20000 for variance) | 10000 |

WIP Settings

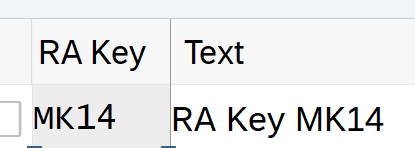

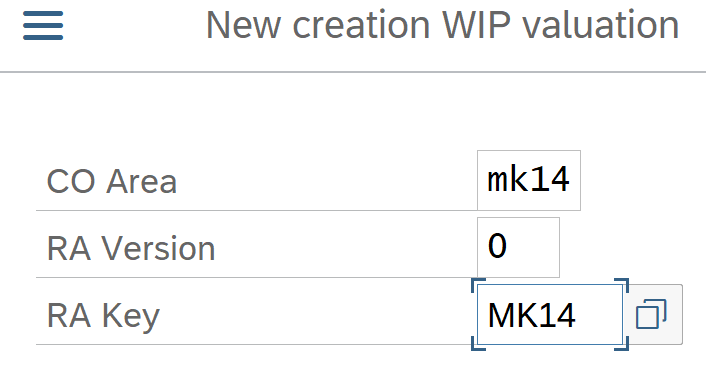

- Define RA Key

Path: Controlling- Product Cost Planning – Cost Object Controlling – Product Cost by order – Period end closing – work in progress – Define RA Key

Tcode: OKG1

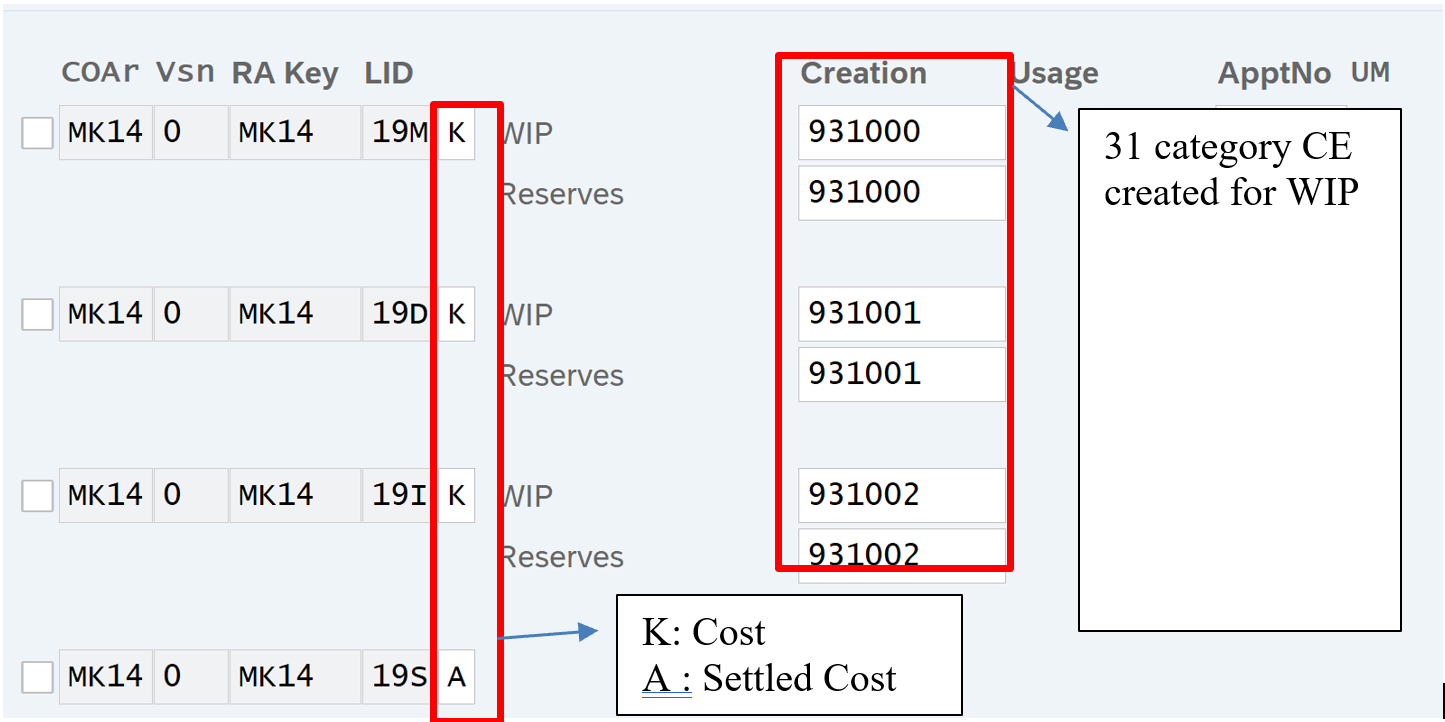

- Define CE for WIP calculation

Path: Controlling- Product Cost Planning – Cost Object Controlling – Product Cost by order – Period end closing – work in progress

Create below secondary (31 category CE): KA06

| Sec CE | Name | CE Category |

| 931000 | WIP Material Cost | 31: Prod Order/ Project Result |

| 931001 | WIP Direct OH | 31: Prod Order/ Project Result |

| 931002 | WIP Indirect OH | 31: Prod Order/ Project Result |

| 931003 | WIP Technical (Total of all WIP) | 31: Prod Order/ Project Result |

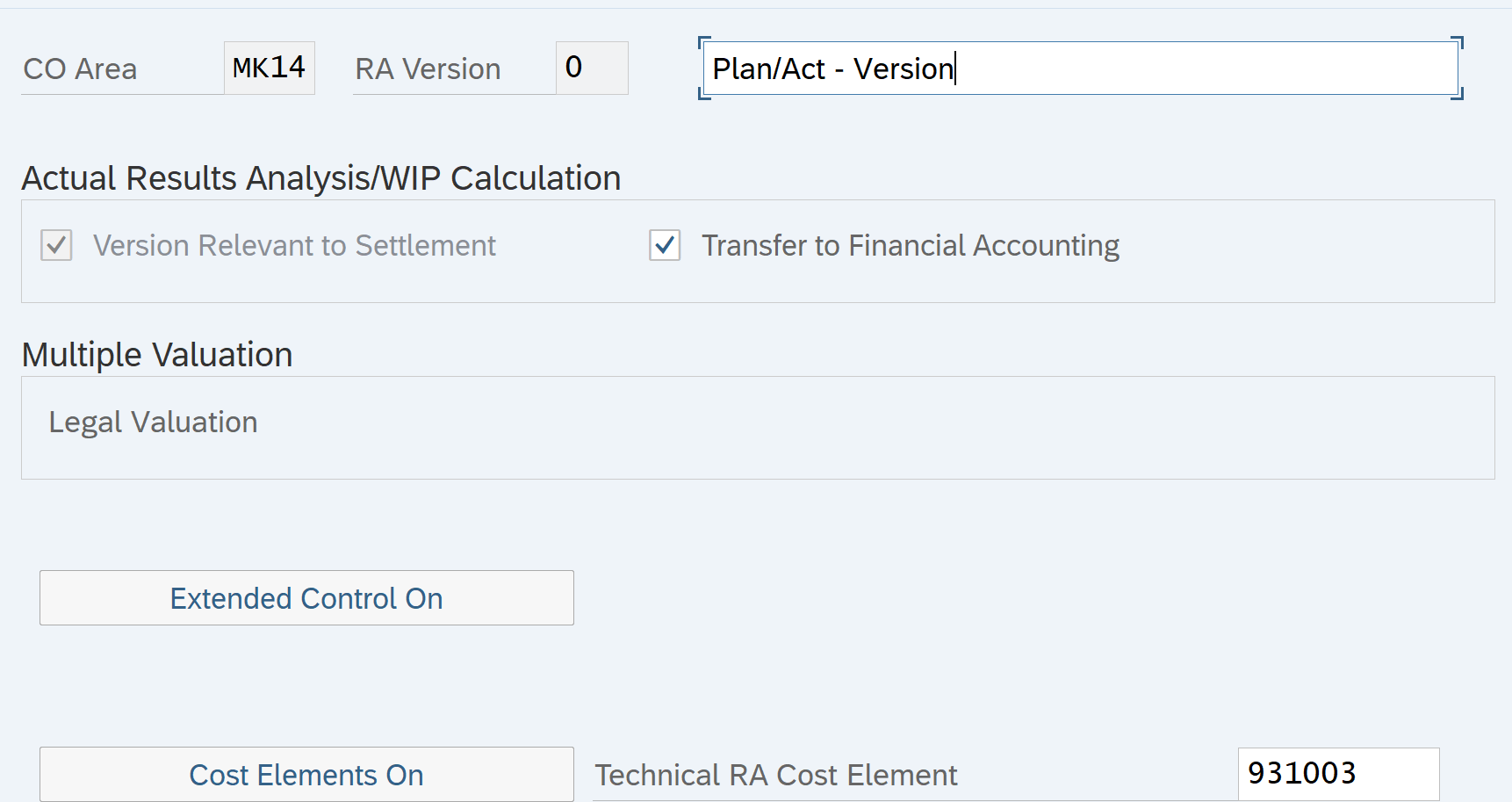

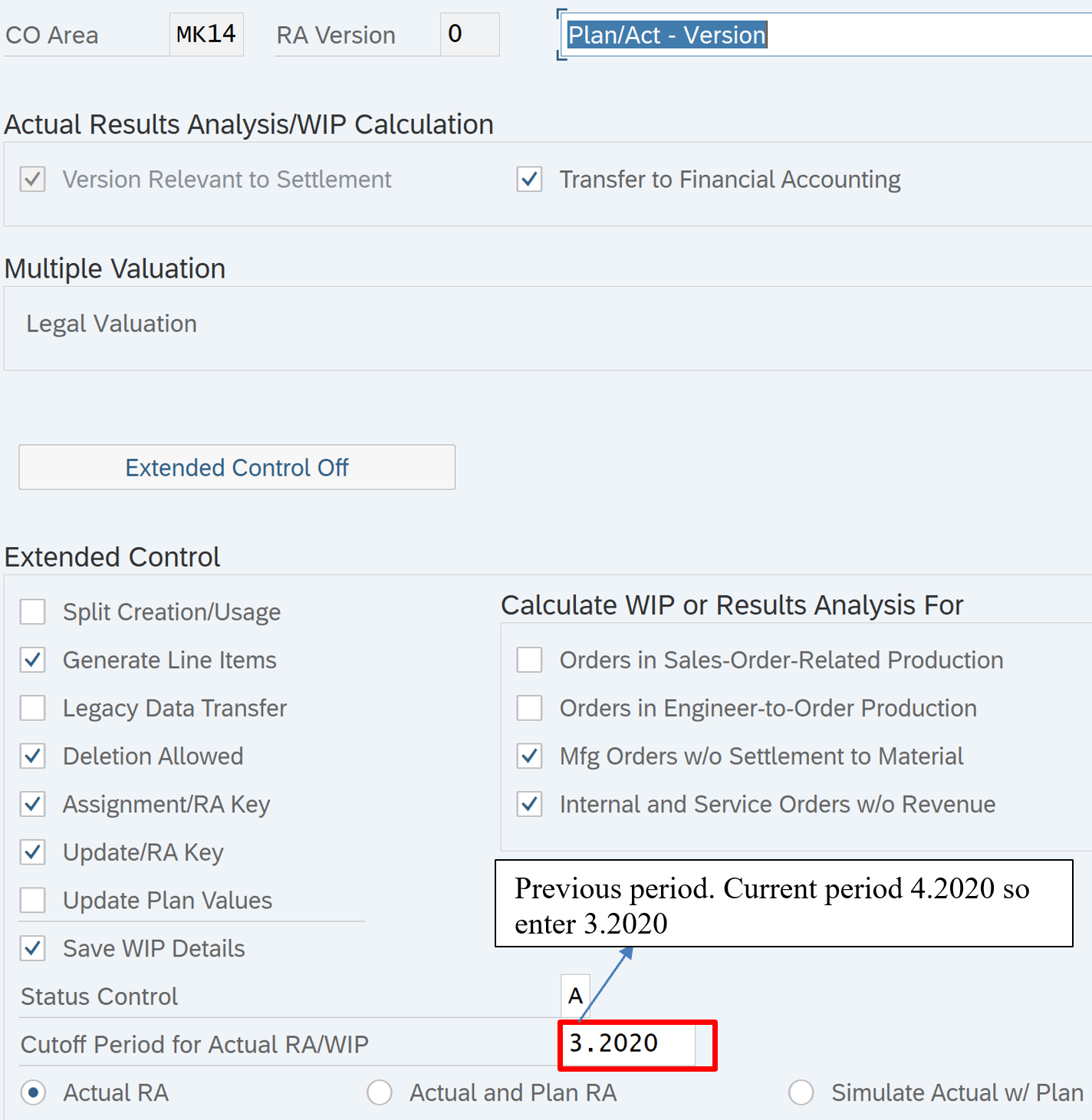

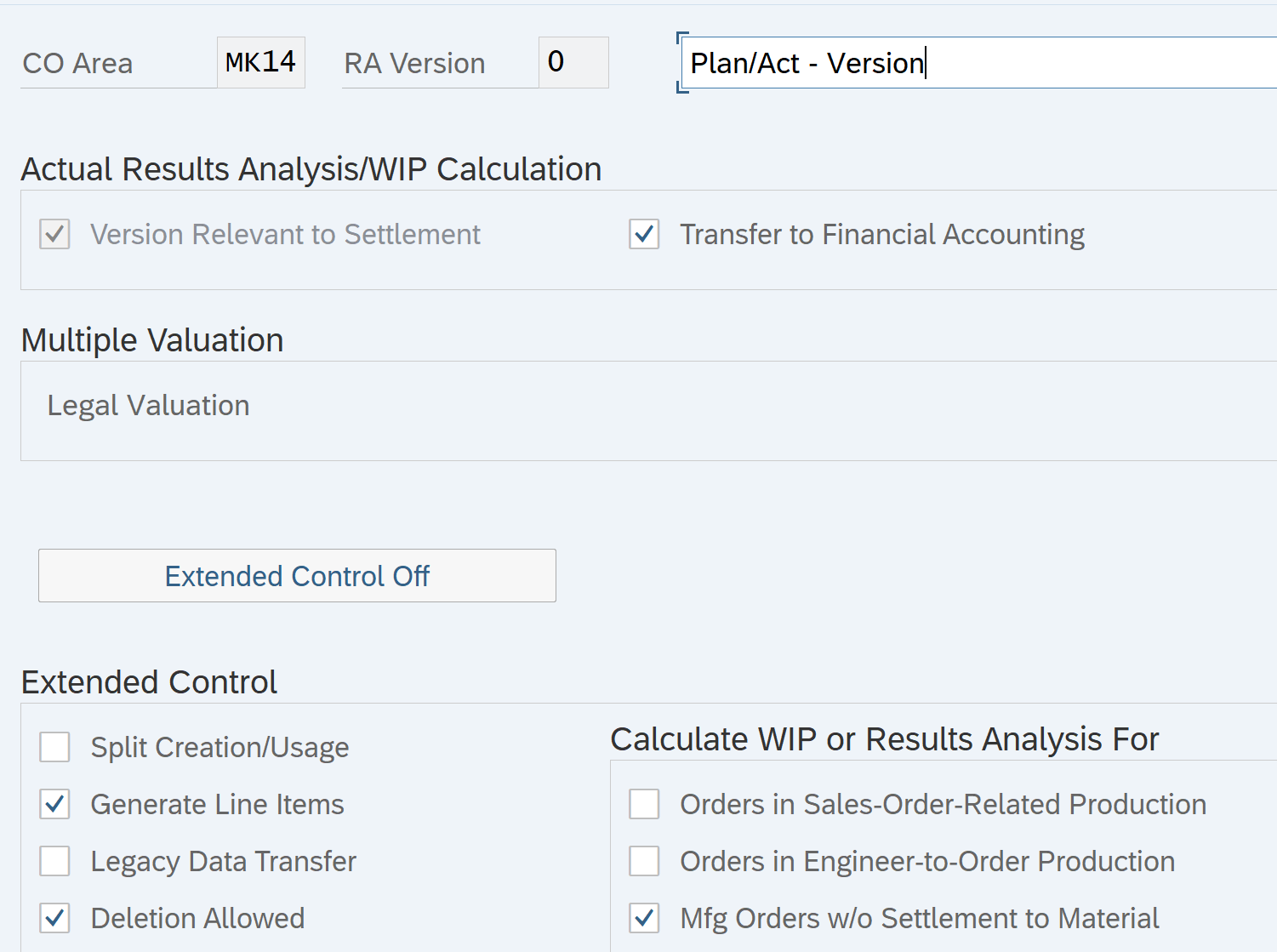

- Define RA version

Path: Controlling- Product Cost Planning – Cost Object Controlling – Product Cost by order – Period end closing – work in progress

All results analysis data calculated in results analysis is updated on the order with reference to the results analysis version. This enables you to calculate work in process on the basis of multiple results analysis versions. This means that you can use different results analysis versions to define different methods of WIP calculation

Click Extend control ON

Save and deselect Transfer to Financial Accounting. This will be reselected after completing subsequent steps

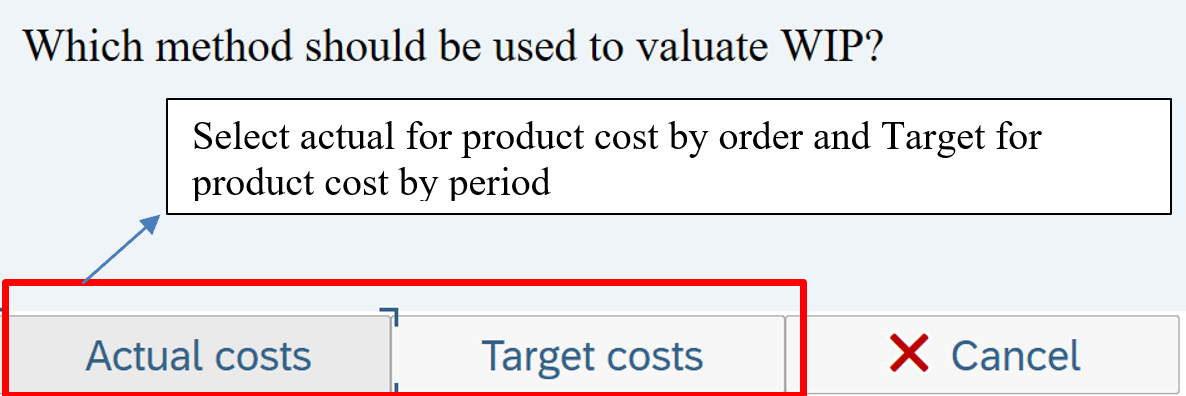

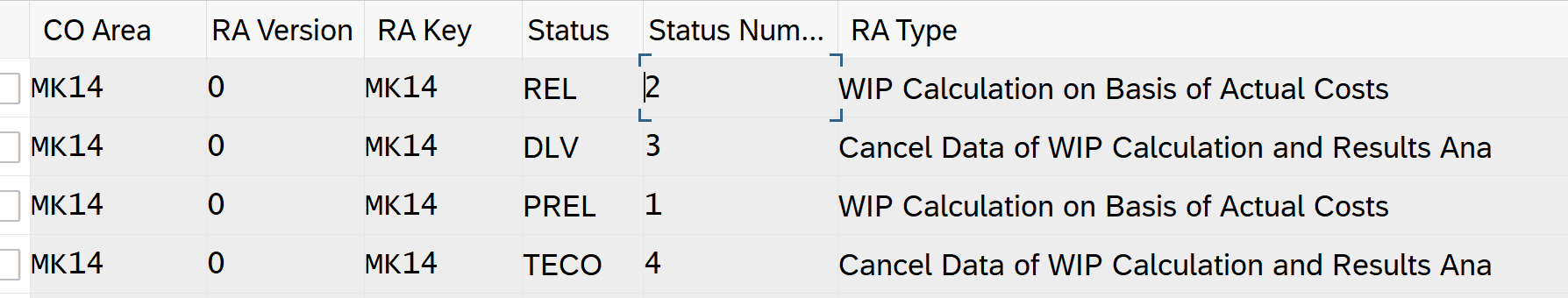

- Define valuation methods actual

Path: Controlling- Product Cost Planning – Cost Object Controlling – Product Cost by order – Period end closing – work in progress

- In this step you define a valuation method for the calculation of work in process.

- In the Product Cost by Period component the work in process is valuated at target costs. The valuation is made based on the quantities confirmed at the operations point

- In the Product Cost by Order component the work in process is normally valuated at actual costs. The value of the work in process is the difference between the debit and the credit of an order if the order has the status PREL (partially released) or REL (released).

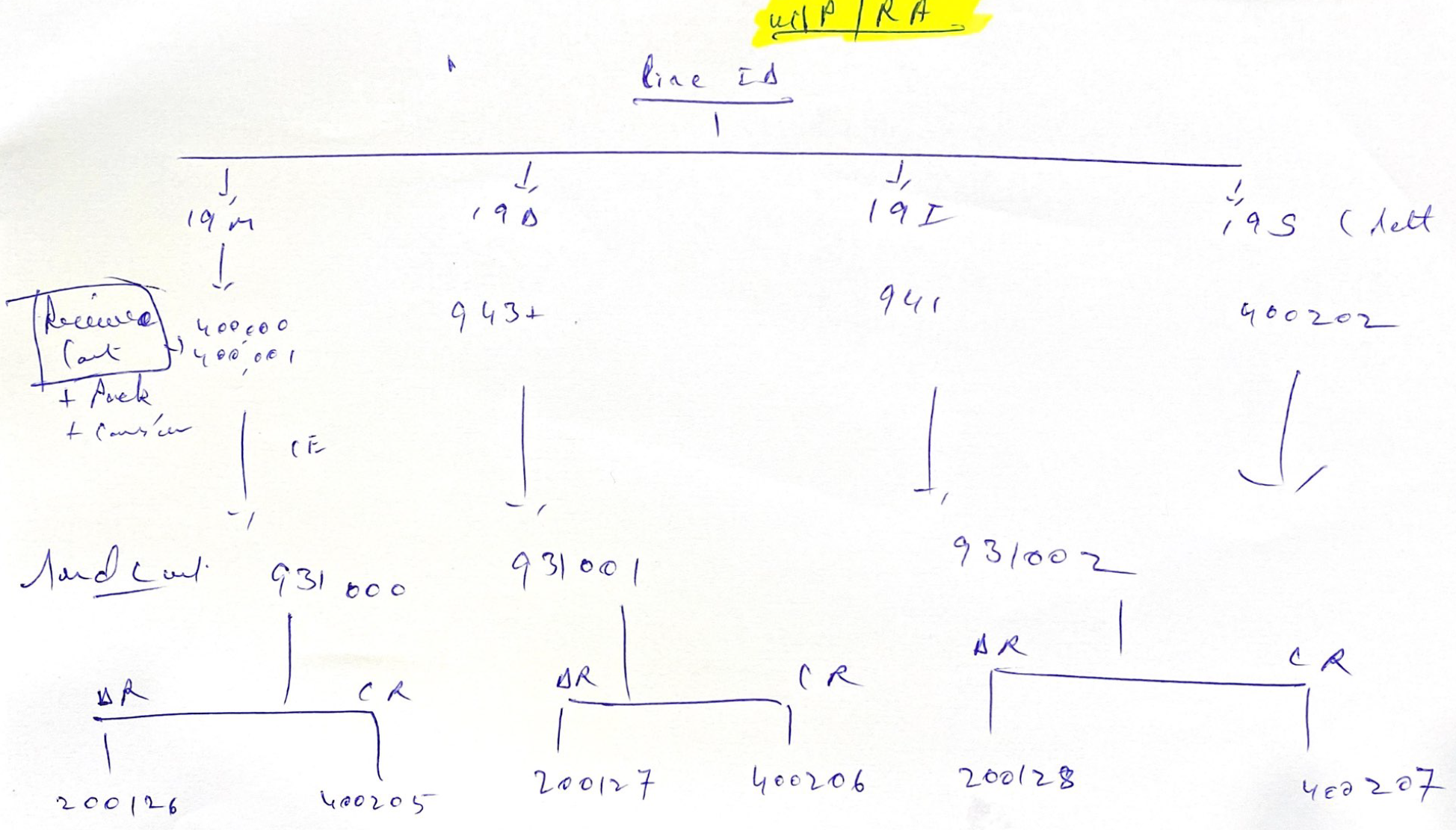

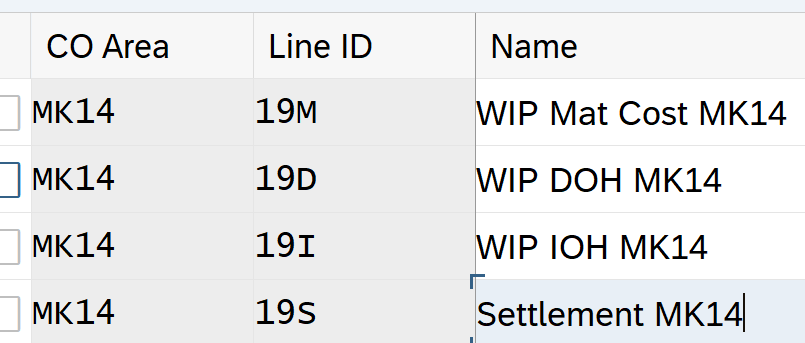

- Define Line ID

Path: Controlling- Product Cost Planning – Cost Object Controlling – Product Cost by order – Period end closing – work in progress

Define Line ID. In next step you assign CE to these Line ID. Line ID receive WIP value from these CE at the time of Production Order Settlement. Create a Secondary CE of category 31 and assign to these Line ID. Secondary CE receive the settled cost. Secondary CE is mapped to FI BS and PL account. This enable posting of FI documents for WIP balance at the time of production Order settlement

Line ID show WIP breakup. New entries and below entries

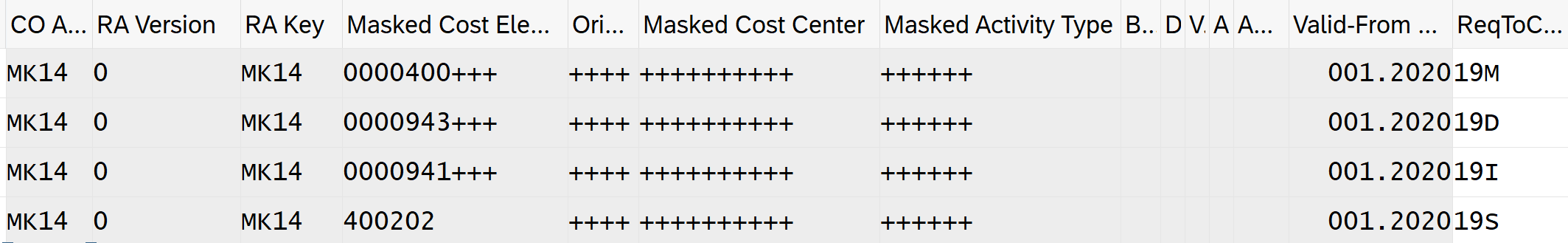

- Define Assignment

Path: Controlling- Product Cost Planning – Cost Object Controlling – Product Cost by order – Period end closing – work in progress

Assign CE / GL accounts to WIP line ID’s created in above step

SAP GL account length is 10 digits. When masking prefix zeroes if length less than 10 digit

- Define Update

Path: Controlling- Product Cost Planning – Cost Object Controlling – Product Cost by order – Period end closing – work in progress

Tcode: OKGA

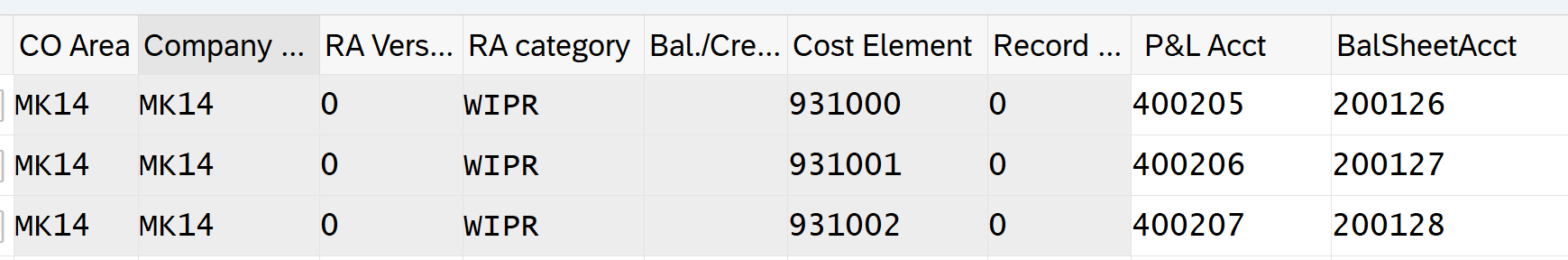

- Define Posting Rule for settling WIP

Path: Controlling- Product Cost Planning – Cost Object Controlling – Product Cost by order – Period end closing – work in progress

Tcode: OKGA

Create below GL accounts: FS00

| GL Acct | Description | Type | Account Group | FSG | Line Item | Sort key |

| 200126 | WIP Mat Cost BS | BS | Current Assets | G006 | X | 001 |

| 200127 | WIP DOH Cost BS | BS | Current Assets | G006 | X | 001 |

| 200128 | WIP IOH Cost BS | BS | Current Assets | G006 | X | 001 |

| 400205 | WIP Mat Cost PL | PL | Manufacturing Expenses | G001 | X | 001 |

| 400206 | WIP DOH Cost PL | PL | Manufacturing Expenses | G001 | X | 001 |

| 400207 | WIP IOH Cost PL | PL | Manufacturing Expenses | G001 | X | 001 |

MTS: Make to Stock use WIPR

MTO: Make to Order use RUCR

Secondary CE 931000 post WIP material cost to BS:200126 and PL 400205 account

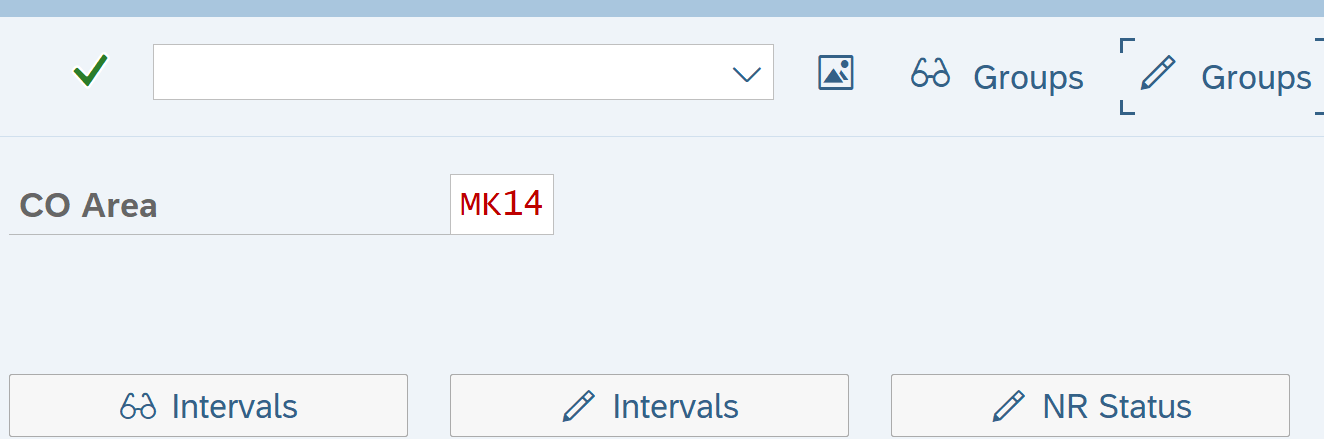

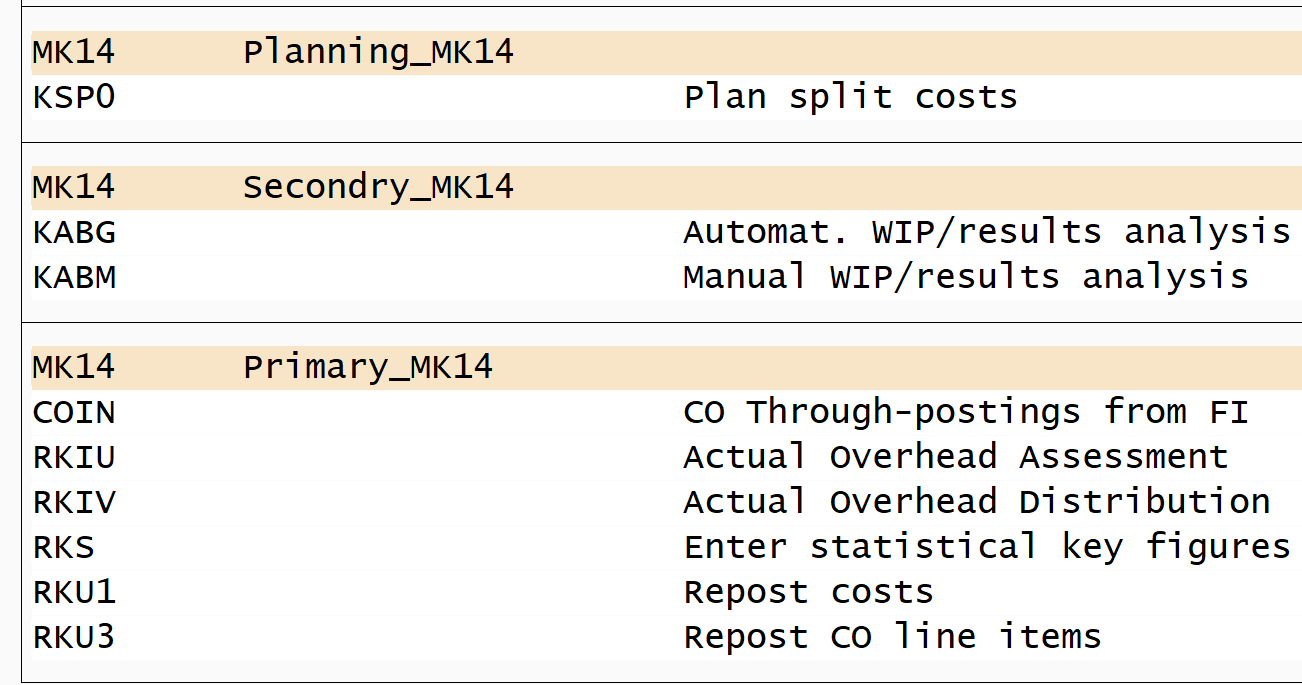

Define Number Ranges

Path: Controlling- Product Cost Planning – Cost Object Controlling – Product Cost by order – Period end closing – work in progress

Click Groups and assign element KABG and KABM to MK14 secondary group

Select Transfer to FI in RA version

Path: Controlling- Product Cost Planning – Cost Object Controlling – Product Cost by order – Period end closing – work in progress

Variance Calculations

Variance Calculation determines differences between the actual costs incurred on a production order and the standard costs of the material produced. Variances are calculated not at once, but for different variance categories.

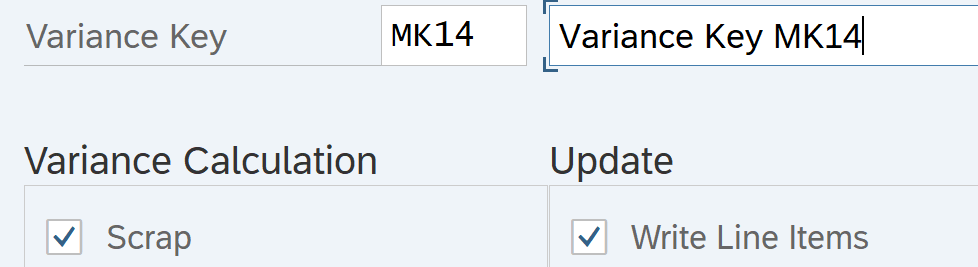

Define Variance Keys

Path: Controlling – Product Cost Controlling – Cost Object Controlling – Product Cost by Order – Period End Closing – Variance Calculation

Tcode: OKV1

Variance key is added to Finished Goods material Master. From the material master it is transferred to production order and control variance calculation

Define default variance keys for plants

Path: Controlling – Product Cost Controlling – Cost Object Controlling – Product Cost by Order – Period End Closing – Variance Calculation

Tcode: OKVW

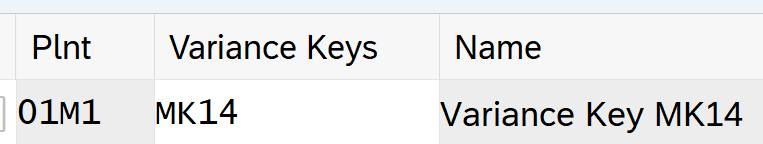

Define variance variant

Path: Controlling – Product Cost Controlling – Cost Object Controlling – Product Cost by Order – Period End Closing – Variance Calculation

Tcode: OKVG

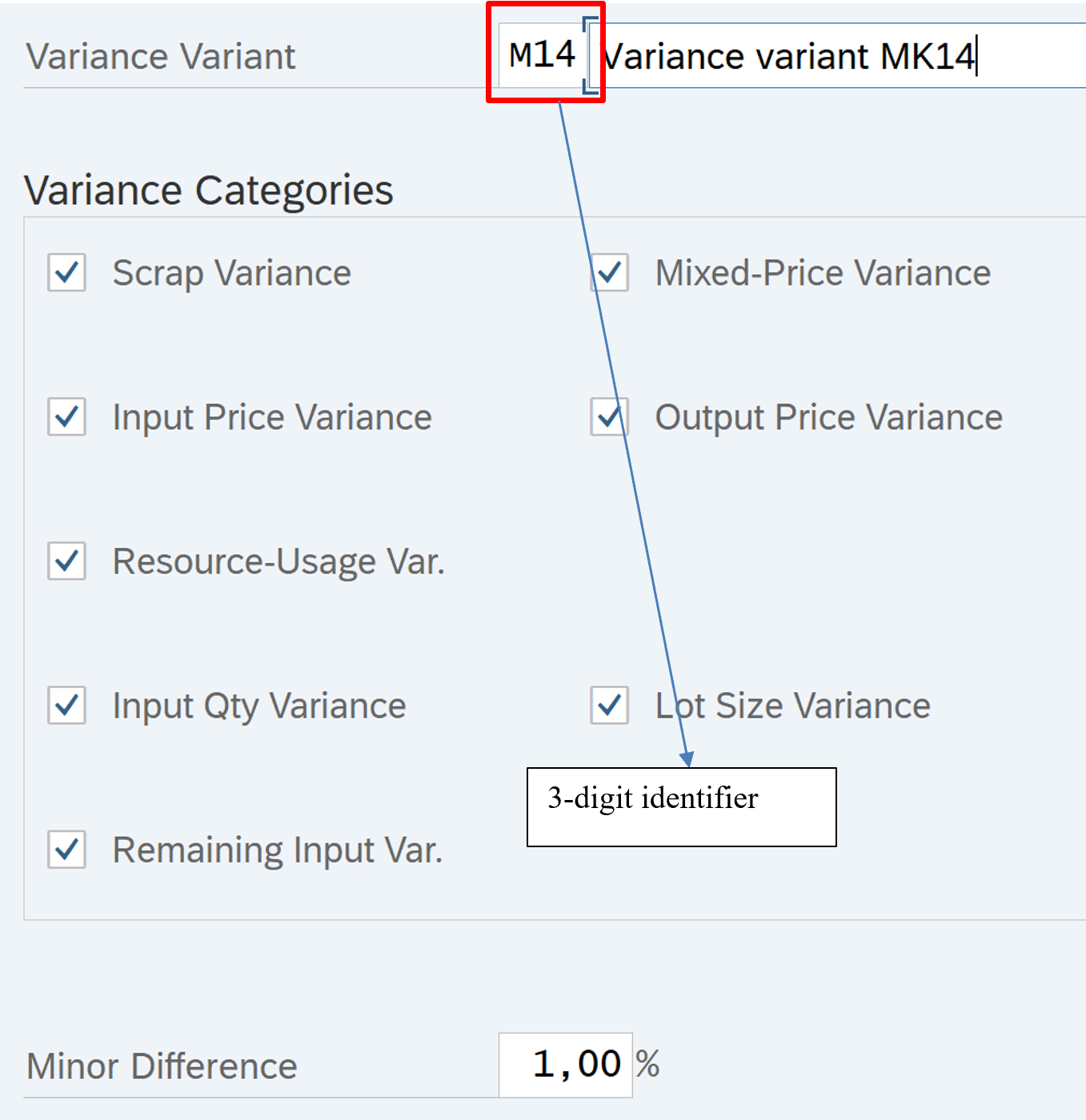

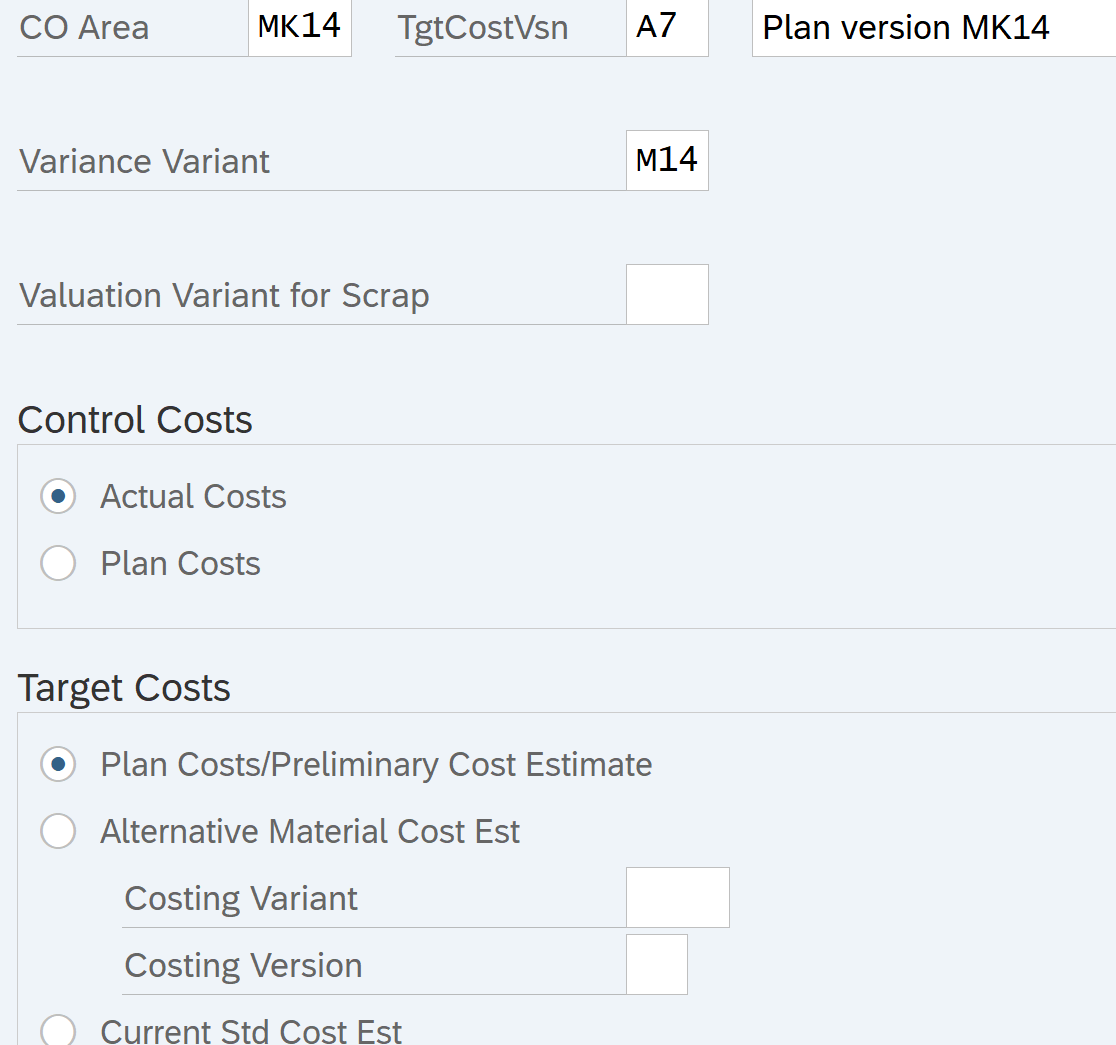

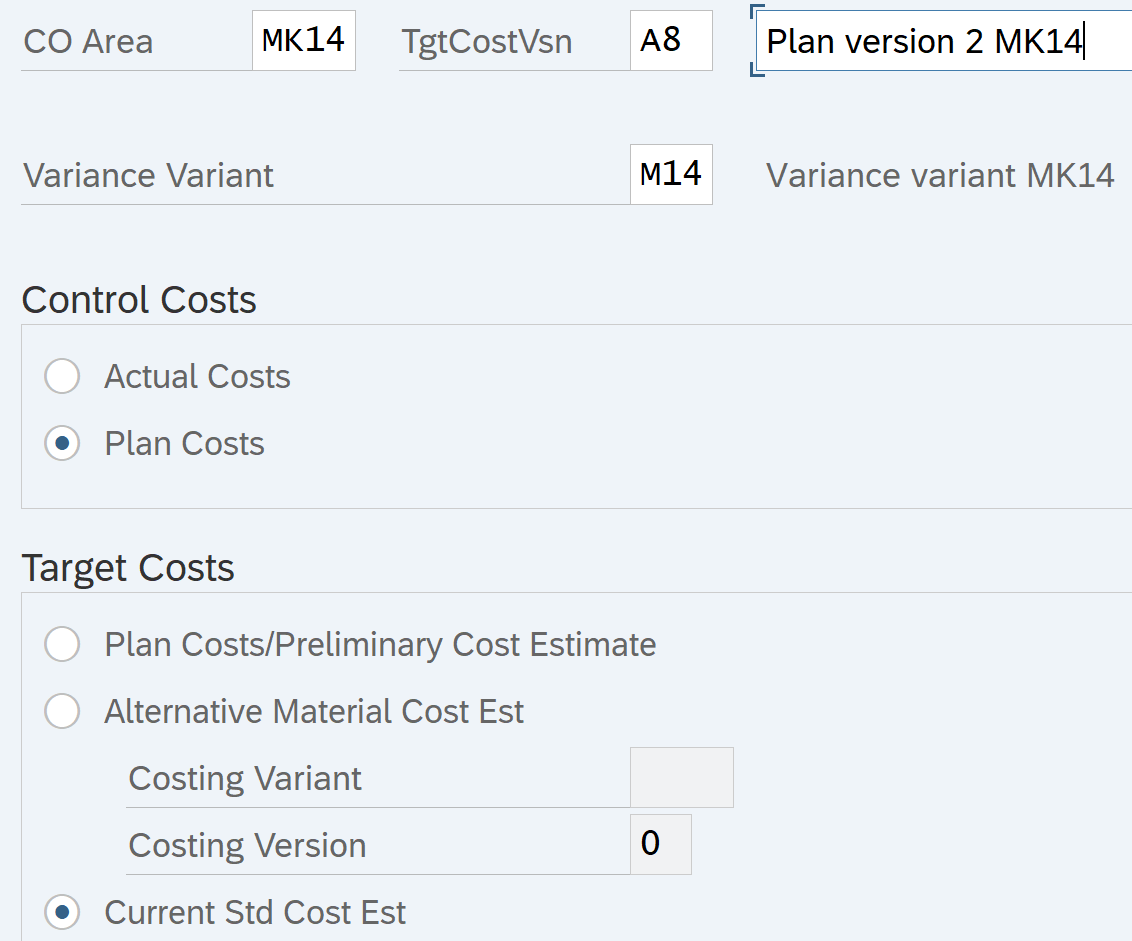

Define target cost version

Path: Controlling – Product Cost Controlling – Cost Object Controlling – Product Cost by Order – Period End Closing – Variance Calculation

Tcode: OKV6

Variance Formula = Control Cost – Target cost

Now Control cost can be Actual Cost or Plan cost depending on version

Target cost can be current standard cost or any other cost depending on version

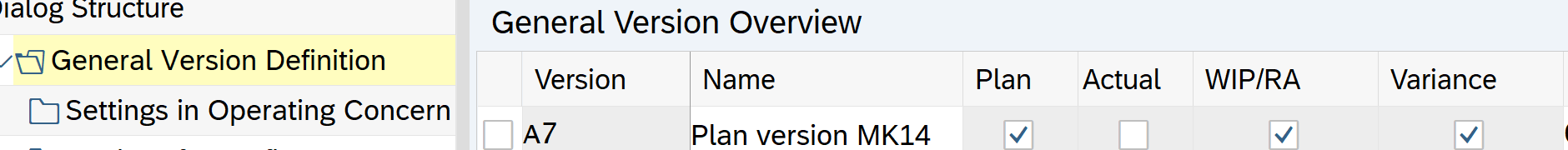

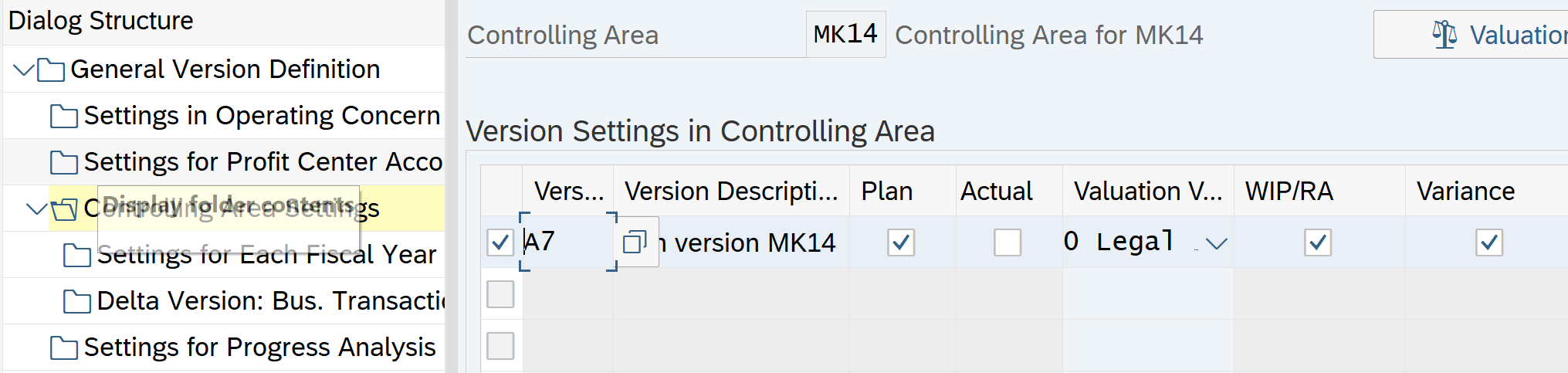

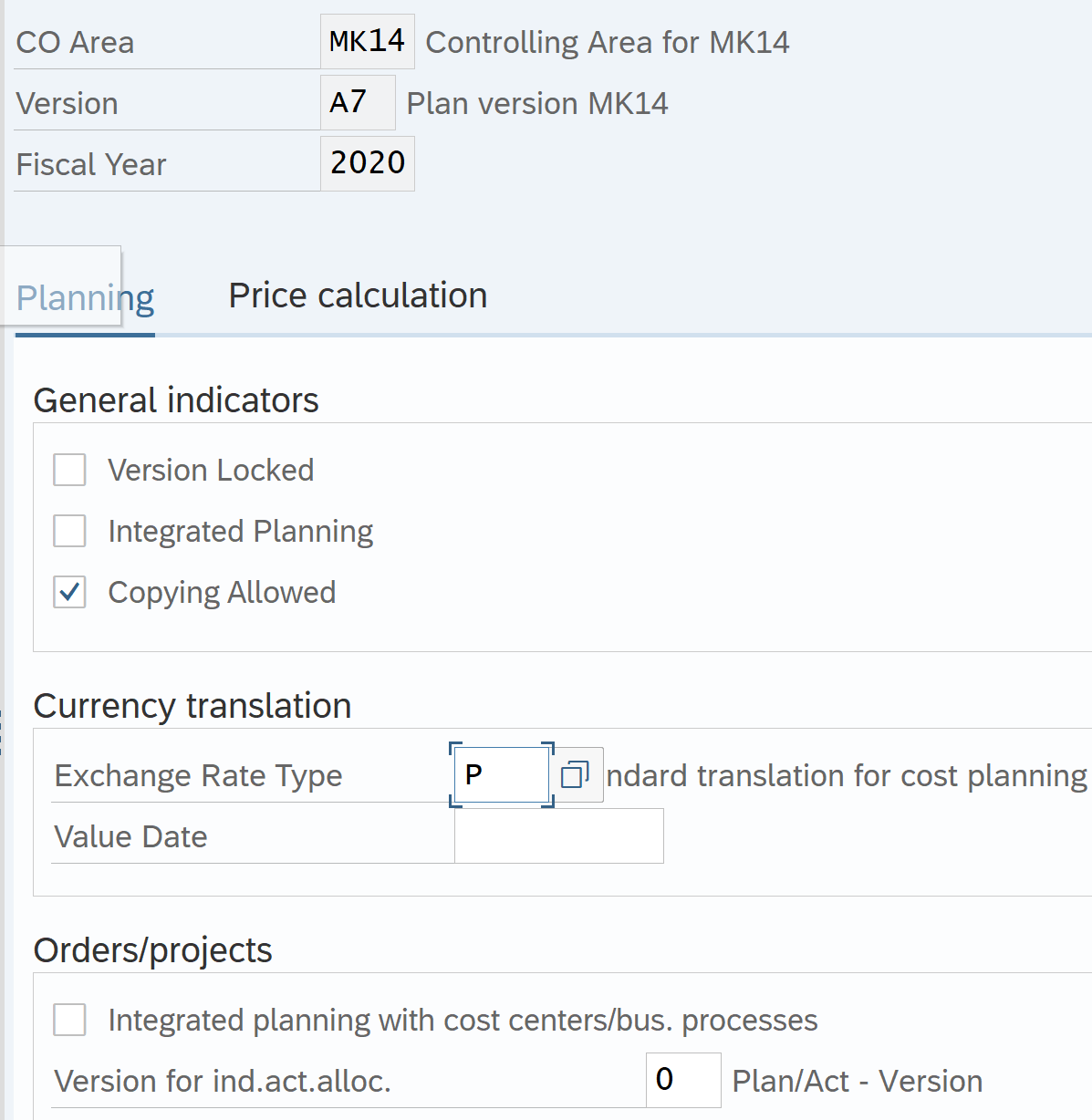

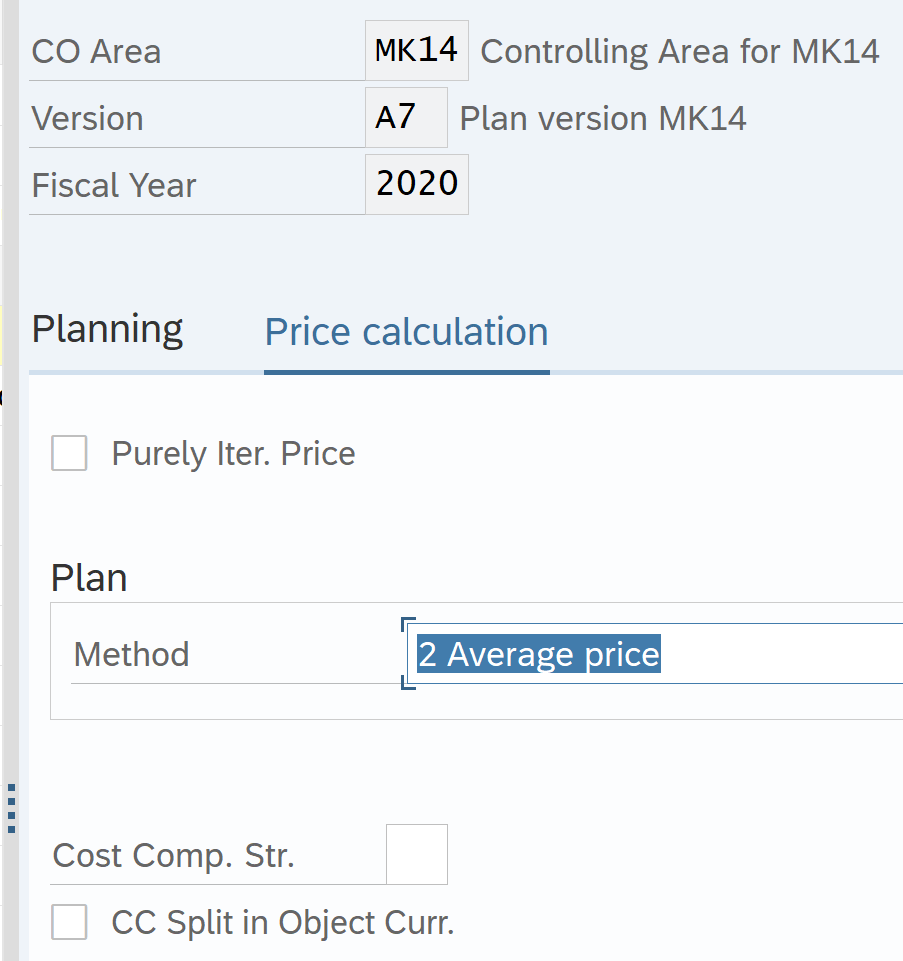

Define Controlling area version for Plan

Tcode: OKEQ

Select and Click controlling area settings

Select and click settings for each Fiscal Year

Similarly create version A8

Now create Target cost version for A7 and A8

Version A7

Version A8

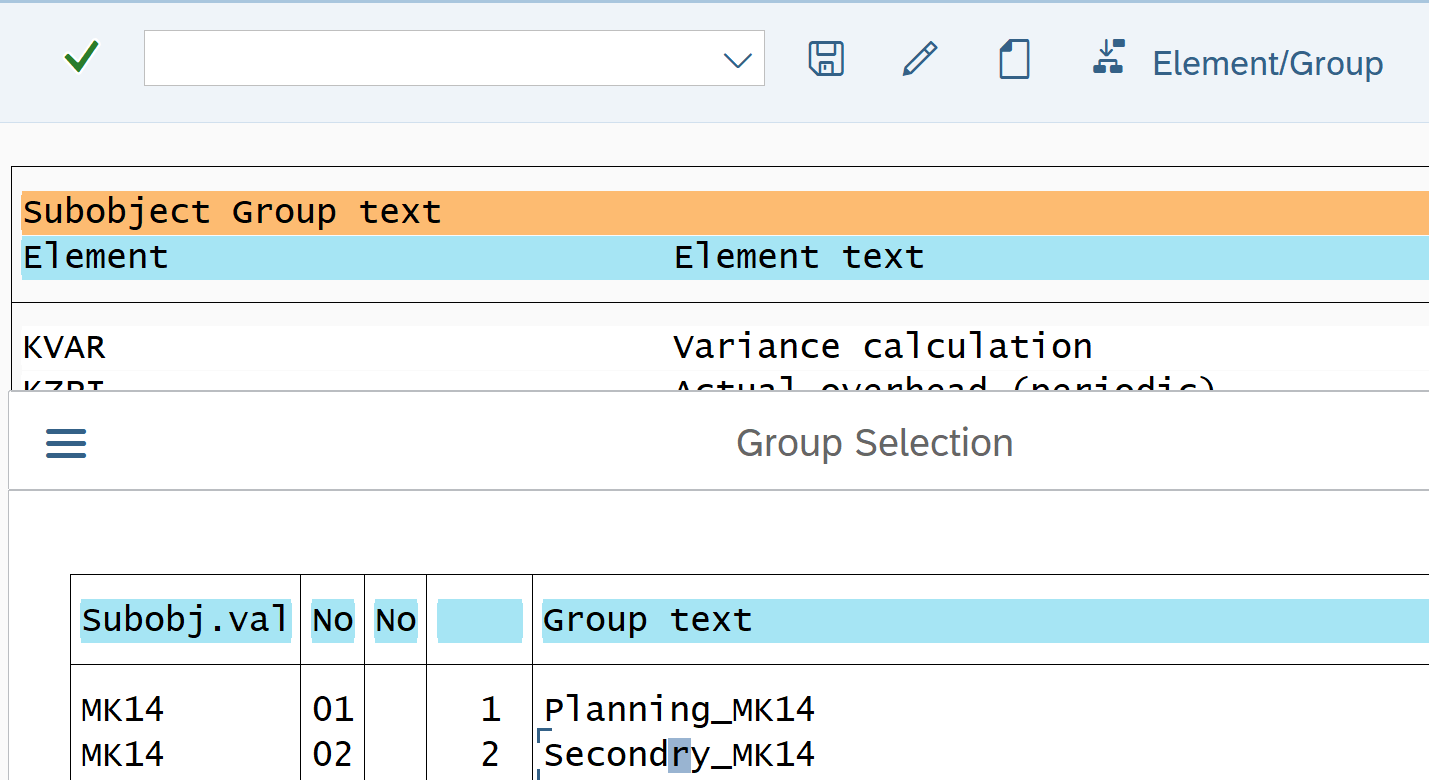

Define Number Range for Variance Documents

Path: Controlling – Product Cost Controlling – Cost Object Controlling – Product Cost by Order – Period End Closing – Variance Calculation

Tcode: KANK

Business Transaction : KVAR : assign to secondary postings

Settlement

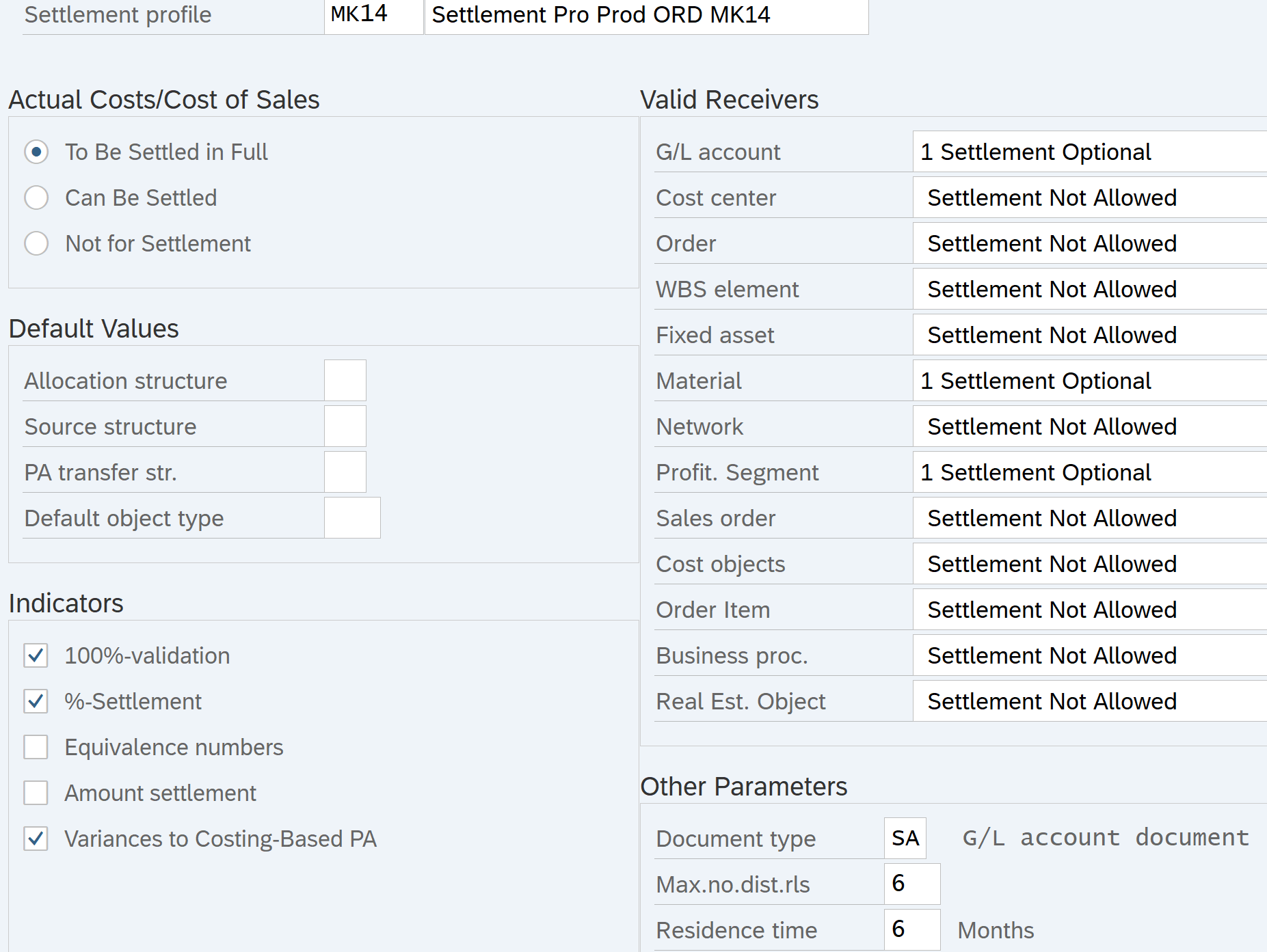

Create Settlement Profile

Path: Controlling – Product Cost Controlling – Cost Object Controlling – Product Cost by Order – Period End Closing- Settlement

Settlement profile used for settlement of Production order

To be Settled in Full: Production order can be settled only when balance is zero

Can Be settled: Order can be settled even with the balance

Not for settlement: WIP can be settled. Variances cannot be settled

Max no. Dst rls: Maximum 6 receiver allowed in settlement profile

Residence time: 6 months before it is archived

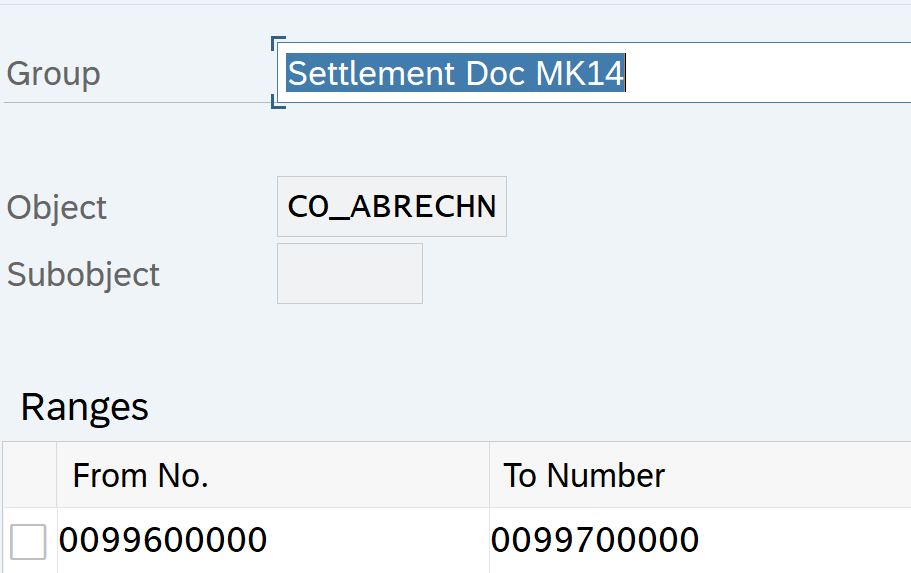

Maintain Number Range for Settlement Documents

Path: Controlling – Product Cost Controlling – Cost Object Controlling – Product Cost by Order – Period End Closing- Settlement

Tcode: SNUM

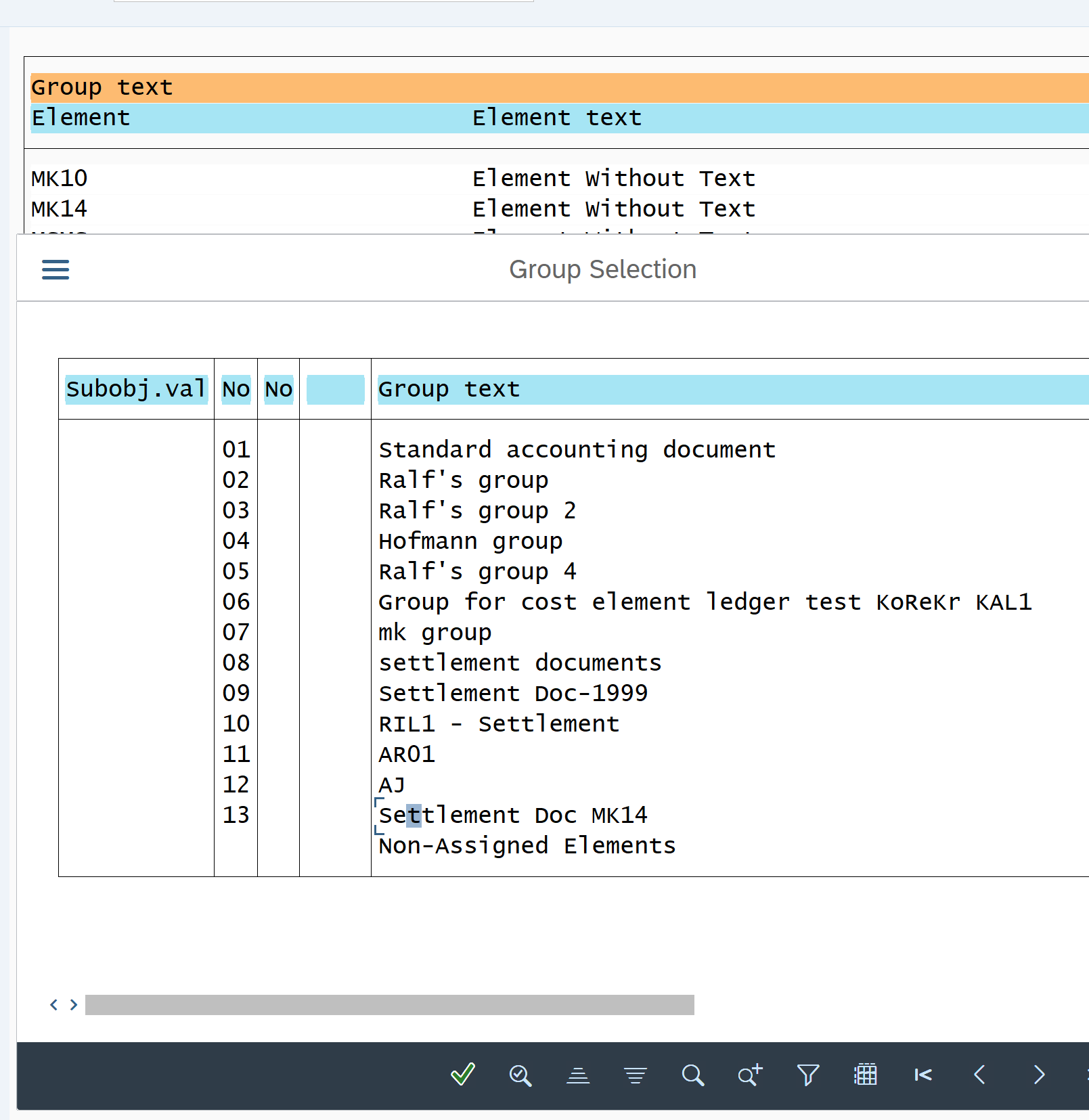

Create Group

Click Change group

Click create and create below group

Search MK14 (settlement profile created in last step) and assign to the group

Master SAP Product Costing Course

For Detailed step by step instruction on SAP Cost Center Accounting, Product Costing, Profit Center Accounting, Internal Orders configuration, testing follow my video tutorial below

Please visit next tutorial on Product Costing in SAP tutorial 2

Please visit previous tutorial on Report Painter Configuration and use in SAP

SAP Treasury and Risk Management

This course on SAP Treasury & Risk Management covers business process, concepts, configuration and testing on below topics. End to End Business Scenarios: Fixed Term Deposits, Interest Rate Instruments, Facilities, Commercial Paper, End to End Business Scenarios: FX Spot, FX Forward, FX Non-Deliverable Forwards, SAP Treasury Month End Process, SAP Treasury & Risk Management configuration, Demo Treasury Project implementation and Testing in SAP

SAP Cash & Liquidity Management

Bank Account Management

Bank Communication Management

Cash Operations

Cash Flow Analyzer- Bank Balance, Liquidity Forecast

Bank to Bank Transfer

Non-Invoice based payment to vendors

Memo Records

Cash Pool and Cash Concentration

Liquidity Management

SAP iDoc Training

This course teaches SAP iDoc uses, configuration, development, testing, and various integration points associated with iDoc. Detailed hands on explanation is provided about Logical system, RFC destinations, Maintain Ports, Create Partner profile, create distribution model, iDoc segment filtering, enable change pointer for iDoc message types, iDoc Monitoring, Error handling, Reprocess of failed iDocs etc

Payment automation in SAP-Wire, ACH, DMEE

Vendor Payment Process using Check, ACH, and Wire Transfer. Configure Payment Methods - Check, ACH, Wire Transfer in SAP

Develop Wire Transfer file / Electronic Fund transfer file in SAP using Data Medium Exchange Engine. Understand various functionalities of Automatic Payment program in SAP. Test End to End Vendor Payment Process in SAP configured and developed by you.

SAP Controlling

This course on SAP Controlling covers business process, concepts, configuration and testing on SAP Controlling topics like Organization structure, Cost Element Accounting, Cost Center Accounting, Master data creation, Planning, Budgets, Actual Posting, Variances, Report Painter, SAP Standard Controlling Reports, Assessments and Distributions in Cost Center Accounting, Product Costing, Internal Orders, Profit Center Accounting

Pingback: Course Material - AIERP2